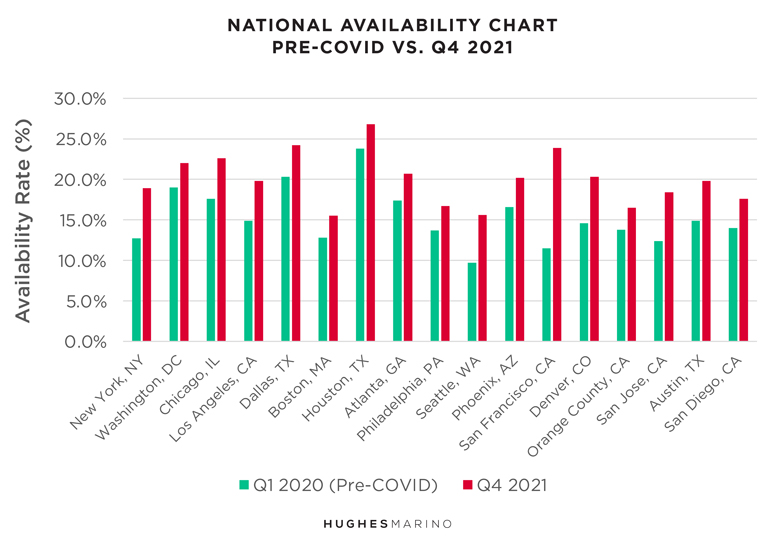

Looking back at how the national commercial office markets were first impacted by COVID in 2020, availability rates in all US markets spiked—generally by 20% to 40%, but as high as 44% in New York City, 57% in Seattle and doubling in San Francisco. After this initial shock, 2021 became a year of sorting out, where many companies hit pause on their plans to go completely remote. While some people began to trickle back into the office, for the most part, tenants just kept paying the rent, hoping that COVID would end, and that people would come back…but it hasn’t, and they don’t seem to be.

Most business owners ended 2021 still struggling to get their employees back into the office, and effectively powerless in making them do so. While being paralyzed by ongoing COVID variants and shifting perceptions of workplace safety, the overwhelming majority of companies still have yet to formally enact a remote working or hybrid strategy that would impact how much space a company leases long term. Most employers have not been forced to make these sizing decisions, as only 25%-30% of office leases have expired in the United States since COVID began. Over the next four years, the bulk of the remaining US office leases will expire, and one by one, business owners and management teams will make the decision to stay or move, reduce office size or stay the same.

Most metro office markets increased modestly in 2021, ending the year within a percentage point of where the year started. Some metro markets continued to slide in 2021, with San Jose availability increasing by 2%, Chicago by 1.4% and San Francisco up another 1%. On the other hand, Austin’s availability went down by 1.3%. Overall, most of the US markets are still in turmoil as the chart below shows.

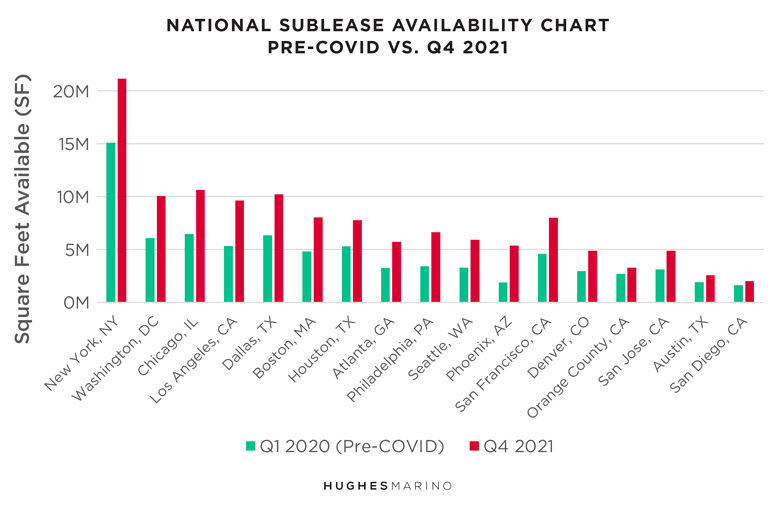

But what does the future hold? If you walk around office buildings all week like we do, visiting hundreds of companies a month and talking to thousands a year, the reality is that most companies are not using most of their space. With work from home, hybrid working, and work from anywhere becoming the new de facto normal, logic prevails that most companies never will use some portion of their space. In fact, it’s playing out in reality through the uptick in total sublease inventory, as when companies put their space on the market for sublease, that means they are never coming back.

2020 ended with a record amount of office sublease inventory on the market in every US market. Most US markets are up 35%-80% from pre-COVID, with Phoenix up 186%. One would think that sublease inventory would have been declining by now. Instead, more companies continue to reach the conclusion that they are not coming back to their current footprint, resulting in new subleases on the market every week. Virtually all US office markets ended 2021 with the same amount of sublease space on the market as the start of the year, with the exception of Phoenix up 29%, Washington DC and Philadelphia up 17%. Only a handful of markets ended 2021 with any material improvement, with Austin down 31%, and San Diego, Seattle and San Francisco inventory down ranging from 16% to 18%.

The languishing of sublease inventory will continue to provide great opportunities for tenants in 2022-2023 to get well-below market rates and plug and play space, and landlords will continue to underperform. Depending on the COVID variant’s impact on health conditions for the balance of the year, this total glut of office sublease inventory will persist well into 2023 and 2024, continuing to be a thorn in the side of all landlords who will have to compete with their own tenants looking to dump space.

In many US metro areas, the long range prognosis for the office market space is grim with the exception of some unique submarkets, such as the Cambridge area of Boston, South Lake Union Seattle, Central San Diego and South San Francisco, where the biotech industry is flooding into office space. Over the next 4-5 years, the remainder of most US office leases will expire, allowing tens of thousands of commercial real estate tenants to reassess their footprint requirements each year. Consensus is that remote working and hybrid models are here to stay for most companies in most industries, and tenants are going to need less space when their lease expires. As companies relocate or downsize their current space, the net result is that US landlords are going to be handed back tens of millions of square feet of office space every year. It’s not something anyone’s going to notice in any particular quarter, but there is going to be a long four-year drift to the bottom.

Marketing statistics provided by CoStar Group.