It’s hard to believe that we are completing a three-year milestone since the COVID-19 pandemic began in March 2020. While virtually every office tenant in the United States was immediately forced to work remotely until the virus’ passing, this persisted unexpectedly for months, permanently changing how employees and employers utilize their office space.

An immediate robust debate broke out in the commercial real estate industry as to how this would affect office space retention and demand post-COVID. Building landlords somewhat shrugged it off and were more worried about whether tenants would keep paying rent. In speaking with thousands of business owners and executives in the early days of COVID, Hughes Marino generally heard positive experiences with employee productivity. Many of those CEOs and business owners quickly embraced the idea that some people could work from home some or most of the time…and those same executives were more often enjoying it themselves—change was in the wind.

However, the landlord brokerage side of the real estate industry had to promote for landlords that everyone would come back. There were a half dozen return-to-work deadlines whereby the brokerage community promised everyone would come back, and they were all wrong. But the job of the big brokerage firms, which were built on the backs of building owners, is to price-support building landlords, and that was done robustly and in coordination. It was executed so well by landlords and their brokers that dominate the commercial real estate press (go online and read how grossly wrong all of their 2020 and 2021 forecasts were) that office space asking rents around the country have been essentially unchanged as the big landlords and their brokerage teams worked together to keep a glass floor on prices. That glass floor is being shattered real time, and if you are a commercial real estate tenant reading this, we are going into a market that will benefit your bottom line for many years to come.

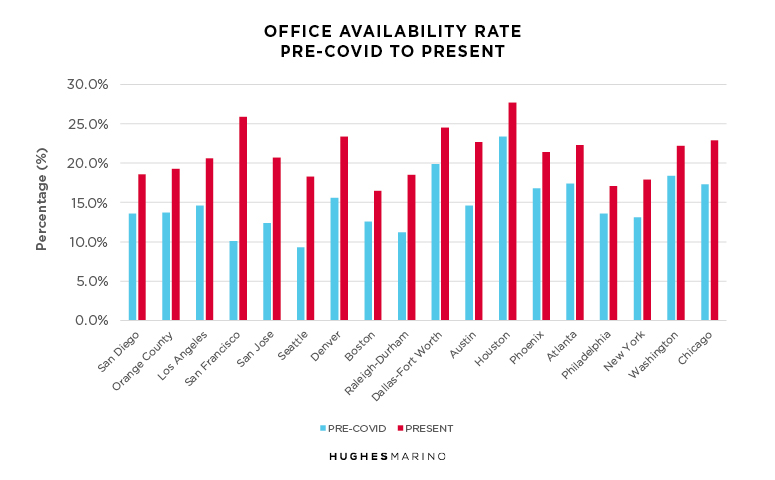

Office Space Availability Spiking Nationally

With now three years of data, there’s no question left as to what’s happened around the country with office space supply and demand in every major metro area. The chart above shows that virtually every office market in the United States is trending up towards 20% availability, which is a tipping point where office markets become extremely tenant-favorable. Some markets like Denver and Dallas are headed towards 25%, or already passed it on the way to 30%, as in the case of San Francisco and Houston.

Some companies have experimented with going fully remote and letting employees work from anywhere. While we don’t think that generally ends well overtime as it would likely affect innovation and collaboration, the short-term effect is that some minority of companies have given up their office space. The bulk of companies are experimenting with a hybrid model. Most companies will likely insist on their employees getting back to the office anywhere from two to four days per week in 2023…at least those that still live in the region, as many companies now have 20% or more of their employees no longer working where the company is based. A lot of those companies will be able to take advantage of office and workstation sharing for at least a portion of their employees, and another portion of their employees will have gone fully remote. The net effect is that when leases expire, most companies are going to be getting smaller.

As a firm that represents only tenants, we literally walk into places of business every day, visiting hundreds of companies every month. What we see with our own eyes are a lot of empty offices and more empty workstations. Reasonable estimates are that the average company can downsize anywhere from 20% to 30%. As leases expire every day around the country, the negative net absorption is going to be apparent very quickly. The spiking in office availability around the country that we’ve already seen is just getting warmed up—fast forward three years and another 10% availability will be added to many markets.

This kind of forecast has the same fatality for many office building landlords that unfortunately was experienced in the early 90’s when foreclosures of office buildings became widespread. The industry has been fortunate to be stable for over 25 years, but this might be one of the tragic byproducts of remote working and hybrid models across Corporate America, whereby most office markets around the United States end with availability rates in the 30% to 40% range. While this might sound alarming, there already are many individual submarkets within these metro areas where availability rates are already in this range—the Downtowns of San Diego, Denver, Dallas and Seattle being a few examples.

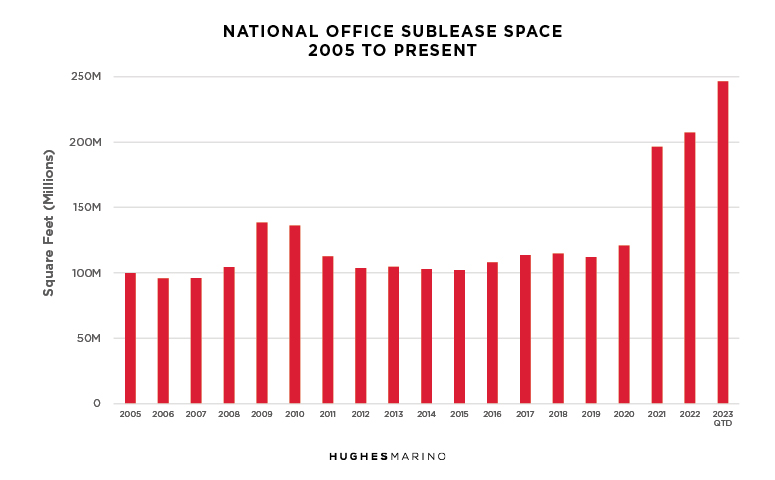

The Office Sublease Story—Setting Records

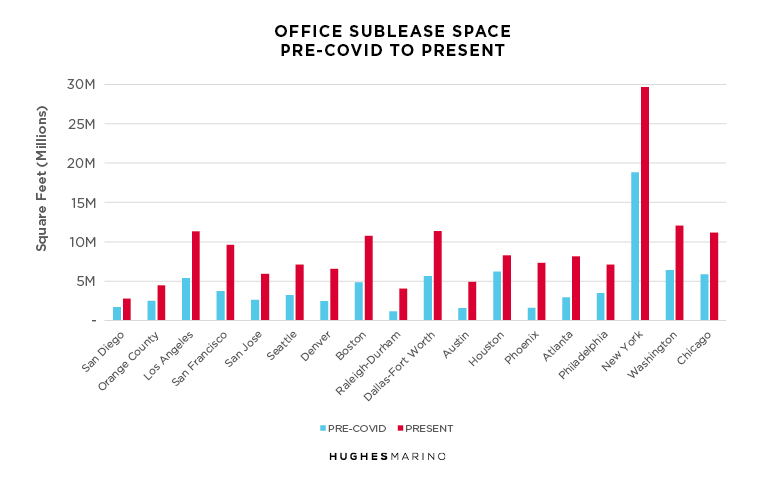

When you dig into the details of what’s driving the increased availability around the country, besides companies relinquishing their space in some cases or downsizing more often, is Corporate America’s behavior as it relates to subleasing some or all of their excess space. While many companies with leases expiring in two years are just waiting to have the lease expire and downsize, there’s been a historic surge of sublease availability that began with COVID in 2021 and has increased to historic levels.

Going back to 2005, there has been a relative equilibrium of the total amount of office sublease space on the market nationally in the hundred million square-foot range. Only in 2021 did that number double, and now is 2.5 times the normal conditions, and growing. Corporate America wants to get out of a lot of office space, and this is just what’s listed for sublease that companies can rationally shed, based often on the ability to demise and secure separate space to bring to market. We’ve met many a company that should rationally sublease all their space, but doesn’t want to recognize the accounting treatment loss in doing so, and would rather write rent checks to the end. There is also a feeling of hopelessness in the subleasing game.

As we look at each major metro area above, comparing pre-COVID conditions to current, the severity of this problem in major metro areas becomes apparent. Almost every major metro area has seen sublease inventory double from pre-COVID times, and in some cases like Raleigh-Durham, Austin and Phoenix, literally triple.

Every day some of these subleases expire and the space reverts back to the landlord, or the space gets taken off the market, but sublease inventory levels keep going up. Office sublease inventory represents a major percentage of the total space available in every metro area and has become fierce competition to landlords trying to retain tenants or win new ones. This condition is expected to persist throughout 2023 and 2024. Combined with ongoing negative net absorption by tenants continuing to downsize through 2023 and 2024, landlords will lose all of their pricing power this year.

While all of this seems like some Shakespearean tragedy, the reality is that the tenant is becoming king again. For those companies that want to come back from remote working, hope to grow, or are facing lease expirations in the next three years, we’re encountering the softest market we’ve seen since the 2000 Tech Wreck. The days of landlords working together with their price-supporting listing brokers are over. 2023 will finally be the year that building owners are forced to break ranks from the competition as they fight to “survive til ’25.”

Marketing statistics provided by CoStar Group.