Five years post-Covid and it appears that the bulk of the damage has already been done to the San Diego regional office market. Companies adjusted to their new normal by implementing hybrid and remote schedules, and most tenant leases already expired where companies have had the opportunity to reset their footprint accordingly.

Despite this, there’s still more volatility as some very large law firms, insurance companies and other professional service firms still have another two or three years left on their pre-Covid long term leases. These coming lease expirations will create future incremental increases in availability in UTC, Del Mar Heights and Downtown, in particular, for another two years as those companies continue to shed space. Notwithstanding, we are formally reporting that the worst occupancy effects of Covid are in the past.

Downtown San Diego—Turbulence, but Tenant Upside

In September 2024, the Irvine Company sold San Diego’s iconic Symphony Towers, once valued at $134 million, for just $45.7 million. This was a staggering 70% drop that sent shockwaves through the commercial real estate industry. The sale marked a dramatic shift, especially given the building’s landmark status and longstanding ownership. This sale typifies the ongoing upheaval in the downtown district, which is amid a significant and historical transformation.

Buildings that were once considered stable are now facing sales, foreclosures, debt restructuring and ownership turnover. Additionally, gone are the days of downtown San Diego being dominated by a handful of major landlords as ownership diversifies to include a wider range of investors, with Symphony Towers being a prime example.

With so many new owners entering the downtown San Diego market, businesses are experiencing changes in management, lease terms and operating expenses. While these factors can cause potential disruption, they also unlock major opportunities in downtown to renegotiate leases or upgrade space at lower costs. This shift has created an exceptionally tenant-friendly environment, making it a rare and valuable moment for companies to act. This is being reflected in the numbers as availability rates are starting to decline from the above 40% seen in the aftermath of Covid, down to 35% today.

As the demand for life science space surged in the suburbs, IQHQ built the 1.7 million SF life science RaDD project along the waterfront in downtown, which is now also available for office tenants, as demand for wet lab has fallen off. Hughes Marino recently represented the J. Craig Venter Institute for 48,000 SF, which will move into this space next year from Torrey Pines.

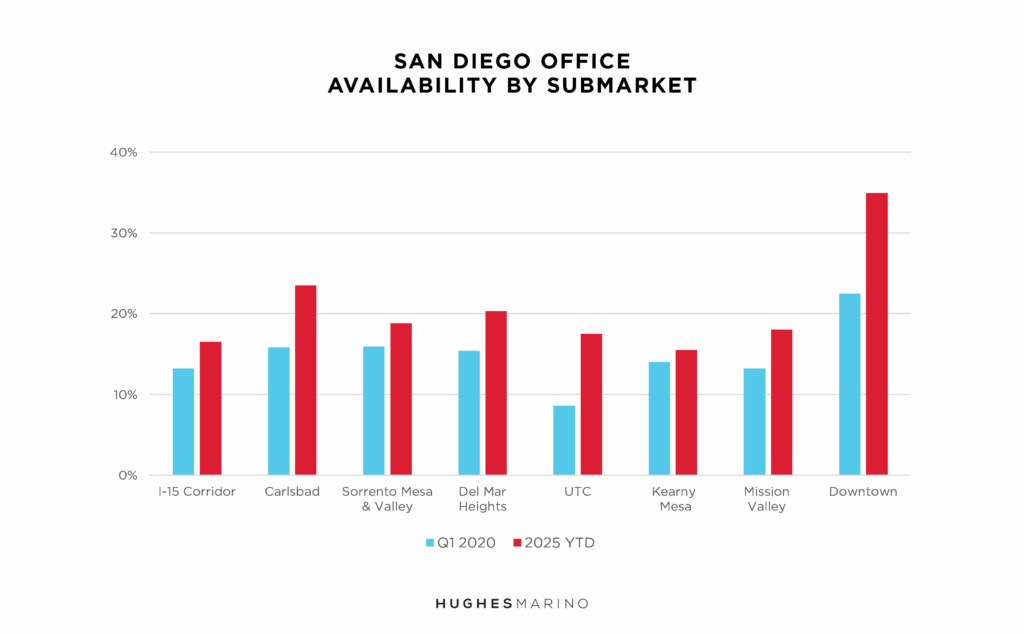

Pre-Covid to Present Availability

When considering the other major San Diego County office submarkets, every submarket is up from their prior 2020 availability rate, and some dramatically so. Carlsbad, UTC and Misson Valley have shown the most availability growth, at increases of 49%, 103% (from being historically tight) and 36% respectively. The I-15 Corridor, Kearny Mesa and Sorrento Mesa (due to half of the office space coming off the market for biotech lab conversion) submarkets are only up 10%-25%, and the damage is not as severe. However, prices have been coming down across San Diego, and concessions remain high, as all of these office submarkets have availability rates above 15%—a level above which the market has shifted beyond equilibrium and into tenant-favorable territory. Any submarket above 20% availability is especially advantageous for tenants, as in the case of Carlsbad, Downtown and what should be happening in Del Mar Heights as well.

Del Mar Heights—An Outlier Story

A stubborn deviation to this 20% rule is Del Mar Heights. A concentration of a half dozen owners, all using the same group of landlord listing brokers, have been able to anchor their prices together and hold the line on asking prices, maintaining the position of most expensive market in the San Diego region. Notwithstanding its convenient location north of The Merge, other than One Paseo, these buildings are generally lacking in amenities and image compared to their counterparts in UTC, just a few exits south. There are still some good values in Torrey Hills, on the southern fringe one exit south of Carmel Valley Road, where tenants can get into the market from $4.00-$4.25/SF, but the bulk of the Del Mar Heights buildings are still pushing asking rents ranging from $4.50-5.50/SF, plus electricity costs. Landlords have been offering massive free rent and tenant improvement packages to continue to prop up face rates, but the price fixing cannot last much longer as the market trend data just does not support the notion of strong or rising rents.

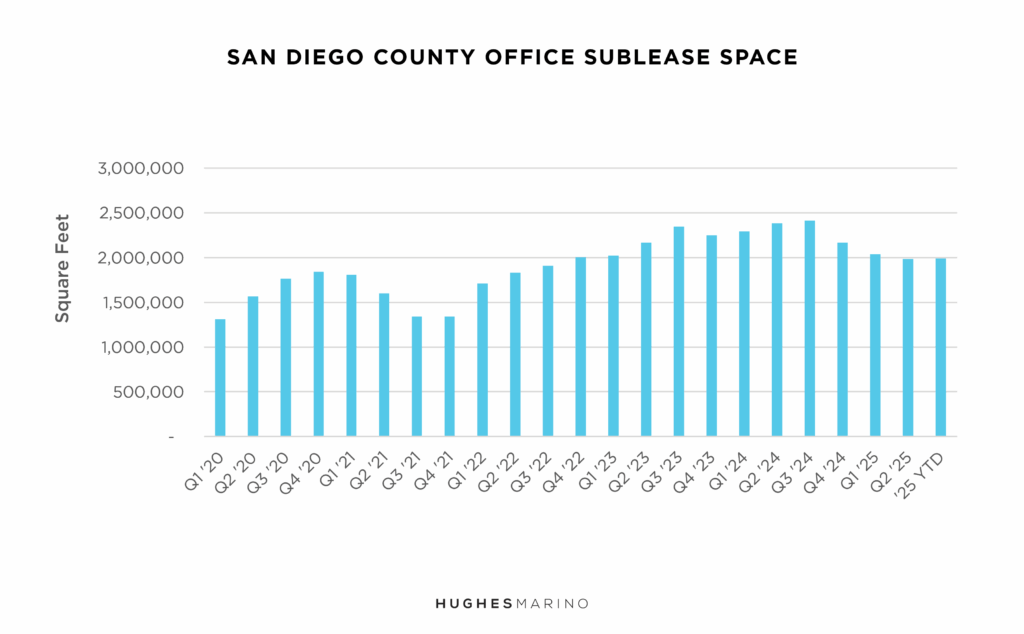

Sublease Space is Trending Downwards as Leases Expire

In response to Covid, the San Diego region saw a dramatic uptick of sublease space available from 2020 to 2021 as tenants concluded they would not be coming back to the office, or that they would be coming back much smaller. In the second half of 2021, as companies began returning to the office, some of that space was withdrawn from the market, and the good sublease deals were picked off by tenants looking to bring their teams back together.

By the start of 2022, employers began to understand that remote and hybrid working was here to stay, as many employees had moved out of the San Diego region, or simply refused to come back into the office, resulting in record high levels of office sublease space being put on, and then lingering on the market. A year ago, this supply started bleeding off as those subleases that had been on the market for 2-3 years had the leases expire and the space revert back to the landlords. The reality is that tenants’ opportunities to pick off a value sublease are starting to dissipate, and oftentimes, tenants in the market cannot find an acceptable sublease with at least two years of remaining term that meets their needs.

Looking ahead, office space availability will remain strong and prices will remain soft, as the availability rates and number of choices that tenants have are just too large to conclude anything else. Tenants are going to enjoy some of the lowest office rents they’ve seen in 25 years for many years to come.

Market statistics provided by CoStar Group.