After almost three years of declining availability, along with significant inflation of warehouse and industrial rents across most the United States, the winds of change are in the air. With Covid behind us and consumers shifting back to many of their pre-Covid purchasing patterns, the growth of e-commerce activity has flattened out, and so have those same e-commerce companies’ voracious demands for warehouse and fulfillment space. In fact, many companies like Amazon have concluded that they overextended themselves, creating too much overlap of facilities, and now not only has their growth ceased, but many of those companies are listing excess space on the market for sublease around the country.

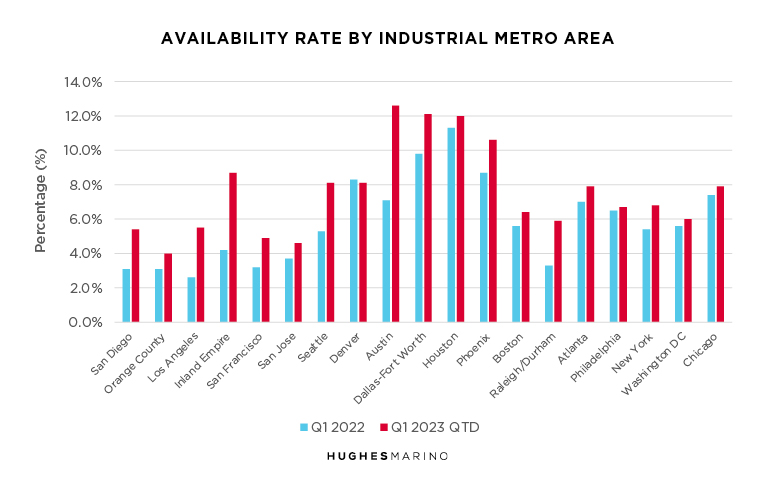

The chart below compares industrial availability in Q1 2022 in blue with current market conditions in red. While a handful of markets around the country are essentially unchanged, over half of the major industrial markets around the country have a noticeable uptick in industrial availability. None of the industrial markets show a material decline in availability, and winds are only blowing one way…north.

Some markets like Raleigh-Durham, North Carolina, as well as the Southern California distribution hubs including San Diego, Los Angeles and the Inland Empire with products coming in from Mexico and Asia, have seen a doubling in availability rates over the last year. While these markets are still landlord favorable with availability rates of less than 10%, the uptick is dramatic and noticeable, pulling the wind out of the sails of those brokers representing industrial landlords who were pushing record-breaking rent increases. Most notable are the Texas and Phoenix metro area markets where availability has pushed above 10%, moving beyond equilibrium where landlords are now competing heavily for tenant interest.

The industrial real estate sector moves in long macroeconomic trends that can take years to move from the tightest market to the softest. Availability rates increase if tenants are downsizing when their leases expire. Consider that only about 20% of industrial leases expire every year, so only a small fraction of companies get to reset their size each year when their leases expire. While U.S. corporations are not generally giving space back upon lease expiration (yet), much of the explanation for these upticks in availability is the rise of sublease space by companies that leased too much space during the Covid run up as well as a large inventory of new development being marketed in most major industrial markets.

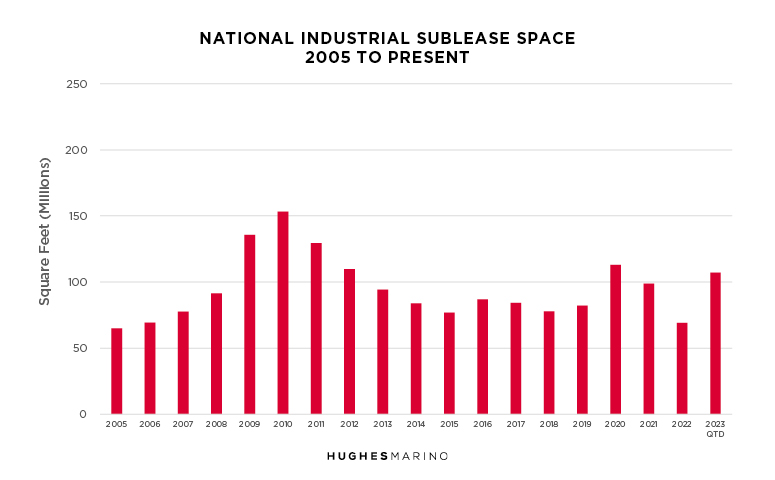

The bar chart above shows the historical total amount of industrial space on the market for sublease throughout the United States. Noticeably, there was a run up in sublease inventory after the 2008 through 2009 financial crisis. What’s happening now is corporate America shedding more industrial space this year than we’ve seen in almost a decade, other than the initial bump that occurred in 2020 in reaction to the initial Covid shock. As for concentration, 14% of all U.S. industrial sublease inventory is in Southern California, which as a region saw industrial rents double from 2019-2022 in most of the region—change is in the winds.

Historically, sublease inventory is the leading edge of things to come as it signals corporate America’s shedding of excess space due to changing economic conditions. If the US economy truly enters recessionary territory, we can expect more sublease space to come to market, creating more below market options for those tenants looking to expand or relocate. Those subleases often come “plug and play,” with racking and other equipment in place at no additional cost, and are often for a shorter length of term than landlords would generally require.

If tenants that have leases expiring in 2023 and 2024 find themselves with excess space, the resultant downsizing will push availability rates up even further, moving some industrial markets into tenant favorable territory. To take advantage of the shifting landscape, those tenants that “skate to where the puck will be next”—to use a Wayne Gretzky quote—will be the ones to score. It means approaching the market more aggressively, not being rushed by a broker or landlord to consider a renewal sooner than you should, and most importantly, going to market with a representative that has an understanding of where the winds are blowing, not just where they came from.

Marketing statistics provided by CoStar Group.