After two years of record low vacancy and 10% to 20% annual rent inflation for industrial properties around the country, it looks like the market is finally coming in to balance. Rumblings of recession and slower consumer demand have already caused some corporate tenants to put a pause on expansion requirements and slow down their demand for industrial space going into 2023. Landlords can no longer assume that Amazon will lease their new warehouse buildings as they are shifting to an owned real estate strategy, and reports in the last quarter signal that Amazon will put at least 10,000,000 SF of warehouse space on the market for sublease in markets like Southern California, Atlanta, New York and New Jersey. Additionally, a cooling housing market across the country is slowing down new construction, thus reducing the residential real estate industry’s supply chain requirements.

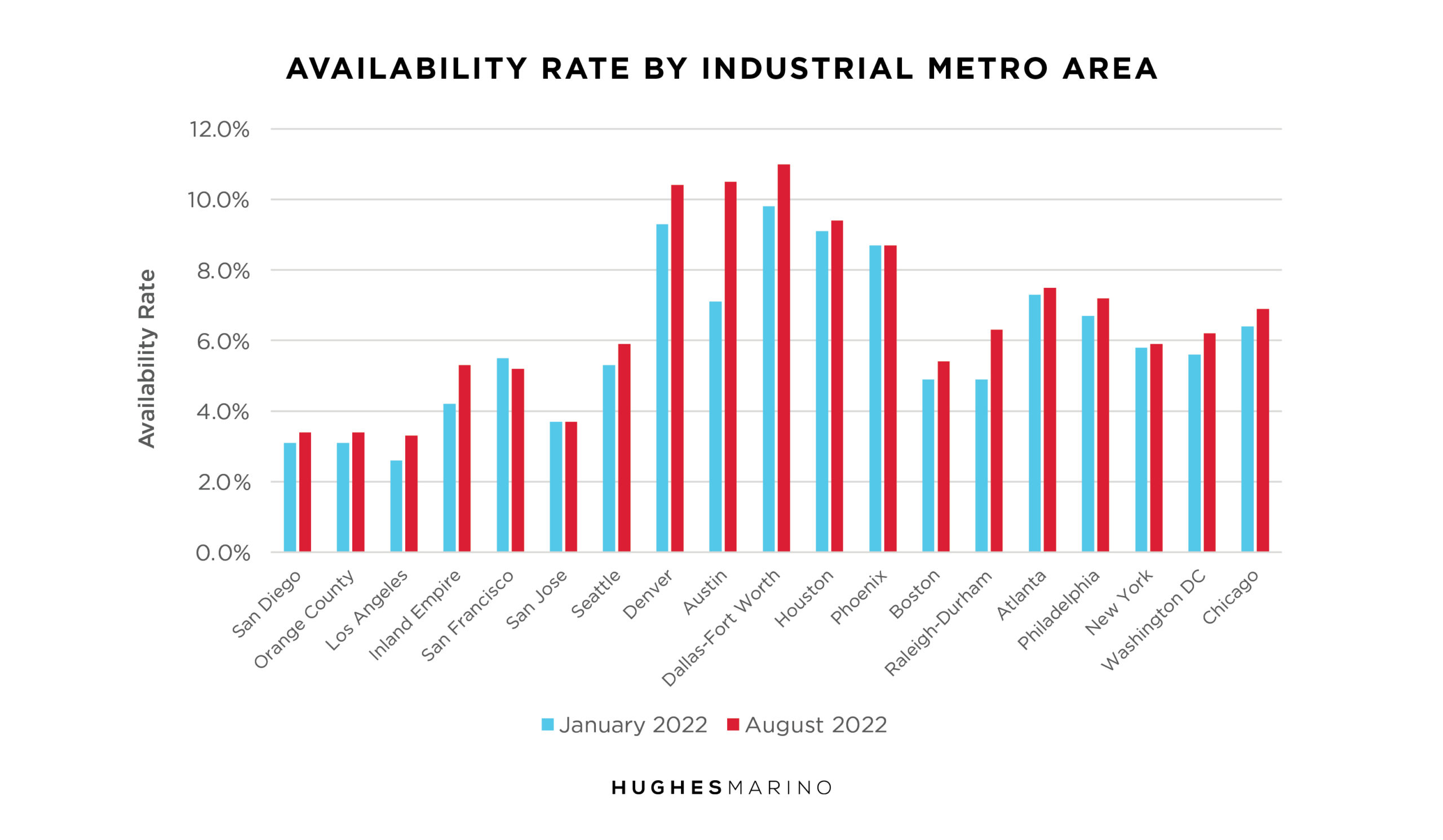

On the supply side, most metro areas across the United States have had an uptick of availability as compared to January of this year. However, this increase in availability is barely noticeable in some markets and availability remains extremely tight in most markets, particularly in Southern California where San Diego, Orange County and Los Angeles hover just above 3% availability and the Inland Empire is slightly above 5%. However, the largest increase occurred in Austin, which moved from 7% availability at the beginning of the year, to just over 10%. Joining Austin are the Denver and Dallas-Fort Worth metro areas, both with over 10% availability. Availability over 10% is the crossover point where markets start trending to be more tenant-favorable than landlord, although the rest of the country still leans strongly to the benefit of building owners. However, after three years of plunging vacancy and availability rates, any report showing an uptick in availability is worth paying attention to, and provides some promise to corporate tenants who are trying to keep their costs under control.

New Construction on the Rise

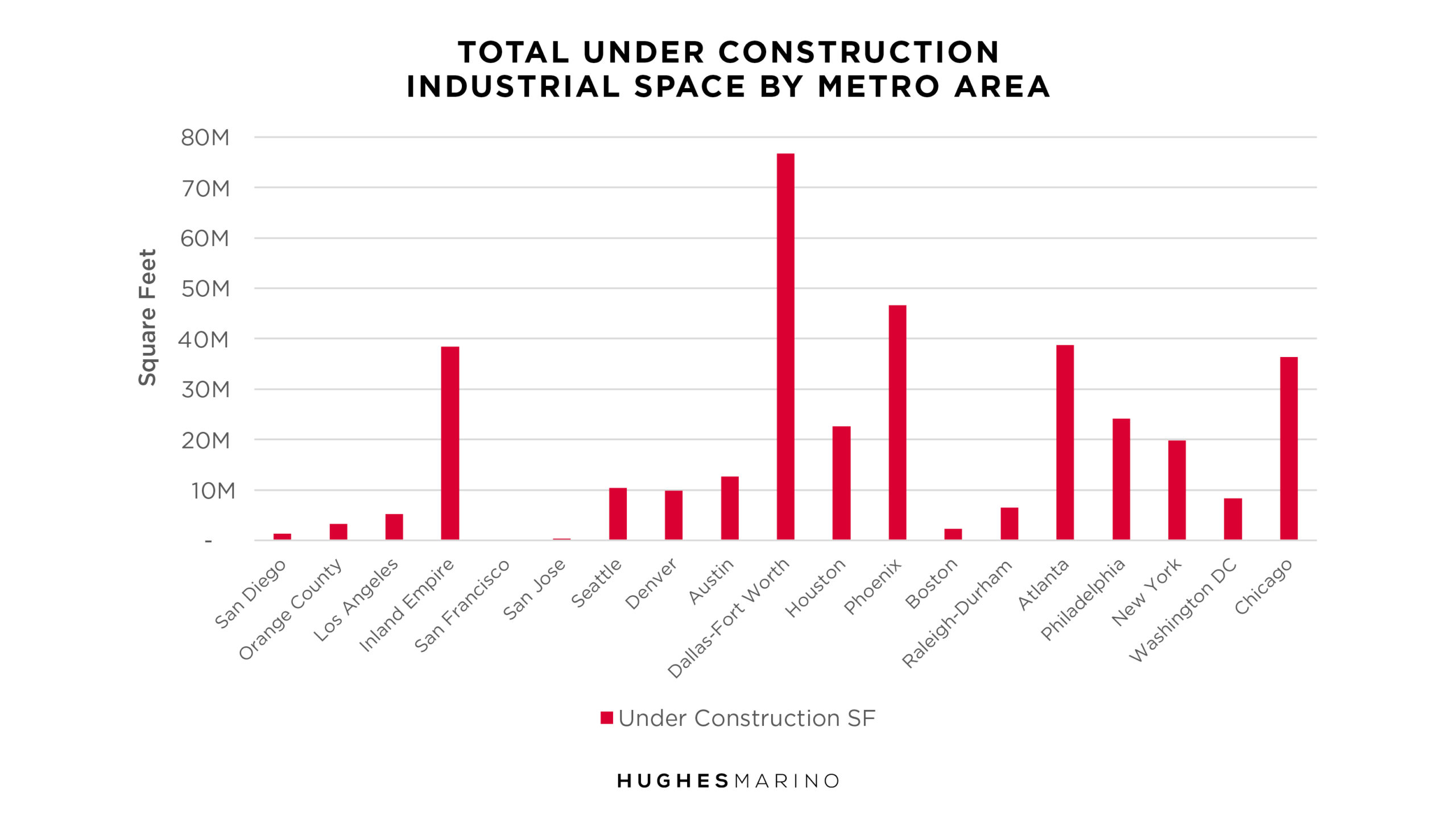

As we look to the future, it’s important to assess all of the new industrial supply coming online, as new construction folds into availability statistics. While most of the country remains relatively in balance with modest amounts of industrial construction, Dallas-Fort Worth tips to chart at 76,700,000 SF of new industrial space under construction. The Inland Empire has almost 40,000,000 SF coming online, which will create much needed opportunities for tenants that have leases expiring in 2023 and 2024. Phoenix has also become a hot market for new construction as the Southern California industrial market tightens up and tenants look for value alternatives in relative proximity of the ports in Southern California, where warehouse rents now range from $1.40 – $2.00 per square foot depending which part of Southern California a tenant might consider. Atlanta, being one of the top distribution markets in the country, and Chicago being the largest US industrial market, aren’t far behind, with over 35,000,000 SF of new construction coming on the market in each location. Considering how tight most of the major markets are around the United States, this new construction in itself should not create a softened market, other than in the Dallas-Fort Worth metro area that could easily be getting ahead of itself.

For industrial tenants looking to relocate or expand, companies are generally still facing limited supply and upward price pressure on rents, very much fanned by the brokerage community that represents the landlords throughout the country. Landlords and their brokers have been benefiting from a tightened national industrial market for several years, most recently exacerbated by unprecedented supply chain demands brought on by the shift of consumers to online purchasing during COVID. Tenants still need to plan in advance more than ever and need to be cautious in over-committing to too much space if they assume that growth projections are going to continue in the next three years based on what has occurred over the last three years. The critical success factor in these markets is to ensure that the tenant has independent and assertive representation on their side that’s willing to: challenge market momentum, push back on pricing gains and ensure that all opportunities are unveiled.