By the Hughes Marino Life Science Team

San Diego is exploding with new life science company formation and biotech companies looking to move to or expand in San Diego from China, Northern California, and other states…even Texas! Beyond being a proven top market in the US for biotech business activity, this recent explosion of the sector is fueled by venture and corporate capital investment.

Approximately $6.5 billion of venture and corporate capital flowed into San Diego in 2021 (most of which went into the biotech sector), along with a historic number of biotech IPOs. This capital investment goes toward research which requires personnel, and therefore space for both. Since the outbreak of COVID in 2020, the biotech industry has signed over 4,400,000 square feet of new leases, and there is going to be another several million square feet of active requirements in the market for occupancy in 2022-2024.

As a result of this demand, the supply of existing wet lab buildings became virtually exhausted by the end of 2020. This left tenants of all sizes facing long and complicated lab build outs to prepare space for 2021 occupancies, essentially depleting all of the wet lab space in the region that was ready for tenant improvements by year end 2021. Over this same time period, with the market having run out of existing industrial and flex buildings to convert to wet lab pre-COVID, real estate developers quickly pivoted toward existing office buildings—many of which were languishing due to many office tenants going remote due to work from home—to convert to wet lab.

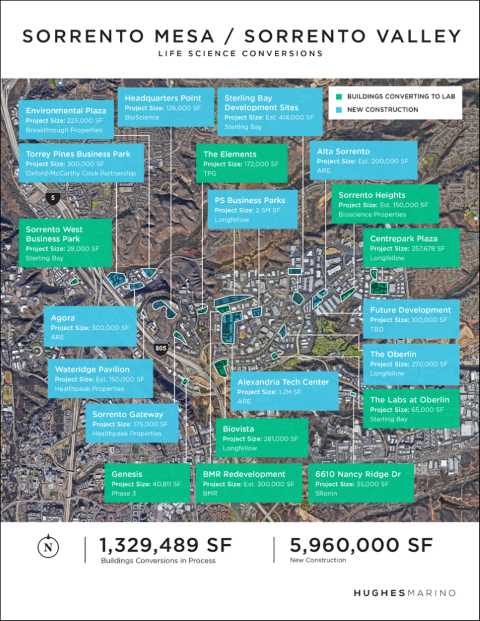

Over the last 18 months, almost half of the “for lease” office space in Sorrento Mesa and Torrey Hills has been purchased to convert from office space to biotech wet lab space—in some cases, being torn down entirely to increase density as well. This has bled over to Del Mar Heights where three office buildings are being converted, to Governor Park where the 141,000 square foot two-story Mitchell headquarters is scheduled for conversion, and to selected buildings in UTC as well. Currently in the region, there are 100 buildings recently converted or scheduled for conversion into wet lab facilities, or being demolished to make room for new wet lab buildings. The map below depicts the recent sites within Sorrento Mesa / Sorrento Valley that are currently slated for conversion.

As for 2022, there are only a handful of lab spaces in each size category being built out by landlords on a “speculative” basis with ready to go lab space—most available options will still require tenant improvements. While there is a massive pipeline of wet lab space coming onto the market, don’t expect most of this space to be delivered until 2023, as the lag in the construction materials supply chain and the City of San Diego permit process (which has doubled in time since pre-COVID to now take 4 months or more) has created a delay in matching the supply to the demand. Knowing the market, getting ahead of it, and planning in advance has never been more important.