By David Marino

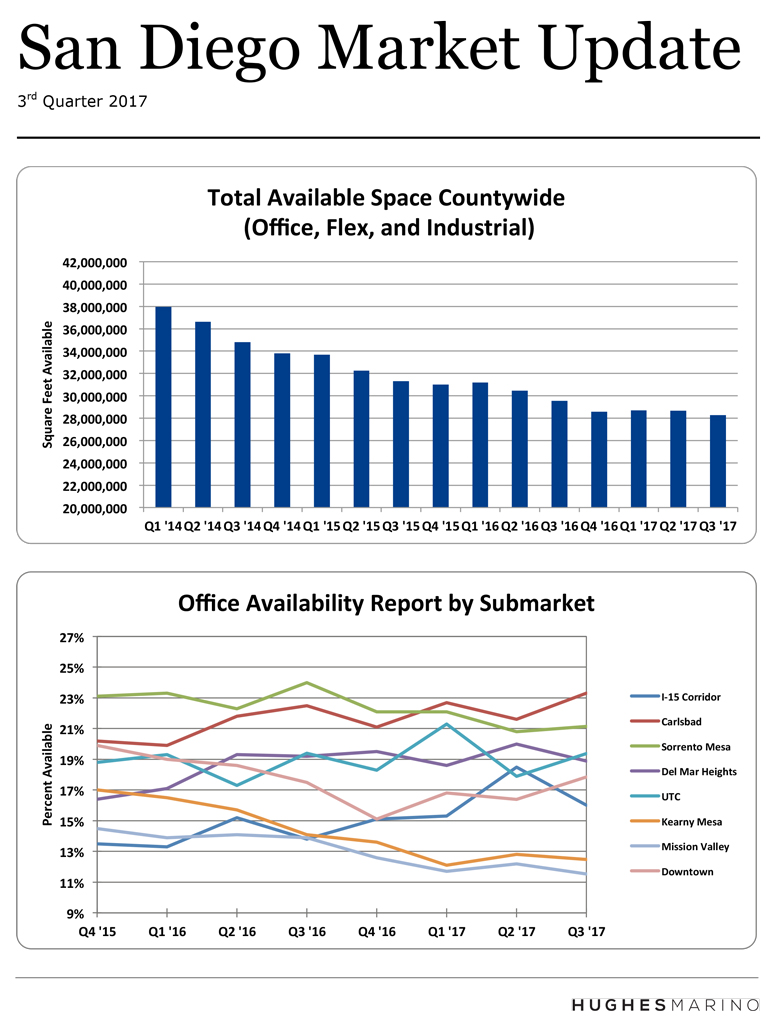

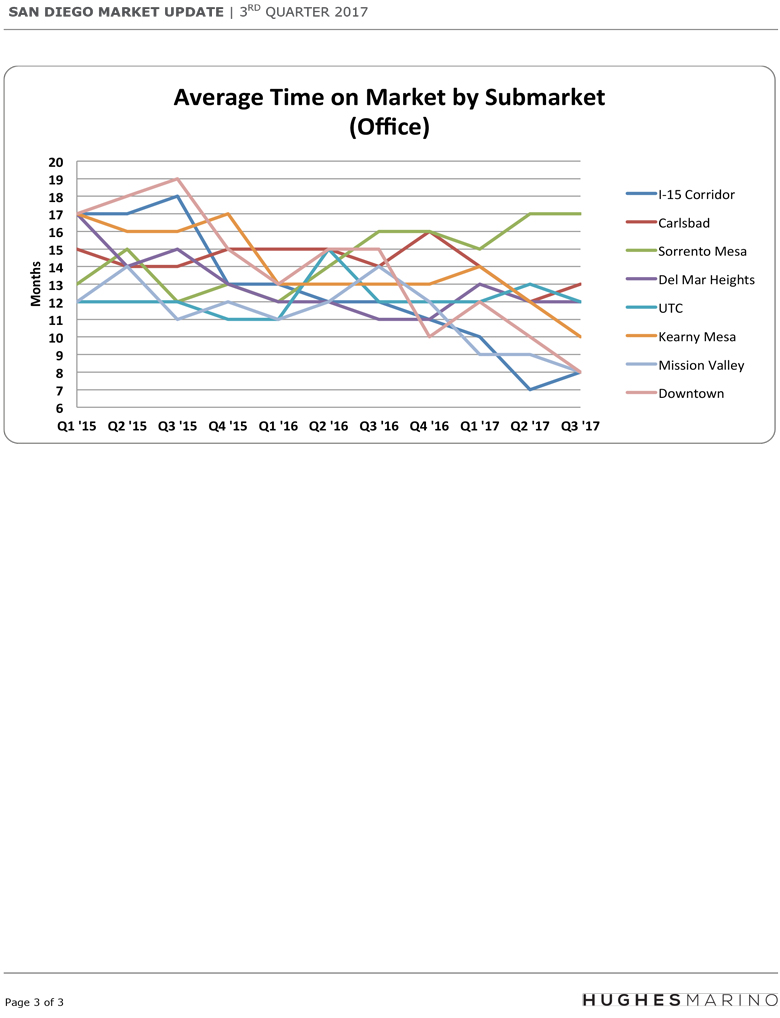

After several years of strong economic growth and 2.5 million to 5.7 million square feet of combined office, industrial and lab space being absorbed annually, 2017 has been and anemic year with just over 300,000 square feet of decrease in total availability across the combined product types. Of concern is the office market, which continues to be stagnant in every submarket other than Kearny Mesa, Mission Valley and Downtown. Carlsbad has bumped up to over 23% availability, as the local economy there has been stagnant. Of greatest concern is Sorrento Mesa, where availability is currently 21%, and a record 30 full floors of office space are available for lease with very little large tenant demand to backfill that space. While rental rates have yet to collapse, landlords are offering generous free rent, tenant improvements and moving allowance concessions to compete over the occasional tenant that presents itself. Of concern is the potential purchase of Qualcomm by Broadcom. Should this occur, we can expect massive job thinning and headcount reductions, which will immediately translate to square footage flooding the market. At least 1,000,000 square feet of additional office space could bleed onto the market, with potentially as much as 2,000,000 square feet in Sorrento Mesa alone. For most people, that square footage is hard to imagine, but consider if the average floor of office space is 25,000 square feet, a 40-story building would equal 1 million square feet. Now imagine two of them! When Qualcomm shed 1,000,000 square feet a few years ago in the region, half of that space still lingers on the market, concentrated in Sorrento Mesa and Torrey Hills, un-leased two years later. If the Qualcomm merger happens, it will result in a regional free-fall leaching into Del Mar Heights and UTC, resulting in a multi-year softness of office space in the central county region.

Add to that that UTC is still tracking 19.4% availability for office space, which is a very fragile situation as The Irvine Company continues to undercut every other landlord in the area, stealing a vast majority of the tenants from other building owners and also drawing some tenants from Del Mar Heights and Sorrento Mesa. Take in case 4747 Executive Drive at “La Jolla Commons,” where US Bank and KPMG are located. KPMG is moving out and the availability rate for that building has skyrocketed to 50% with all of the space that is available now for lease. Landlords are privately stunned and beyond frustrated with the aggressiveness that The Irvine Company has taken market share, but have no capacity to respond due to most landlords needing to perform to lenders and shareholders expectations, propping up rents while The Irvine Company steals every deal they can.

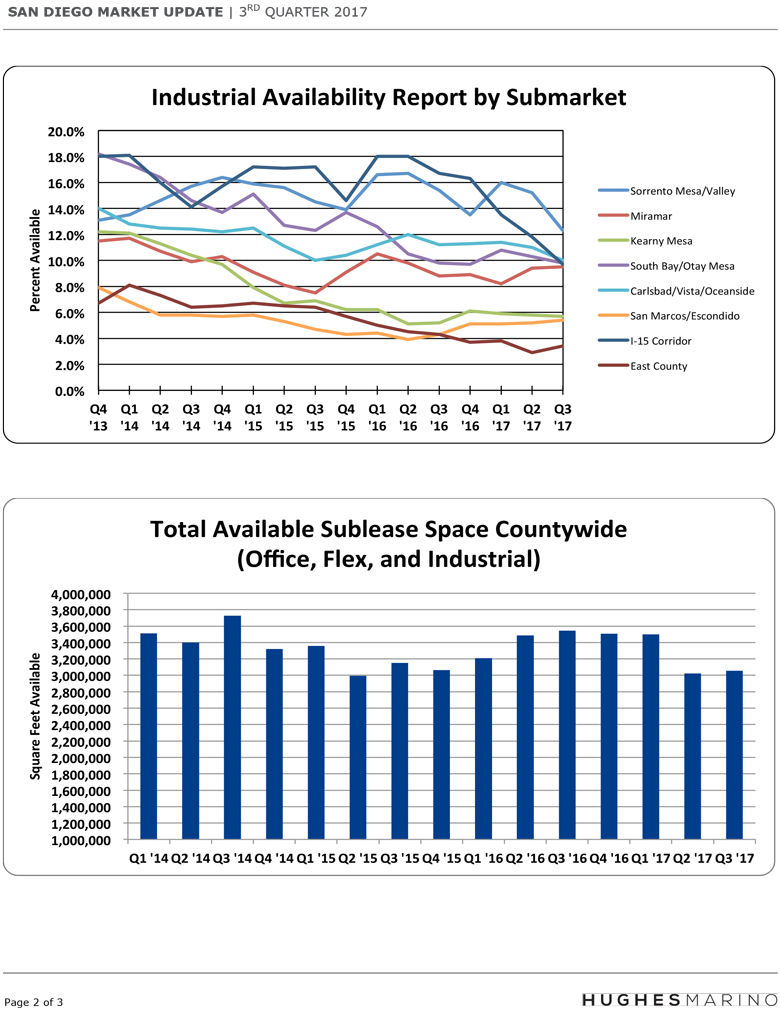

Things are much different with lab and industrial space being much more healthy throughout the region. Industrial and lab vacancy rates have driven down over the last three years, as the strong capital markets in biotech continue to feed growth in that sector, and there are dozens of life science tenants in play to expand and relocate. Most of the activity is centered around UTC, Campus Point and Torrey Pines, with Sorrento Mesa life science buildings lagging due to the traffic congestion and the lack of amenities associated with those offerings. Industrial space has come raging back strong with historic low availability rates due to the growth in the beer industry, e-commerce providers and the industrial supply chain filling back up. Warehouse space in the Central County area that used to lease at $.55 triple net has seen rent growth up to $.95. Every industrial market in the region is now 10% or below in terms of availability with the exception of Sorrento Mesa and Valley, running at 12.3%. Due to the lack of remaining industrial land, coupled with the incredible increase of land cost, we don’t expect materially more industrial space to be constructed in the Central County area during the rest of our careers, so vacancy rates for well-located functional buildings will continue to decline over time, putting increased price pressure on industrial rents.

Right now it’s a winners and losers marketplace, with no universal consistency. Landlords of industrial and lab buildings are outperforming office landlords by substantial margins. For office landlords, the market has flat lined and there are storm clouds on the horizon.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.