As the national office markets all struggle to find some kind of new normal and equilibrium in this COVID reality, San Diego County is one of those showing signs of improvement. This is due to the fact that the biotech industry has taken so much office space off the market, but is also due to tech companies like Apple expanding by several hundred thousand square feet, and most small to medium size businesses that comprise the backbone of San Diego’s economy continuing to use their office space on a hybrid basis.

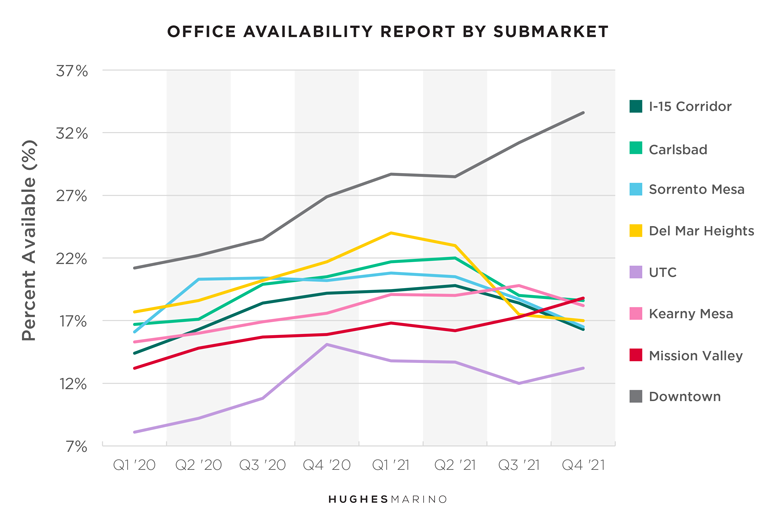

While San Diego’s office availability rate ended the year 2021 at 17.6%, the struggle is most felt Downtown where the availability rate is now at 33.6%, and climbing. This availability rate places Downtown San Diego as one of the softest central business district markets in the entire States. While Downtown continues to get worse on the heels of COVID, most other submarkets in San Diego County show dramatic signs of improvement from over a year ago. UTC, the tightest market in the county pre-COVID, remains the tightest due to its central county location, superior amenities, and relatively a better value as compared to Sorrento Mesa and Del Mar Heights. With more expansion rumored by Apple, and continuing to be highly desirable to tech and biotech companies, UTC should continue to see improvement in 2022. Winning “most improved,” Del Mar Heights had a shocking turn around moving from an availability rate of 24% just a year ago, to now 17%, as biotech companies fill up much of the Class A office space offerings, which is now driving up rental rates now priced from the mid four-dollar range to the low five-dollar range, net of electricity. Sorrento Mesa, usually over the last 30 years the submarket that gets softened the most by any negative correction in the market, only peaked a year ago with availability at just over 20% and is now healing at 16.5%. Again, because so much office inventory has come off the market to accommodate the biotech industry.

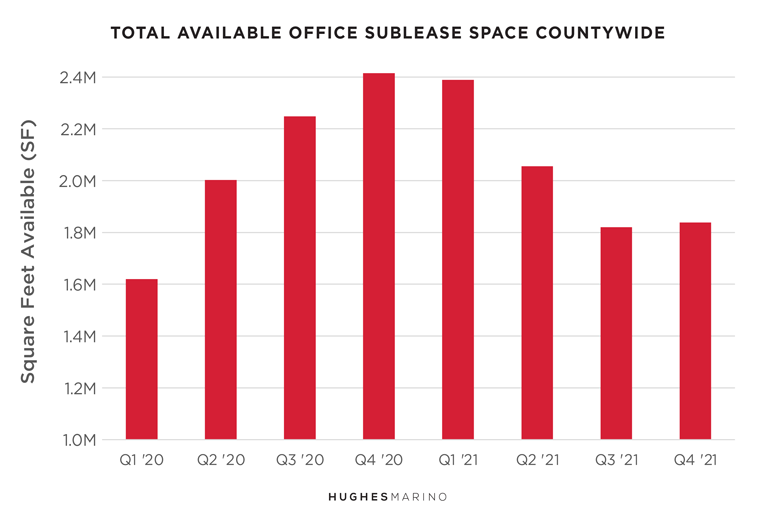

The leading indicator of the healing that has occurred in San Diego County is the total amount of available office space for sublease in the region. Pre-COVID San Diego had just over 1.6M SF of space on the market for sublease. At the end of 2020, office sublease inventory in San Diego had spiked by 50% and appeared as though there would be no end in sight to the increase. However, sublease inventory unexpectedly stabilized going into 2021, as San Diego tenants who had gone to a remote work model and relinquished their space in 2020, began coming back to the market to look for office space. Many of those companies were attracted to the fully furnished and below market offerings that subleases provide. This demand chipped away at the total sublease inventory, and San Diego has almost returned to its pre-COVID levels of total office sublease space available.

San Diego has the lowest amount of sublease inventory of any major metropolitan area in the entire United States. The closest major market with sublease space is Austin at 2.6M SF, followed by Orange County at 3.3M SF. Other markets like Washington DC, Chicago, Los Angeles and Dallas all are hovering around 10M SF each; numbers that are affectively unchanged from a year ago. San Francisco, Boston and Houston, are each hovering around 8M SF. While most of the national markets continue to have office sublease space languishing, and dragging down their markets in general, San Diego is one of those markets, among very few, that is on its way to recovering. While this isn’t the best news for tenants looking for great values and expecting to encounter a continued soft real estate market, the bright side is that the San Diego economy is generally out-performing others around the country. San Diego businesses are getting their people back to work more successfully than we’re seeing in most other metro areas…with the exception of Downtown San Diego, of course.

Marketing statistics provided by CoStar Group.