By David Marino

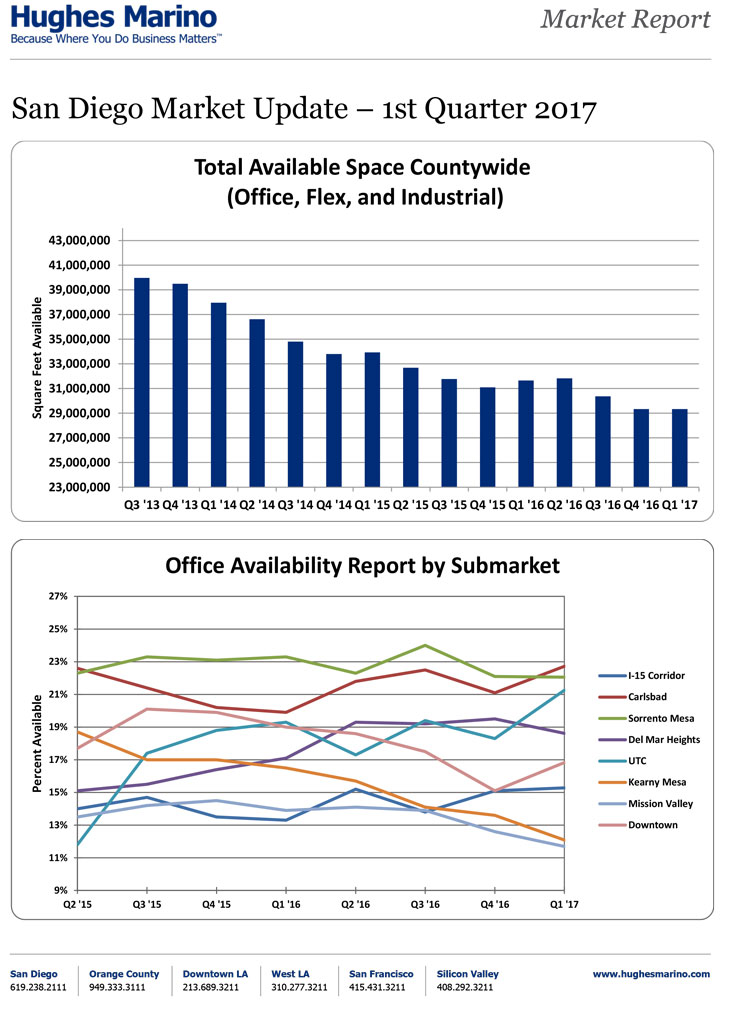

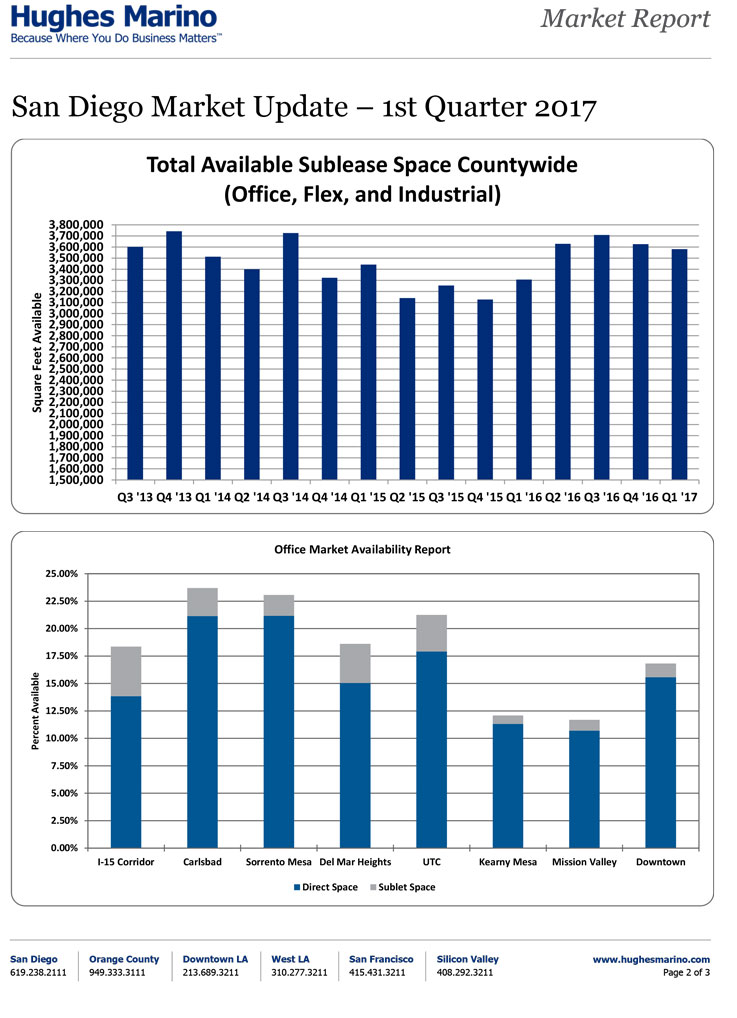

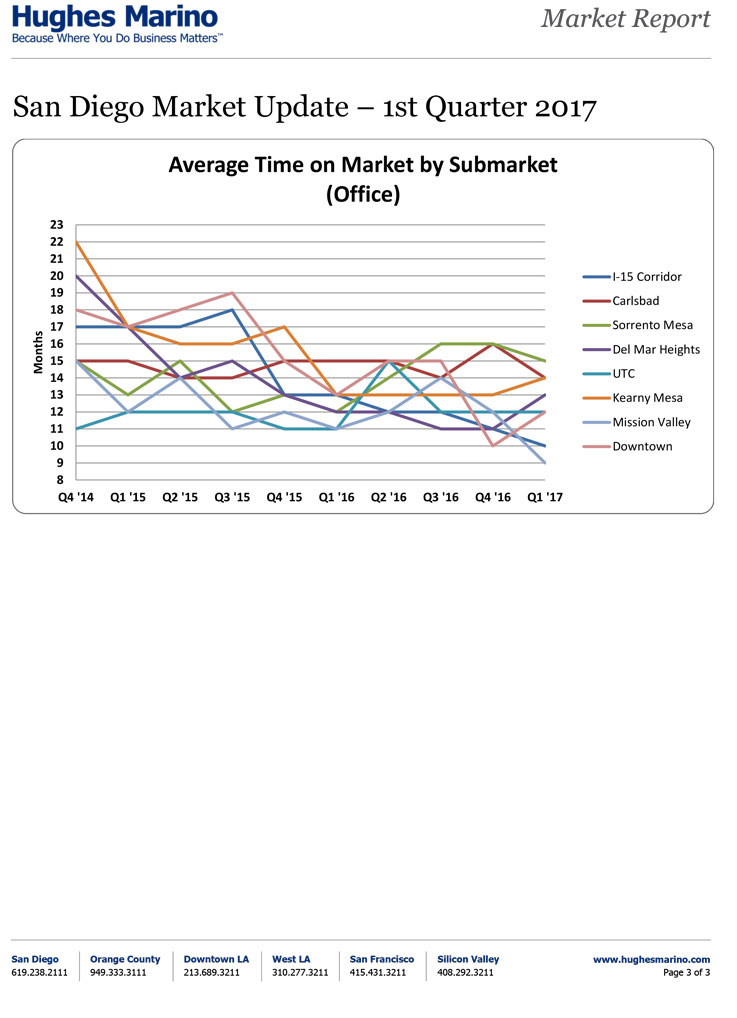

This first quarter of 2017 showed strong stability in the San Diego regional commercial real estate market for office, lab and industrial space. Total sublease inventory trended down slightly, while total availability of space on the market stayed level to the end of 2016. The flat total availability in the county is not shocking as there has been some additional construction inventory, primarily for R&D and industrial tenants in Carlsbad and a new office building in UTC, which have come on the market to add to the total inventory. Leasing and tenant demand stayed strong in the first quarter, while this new inventory came to market, offsetting the total amount of space leased. Certain submarkets like Mission Valley and Kearny Mesa continue to show decreases in availability rates. What is most notable over the last couple of years is the extraordinary decline of the amount of months that office space stays on the market. Just a few years ago the average office space sat on the market from 11 to 22 months, depending on the submarket. Average time on the market has been reduced and now ranges from 9 to 15 months, with Mission Valley and the I-15 Corridor leading the way in terms of popularity.

What is most startling, and literally at the lowest availability rate in 30 years, is the tightness in the industrial market. Industrial buildings over 50,000 square feet in the entire central county area can be counted in the single digits, and we are beginning to see a trend of central county tenants looking both to North County and South County for their industrial space options. Hughes Marino is working with a number of clients in the central county that are looking to retain their corporate headquarters in office space in a central location, and move their warehouse operations to the South Bay or Vista. Warehouse rents in Miramar and Sorrento are now at $.95 per square foot, where tenants can be north or south at closer to $.60 per square foot, so the savings are real.

Downtown availability has been in a continual decline for the past several years. Spaces with a great view in premium buildings are a rare find. A few small (150,000 square feet or less) office buildings are expected to pop up over the next four years – the most exciting project being the 7th and Market site soon to be under development by Cisterra. The jury is still out on Manchester’s Pacific Gateway. My personal belief is that Manchester needed to start “demo” in order to avoid default with the property owner, the U.S. Navy. But it is questionable whether he will be able to get debt and equity lined up – so I give it less than 50/50 that he’ll able to move forward with the office development anytime soon. The multiple hotel portion has a bit better odds.

While the high level data does not yet suggest a strong continued year of demand yet in 2017, based on dozens of major expansions Hughes Marino is leading for local companies, we expect the second quarter to show a continued decline in space availability throughout the region, and across all product types.