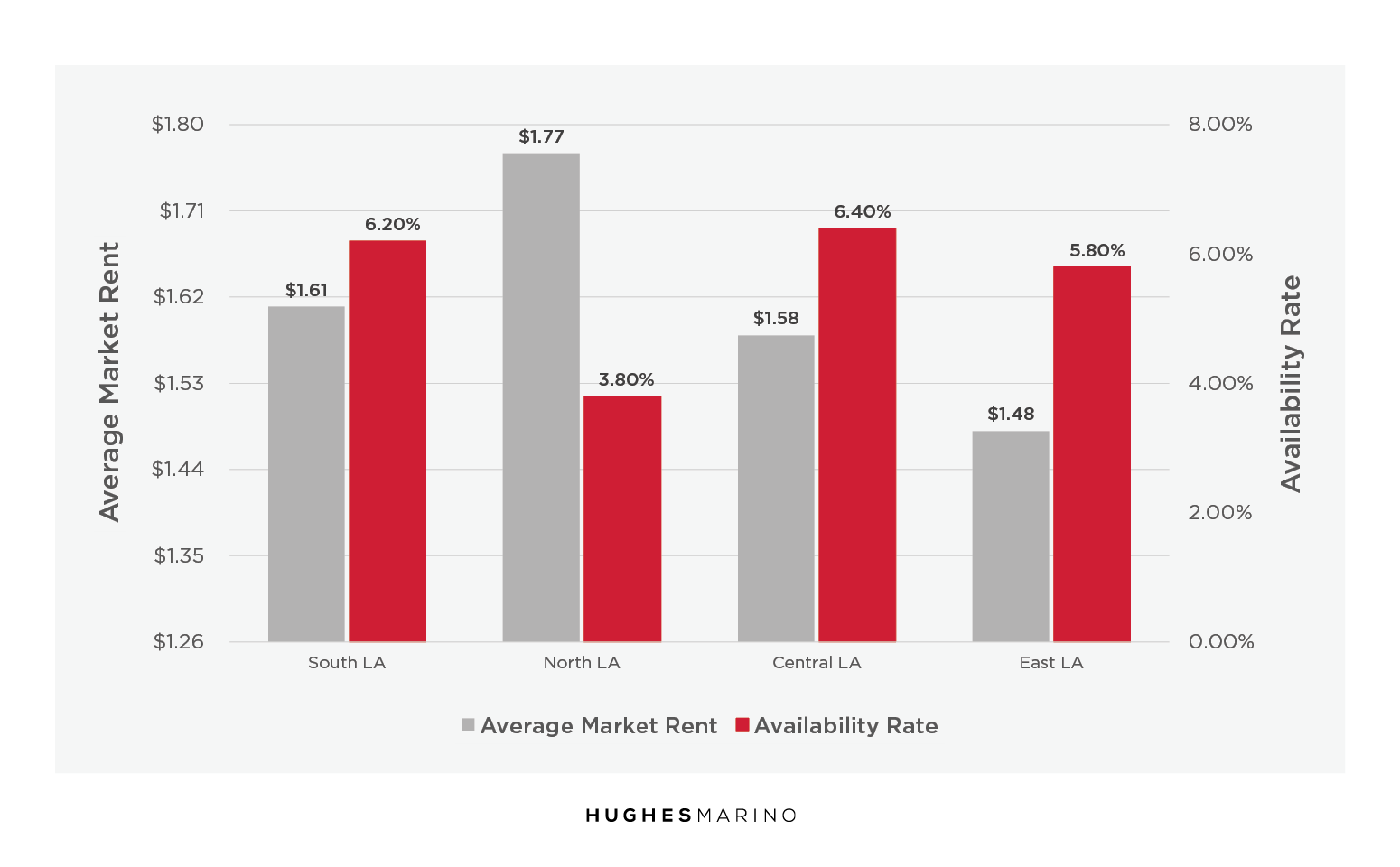

The Details.

Looking at a single market report can be helpful, but without the proper context it can be misleading as well. Each submarket, city, neighborhood and even building, is uniquely positioned within the greater market. In this section, we aim to shine light on the nuances of the four primary regions of Los Angeles. In general, demand for the greater Southern California market is driven by the Port of Long Beach, where rental rates have shot up to over $2.00 PSF for many buildings. However, we are seeing a clear softening of the market as imports to the ports continue to trend downward, reducing demand for warehousing and increasing vacancy across the region.

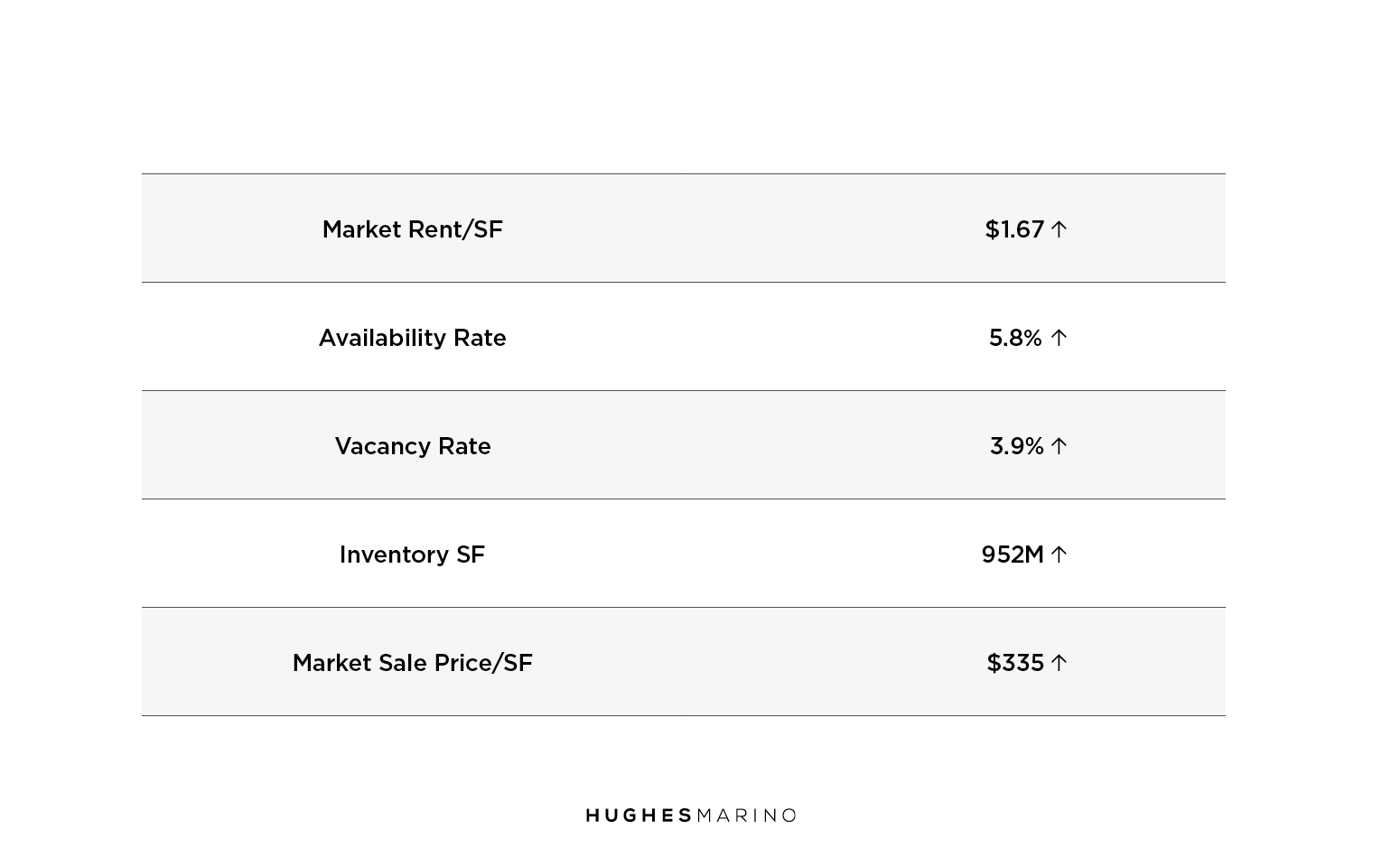

The Big Picture.

The below table provides overall market average figures for Los Angeles, offering insight into the bigger picture of our market. While we continue to see rental rates increase year-on-year, the market as a whole has clearly passed its peak. Over the last three years businesses have had an unprecedented appetite for space, but it seems they have now had their fill. Following the downturn in imports to the Ports of Long Beach and Los Angeles, we have seen all metrics for market conditions soften, including net absorption and total square footage occupied. This is true for the greater Southern California region, but most pronounced in Los Angeles. Despite this shift, vacancy rates are still low, and rental rates continue to increase at a modest rate.

The Buzz.

Dockworkers Reach Agreement. After one of the longest union negotiations on record, dockworkers have finally reached a tentative six-year agreement with shippers to ensure that goods landing in Southern California logistics buildings will arrive as scheduled. This comes right in time for the holiday season.

Rexford Continues Its Buying Spree. Local real estate investment trust, Rexford Properties, is focused on growing its portfolio, which consists solely of industrial buildings in the Southern California region. In 2022, the company purchased roughly$2.4B in industrial properties locally and despite increased interest rates, it has purchased approximately $1B in properties in 2023 so far.

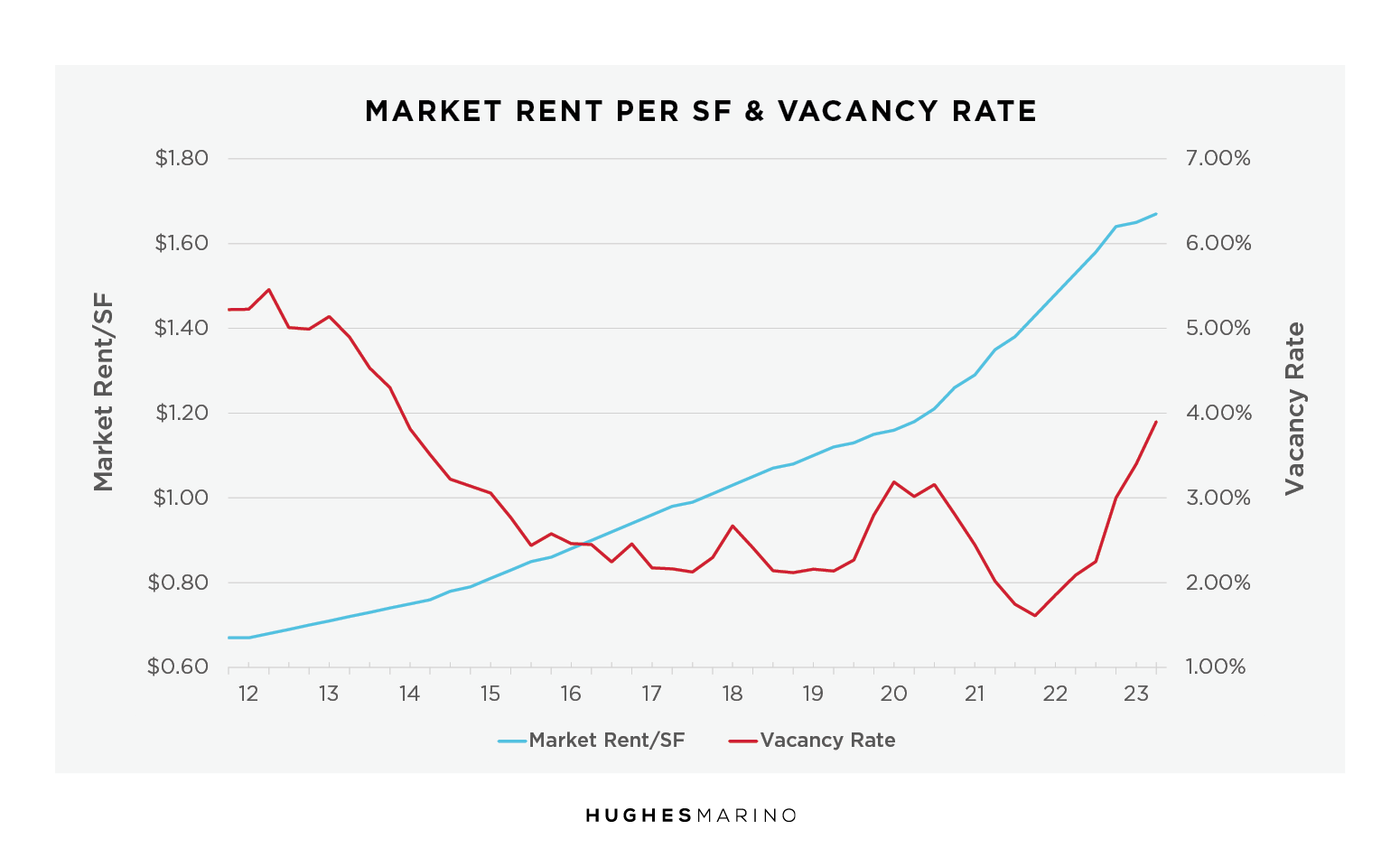

The Trend.

2022, like the two years prior, represented a frenzy of leasing and rental rate increases in Los Angeles, but we have seen that momentum slow in 2023. While 2021 and 2022 represented the fastest rental rate increases of any market on record, 2023 has proven to be the return to rational market behavior. This year we have seen occupancy drop, vacancy increase, availability increase and overall market conditions move in favor of the tenant and buyer—conditions not seen in years. Landlords are no longer in the driver’s seat of negotiations, and competition for new tenants is becoming fiercer every day. For the first time in years, it feels like tenants have taken back their leverage in the market.

The Neighbors.

Southern California boasts some of the highest rental rates in the country. As a result, many companies that do not have an operational need to maintain a facility in the region have elected to relocate, or expand out of state. Many major markets like Dallas, Texas and South Carolina can offer state-of-the-art properties at less than half the cost of Southern California. These real estate savings often outweigh any costs of relocating.

Marketing statistics provided by CoStar Group.