HM Blog

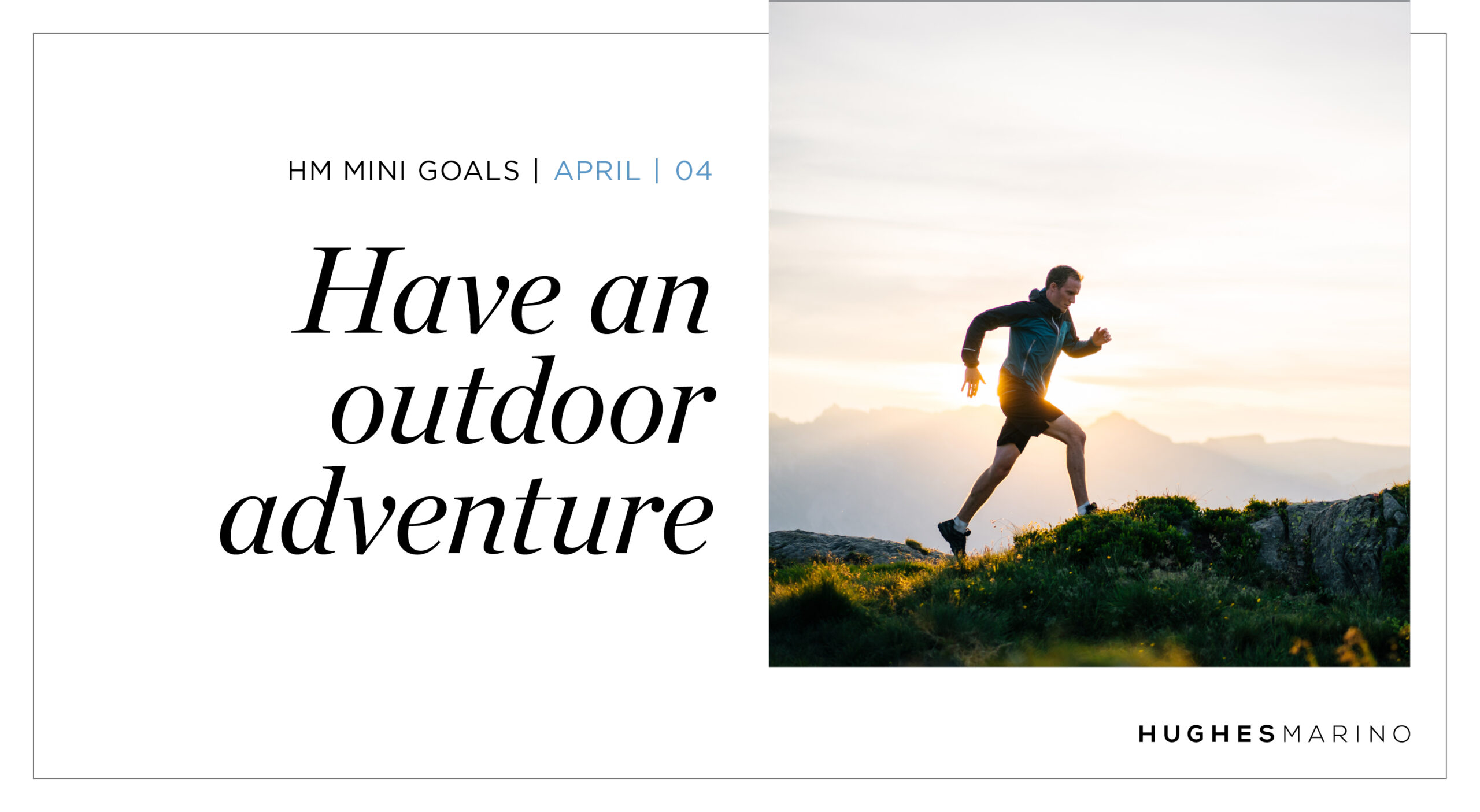

April HM Mini Goal – Have an Outdoor Adventure

Hughes Marino on April 01, 2024

One whole quarter of ‘doing what we said we would do’ for our 2024 HM Mini Goal Program is complete! Isn’t it fulfilling to have accomplished three fun goals this year? In March, our goal was to plant something, and we loved seeing your green thumbs in action! From planting trees in your backyards, to planting seedlings across our offices, to herb and vegetable gardens, you really showed up to celebrate spring. Keep scrolling to see some of our photo submissions of our plantings across the country. It’ll be rewarding to see their growth in the summertime!

Read More

Hughes Marino |

07 March 2024

Hughes Marino Debuts Newest Office in Booming Salt Lake City

Hughes Marino |

06 March 2024

March HM Mini Goal – Plant Something

Hughes Marino |

05 March 2024

February HM Mini Goal – Paint Something

Hughes Marino |

05 February 2024