By John Jarvis

The Big Guns

The strength of the San Francisco office leasing market through the first half of 2017 is being supported in large part by the “Big Guns” in the market, and a few of the still-hungry, hyper-growth technology companies. So far in 2017, large leases (100,000 square feet and greater) have been taken down by Google, Adobe, Uber, UCSF, Accenture, Slack, WeWork, Otto and Cruise. Some of this leasing seems to be in response to employees living in the city and expressing growing frustration with the shuttle-bus-commute to points south along the Peninsula. The latest evidence of this movement into the city, where many of the young tech workers choose to live, is Facebook’s current negotiation for approximately 70,000 square feet at 110 5th Street. This would be Facebook’s first lease in the downtown San Francisco market, and it is rumored that a few Instagram teams will occupy the new space as they test the waters on this new San Francisco satellite concept away from Facebook’s Menlo Park center of gravity.

Musical Chairs?

The office building developers and their brokerage teams all remain outwardly optimistic and bullish, but there is almost certainly underlying anxiety creeping into their project team meetings. With 2.5 million square feet of new office space finishing in 2017, and another 1.5 million square feet in 2018, the building owners need the big tenants to stay hungry. Jay Paul Co.’s “181 Fremont” (413,000 SF), John Buck Co./Golub Co.’s “Park Tower” (750,000 SF) and Kilroy’s “Exchange” (750,000 SF), are all due for completion within the next twelve months and none have yet to sign a lease. Hines is feeling better about Salesforce Tower (1.4 million SF), due to finish later this year and now reporting 90% occupancy (Salesforce’s preleasing commitment was for the bottom 50% of the tower). Timing is everything, and these massive projects can take years to complete. If it takes too long to get the building out of the ground and finished developers can find themselves forced over into the subsequent market cycle. One example, San Francisco Shipyard by FivePoint is charging ahead with their plans to deliver 4.3 million square feet in 2021, and nobody knows what the leasing market will look like at that time. Builders build, it’s what they do. And they are building well into the current boom cycle. If the tech sector or the stock market were to sneeze, let alone catch a cold, it could send this market into decline. When the music stops, there could be a lot of real estate looking for tenants.

Mission Bay Fever

Mission Bay is a scene of frenzied development in 2017. Longtime neighborhood incumbent UCSF has four large developments currently under construction, including three medical/research buildings totaling close to 800,000 square feet as well as 600 residential units for graduate student housing. Add in the 435,000 square foot office complex Alexandria is building for Uber and things are starting to get crowded. And this is before we add the NBA Champion Golden State Warriors and their new Chase Center arena, which includes another 580,000 SF of office space delivering in 2019/2020. It is going to get a little crazy, and not just when the Warrior’s home games draw another 18,000 spectators. The city is trying to keep up with the requisite infrastructure upgrades, from sewer lines to transit solutions. This will be interesting to watch, and there will likely be some growing pains in this busy little submarket.

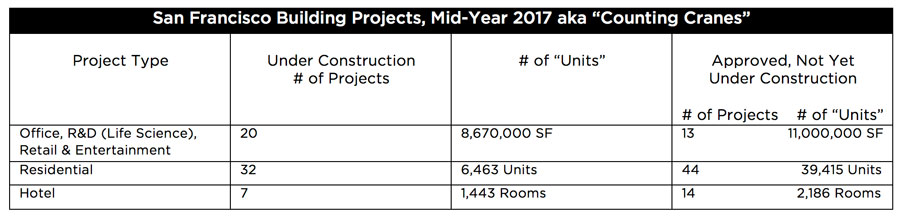

Counting Cranes

Yes, builders build, it’s what they do. You may have noticed a few cranes across the San Francisco skyline. Here is a quick summary of what is going on.

Parting Thoughts

And a few data points to put things in perspective:

US Median Home Price: $245,000

San Francisco Median Home Price: $1.5 million

San Francisco Median Condo Price: $1.2 million

(New York Median Condo Price: $1.1 million)

John Jarvis is an executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact John at 1-844-662-6635 or john@hughesmarino.com to learn more.