Four years after the onset of Covid-19, the commercial real estate market in Silicon Valley is still adapting to the long-term impact of the pandemic. With approximately half of office leases signed before Covid yet to expire, many tenants have not addressed their surplus space resulting from the shift to remote and hybrid work. The decline in office space demand is significant and ongoing. But how extensive is the situation across Silicon Valley, and what does the future hold?

Availability Over Vacancy

Traditional brokerage firms representing both landlords and tenants tend to report only on “vacancy rates,” which can create a partial view of market conditions. Vacancy rates are useful in a strong market but do not capture the nuances of a softened one. For a complete picture, it’s essential to look at “availability”—all spaces listed for lease or sublease, whether occupied or not, or still under construction. Think of it as shopping for a home: you’d want to see all available homes, not just vacant ones.

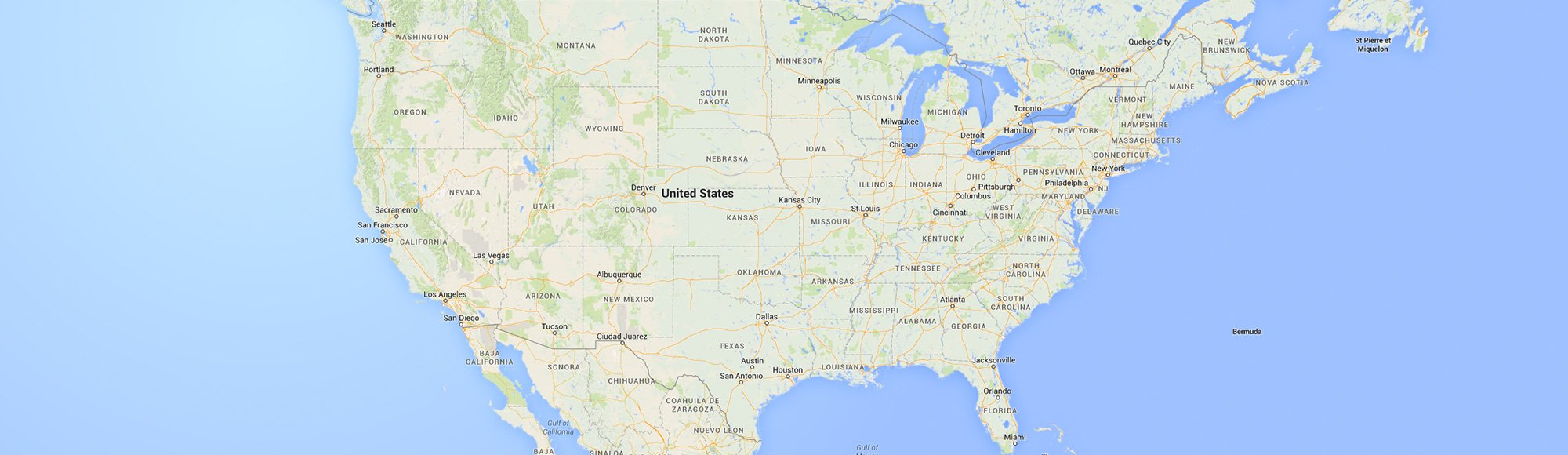

Throughout Silicon Valley, availability rates have surged in every major submarket. Data reveals substantial increases since 2020. Menlo Park’s availability rose from 8.3% in Q1 2020 to 30.8% in 2024. Mountain View increased from 7.1% to 36.4%, Palo Alto from 14.1% to 20.8%, Redwood City from 10.5% to 28.5%, San Mateo from 12.1% to 22.9%, Sunnyvale from 8.5% to 21.0%, Santa Clara from 17.9% to 27.1% and San Jose from 14.0% to 24.5%.

![]()

Looking ahead, availability is expected to continue climbing as more pre-Covid leases expire. Many companies across Silicon Valley may choose to downsize further as remote and hybrid work continue to affect office utilization.

Surge in Sublease Space

A key driver of rising availability is the surge in sublease space, now at unprecedented levels. Sublease inventory that often offered “plug and play” at reduced rents with flexible terms, has doubled compared to pre-pandemic levels. For tenants, this trend presents an advantage, offering greater flexibility and competitive pricing in well-furnished spaces.

While these dynamics challenge landlords, they provide a unique opportunity for tenants approaching lease expirations, putting them in a stronger negotiating position to make the most of current market conditions.

Marketing statistics provided by CoStar.