By David Marino

For the past two decades, clients and leaders in the local business community have often referred to the Hughes Marino quarterly report as a “canary in the coal mine.” Hughes Marino has consistently reported negative trends 12-18 months ahead of an actual market collapse, and forecasted recoveries up to a year ahead of past post-recession cycles.

These leading edge insights are generated from first-hand market information gained in the field, as at any given moment we are actively representing up to 300 active tenant/buyer engagements for 4+ million square feet of commercial space in San Diego County, across industries, company sizes and submarkets. Hughes Marino’s client engagements include expansions, contractions, relocations and lease renewals, which afford us the opportunity to work with corporate tenants 6-18 months in advance of their next occupancy requirement. The lease and purchase transactions we are engaged in today are for companies planning for their 2017 and 2018 real estate strategies and headcount requirements, giving us leading-edge insight into the underlying business requirements that are driving their anticipated growth or contraction, and related job growth.

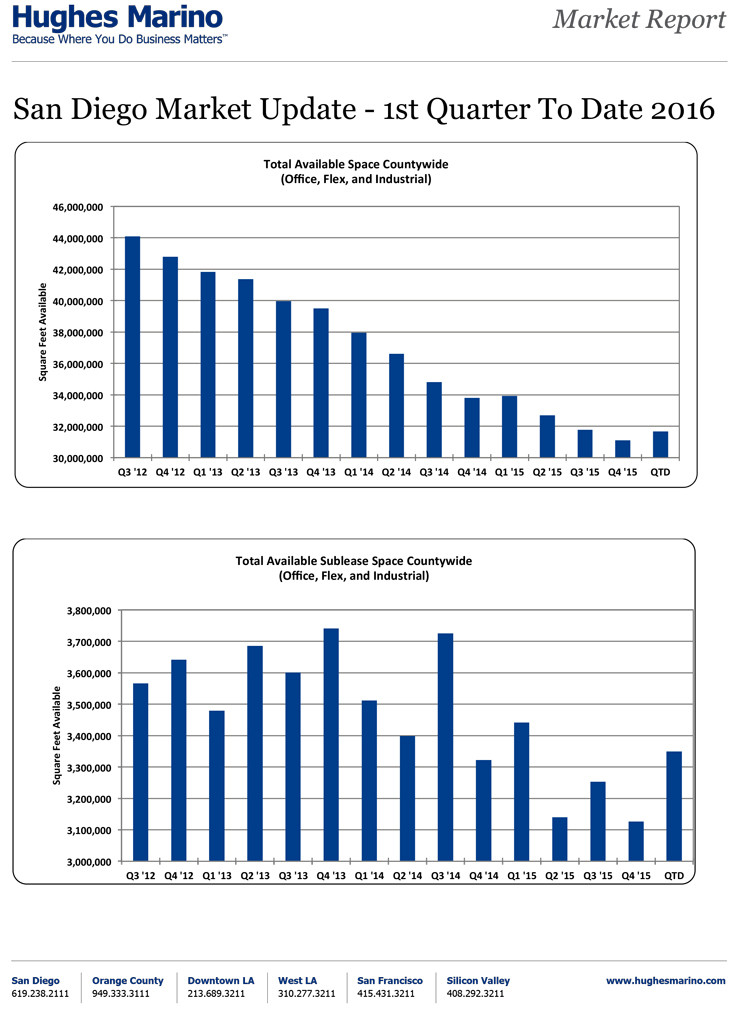

Typically we would wait until the end of the quarter to release this report, but we felt something in the wind, and we wanted to get ahead of it. After five years of recovery starting after the third quarter of 2010 when the commercial real estate market was at its bottom, 2016 has seen availability rates spike back up. Year to date, 572,000 square feet of net lab, office and industrial space has come on the market, and we fear that there is more to come. 224,000 square feet of that 572,00 square foot total represents a net increase in sublease space, sliding both total availability and sublease availability back up to third quarter, 2015 levels.

None of this year-to-date net increase is related to Qualcomm, which announced last year that it would be vacating roughly 365,000 square feet in six buildings in UTC, Sorrento Mesa and Torrey Hills, all of which hit the market in 2015. (Another 304,000 square feet was quietly vacated in Campus Point, and that building was bought by Alexandria Real Estate and leased to Eli Lilly for a relocation and expansion of Lilly’s Campus Point site). Nor has the uptick in supply been driven by ground-up new construction. Rather, it can be mainly attributed to new availabilities in existing buildings throughout the region, particularly along the coastal submarkets of UTC, Sorrento Mesa, Del Mar Heights, and Carlsbad, as well as a general slowing of demand and expansions.

In particular, we are seeing a softening of demand in the life science market, as life science IPOs and the capital markets around the industry have receded. At the same time, significant new remodels of office and industrial buildings being converted into lab space by Biomed Realty, Alexandria Realty and Phase 3 Properties in UTC and Campus Point, plus 330,000 square feet of new construction by Biomed Realty off the I-805 freeway at La Jolla Village Drive, which will be finished in June 2016, are adding nearly a million square feet of lab space to the market. While all of this square footage is already in the 2015 availability totals, the timing of delivery is going to make it a knife fight among life science landlords in the region. Additionally, a number of life science companies are beginning to struggle to meet their lease obligations, and those coming downsizings will contribute more sublease inventory to the market in the next two quarters of 2016.

In contrast to all of this, Downtown’s Class A market is tight and is not contributing to the uptick in availability, with a few caveats for landlords who are viewed as less than prime (yet trying to get prime rates). The market is still very soft for Class B, and it will take years for these buildings to stabilize. There are even softer Class C buildings like the Executive Complex and The Chamber Building, and these are functionally obsolete and will need a total retrofit (inside and out) just to remain moderately competitive in the future.

While we are not forecasting any kind of recession or economic calamity like we did back in 1999, and again in 2007, we are seeing demand maturing such that landlords and their full-service listing brokers are going to have a tough time continuing to drive up rental rates and pushing over-market rent increases. The Irvine Company has been demanding 4.5% annual increases in their leases going on four years now, which made sense at the time as the office market in the region was hyperinflating. However, these over-market rent increases are no longer reflective of future expectations for rent growth, and adjustments will have to be made.

As we begin to see anxiety from large institutional landlords for tenant retention and acquisition, it is clear that the commercial real estate market in 2016 is going into equilibrium. While we don’t expect a return to a tenants’ market any time soon, the pendulum that has swung so strongly to create a landlord’s market over the last three years is finally peaking out.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.