By David Marino

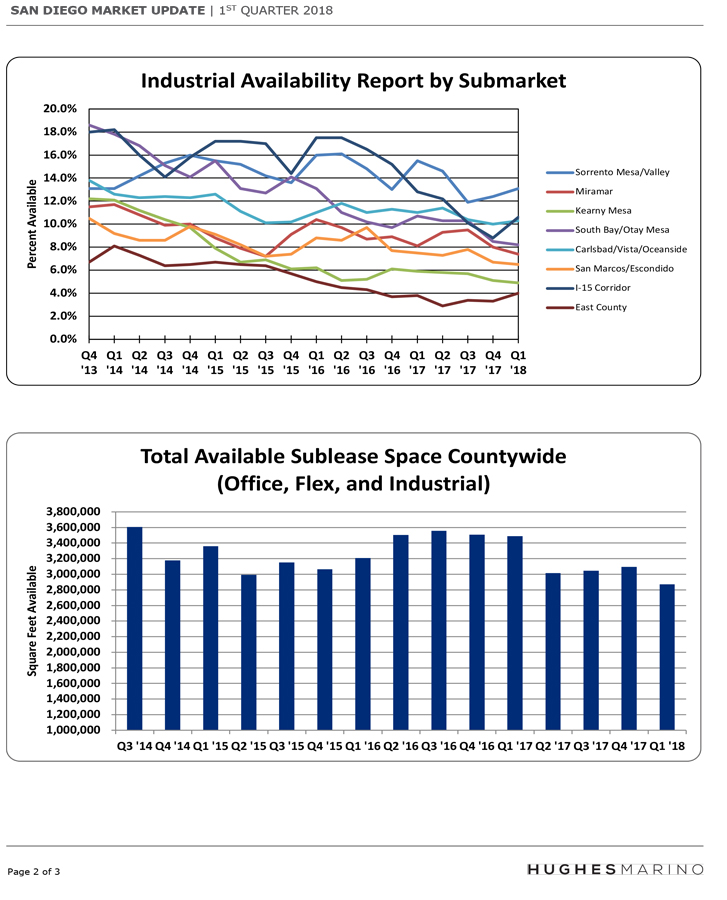

The continued job creation and economic growth in the San Diego region has driven another robust quarter for the commercial real estate industry. Most notable, total sublease inventory for the entire region is under 3 million square feet for the first time in a decade. The amount of sublease inventory on the market is directly correlated with the health of San Diego companies. Back during the recession of 2008, there was almost 3 times that amount of sublease inventory being shed by San Diego companies. The largest concentration of sublease space as a percent of total availability in the region is in UTC, followed by Carlsbad and then Del Mar Heights, making those three submarkets some of the best for tenants looking for below market opportunities.

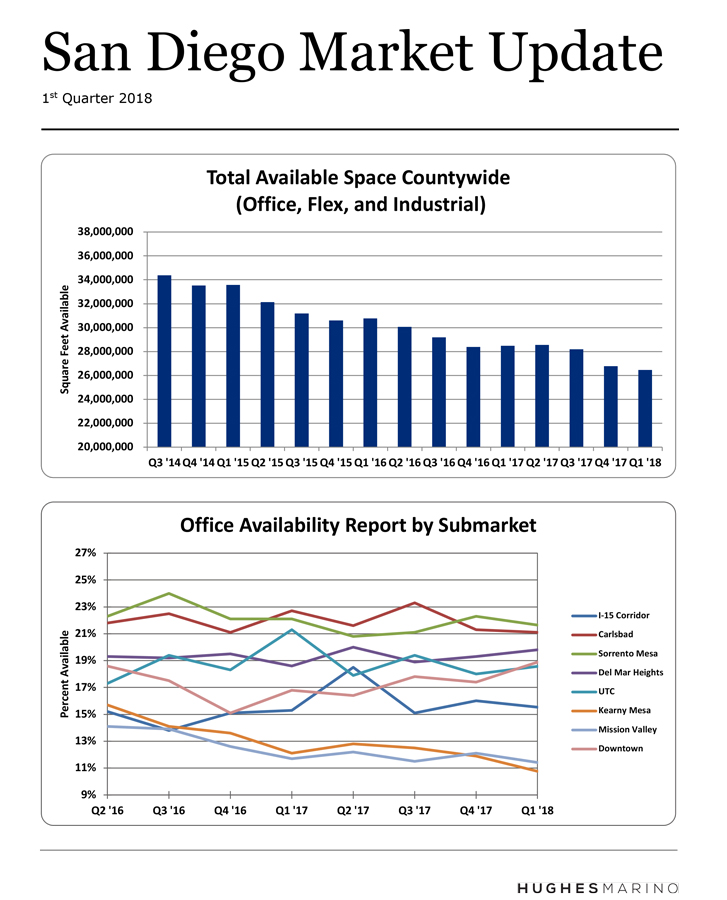

Total availability in the region continues to shrink now, with another 325,000 square feet of office, lab and industrial space coming off the market last quarter, trending nicely with the last few years of absorption. Particularly notable are the continued low availability rates for industrial and lab facilities throughout the region with availability in every submarket except Sorrento Mesa being under 11% availability.

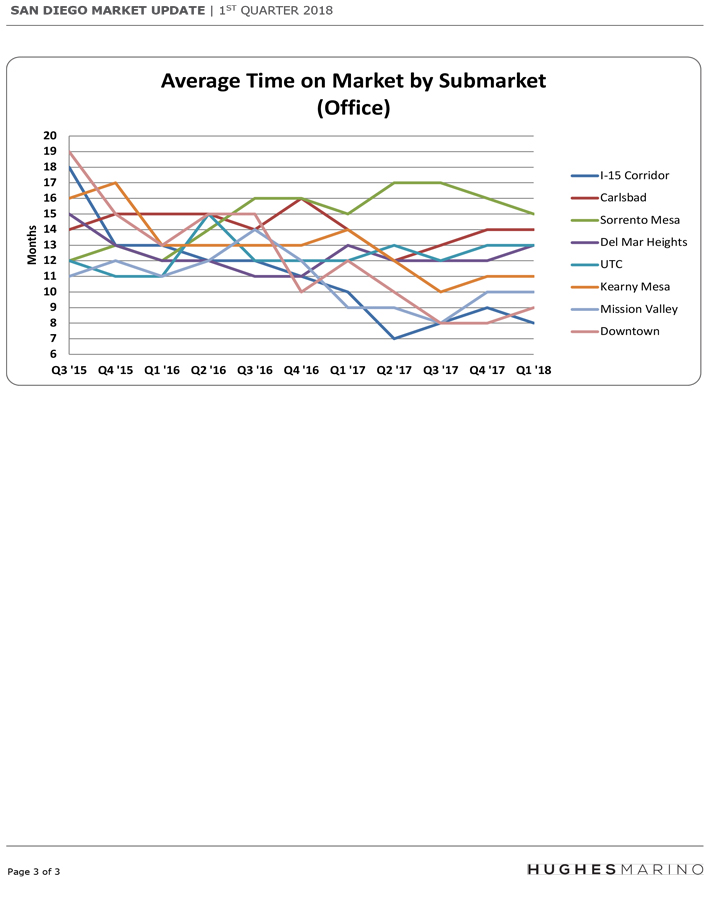

As for office space, the central county submarkets of Mission Valley and Kearny Mesa continue to lead shrinking supply. Each have limited options of availability, particularly for tenants over 20,000 square feet. For the first time in two years, downtown San Diego has had an uptick of 1.5% in availability. Carlsbad and Sorrento Mesa continue to be the laggards in their recovery, with availability rates of just over 21% in both cases. Fortunately for Sorrento Mesa, the termination of the Qualcomm acquisition by Broadcom saved the day, as we forecasted that availability rates in Sorrento Mesa would double should such a merger occur as Broadcom would have surely shed at least 2 million square feet of office space as cost cutting measures.

Downtown has limited Class A space available—but plenty of Class B & C. For companies wanting cost effective solutions, there are lots of options. And it will only get better as more companies begin to relocate to the suburbs. Additionally, look for the former Thomas Jefferson Law School building coming on line for multi-tenants and an empty 1010 Second Avenue coming back to market with a new curtain wall face-lift. Those two buildings will add 8% availability to the existing 12.3% vacancy.

Overall, 2018 is shaping up to be another good recovery year for commercial real estate in the San Diego County region.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.