From 2020-2022, the biotech industry was the standout of the U.S. capital markets, thanks to the vital role the industry played in the Covid-19 pandemic response and the unprecedented capital investment that flowed into the industry for the diagnosis and treatment of all disease conditions. With that fresh capital, biotech companies leased millions of square feet of biotech wet lab space from 2020-2022 in an unprecedented surge that real estate developers and their landlord brokers thought would last for many years to come. In contrast, back in 2023, Hughes Marino began sounding the alarms that a perfect storm was on the horizon for the San Diego region’s biotech wet lab market, that would affect all U.S. wet lab markets. That perfect storm would be comprised of 1) changes in the capital markets that would negatively affect demand, 2) growing wet lab sublease inventory that would unexpectedly increase supply and limit landlords’ pricing power and 3) record levels of excessive new wet lab construction and office-to-lab conversions that would exacerbate the supply problem. We forecasted that these factors would collectively lead to a historic wet lab supply and demand imbalance, which is exactly what has occurred.

The Torrey Pines Story

Since the 1980s, with its proximity to San Diego’s prominent research institutes and UCSD, Torrey Pines had been the most desirable biotech submarket in the region. With historically very little availability and high prices, biotech companies began to peel off “The Mesa” back in the 1990s, initially moving into Sorrento Mesa, and into UTC and Campus Point in the 2000s, with a sprinkling of other companies pioneering Torrey Hills and Del Mar Heights in the 2010s.

Over the last 30 years, Torrey Pines has lost a bit of its caché as the quality of real estate in the surrounding submarkets elevated, and the price premium that tenants were willing to pay for Torrey Pines reduced. Back in 2021, with the lack of Torrey Pines wet lab space and rents there skyrocketing to $6.50 NNN per square foot, tenants shifted their requirements from The Mesa, to adjacent value submarkets where rents were generally $4.50-$5.50 NNN. A victim of its own success, Torrey Pines availability tightened to the low single digits in 2021 and 2022, as landlords held firm with asking rents in the $6.50-$7.00 NNN range. Tenants then shifted their space requirements away from Torrey Pines, just as landlords were bringing on new supply in Torrey Pines by renovating older buildings and demolishing several to add more density.

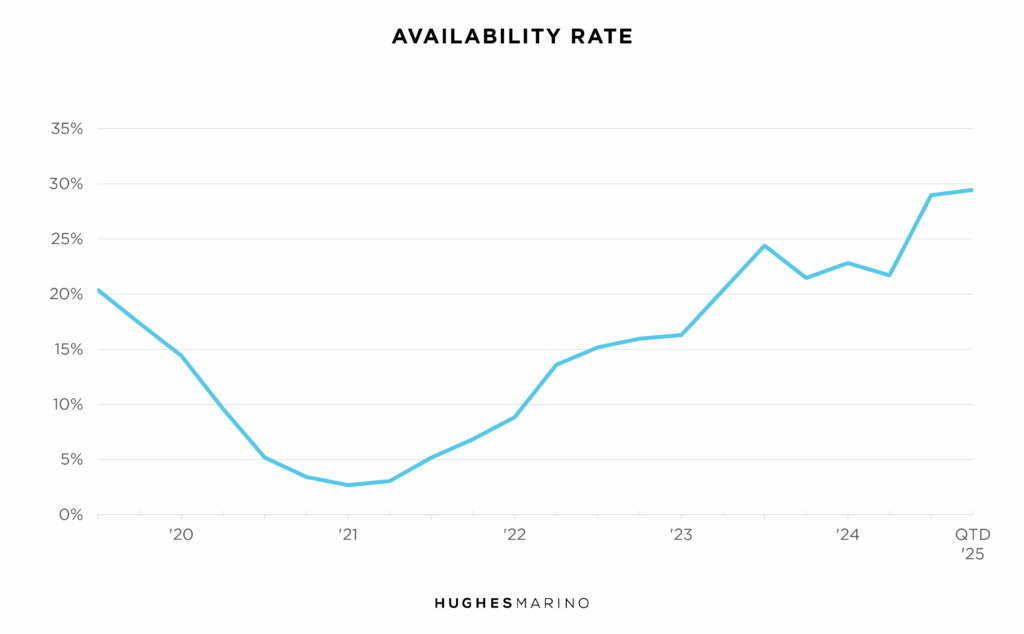

Torrey Pines wet lab availability began spiking in 2023, but you would not have realized it at the time as the landlord brokerage firms’ sleight of hand “vacancy rates” reports insisted the market remained tight. But the big landlord brokerage houses do not include buildings under construction or renovation that began coming online in 2022 in their vacancy calculations, nor do they include the quantity of sublease spaces that began to flood the market in 2023.

Measuring the market through the tenants’ lens considers all space “available” for lease or sublease in all buildings, even if they are under construction or conversion. Through that “availability rate” recalculation, a very different story was revealed whereby Torrey Pines wet lab availability broke into the teens in 2023, and today is 29% for just over 1.2M square feet of available space, which includes over 500,000 square feet of sublease space in 14 subleases from 5,000-80,000 square feet. While these numbers are eye popping, it’s about to get worse for building owners. BioMed Realty has quietly bought the five-building former Pfizer campus at the end of Science Center Drive of approximately 630,000 square feet, which BioMed will remodel and reposition when Pfizer relocates and downsizes to 250,000 square feet in Torrey Hills. When these five former Pfizer buildings hit the market, availability will pop to a record breaking 45%, making Torrey Pines one of the softest biotech wet lab submarkets in the United States.

Sorrento Valley/Sorrento Mesa—How the Value Market is Performing

Looking east to Sorrento Valley and Sorrento Mesa, the story is similarly staggering. Sorrento is the heart of where most of the office-to-biotech lab conversions occurred from 2022-2024, as half of the office space in Sorrento Mesa was renovated into wet lab space in anticipation of ongoing supply shortages caused by the 2020-2021 wet lab demand surge. Sorrento is also the heart of where developers were able to find available land, or low density industrial or office parks that could be torn down and redeveloped into new state-of-the-art multi-story lab buildings, all completed at the same time in 2024-2025. This flood of conversions and new speculative construction is the major contributor to the over 3.2M square feet of available Sorrento wet lab space now dragging down the market, which includes approximately 30 subleases ranging from 3,000-60,000 square feet, totaling 650,000 square feet.

None of this carnage even includes all of the dozens of available wet lab spaces for lease and sublease in UTC, Torrey Hills, Del Mar Heights, Governor Park…and Downtown if you include the 1.65M square foot IQHQ RaAD project on the San Diego bayfront.

A Historic Supply Crisis Leads to a Tenant Favorable Market

The market has become flooded with options, and just digesting and comparing them is a complicated process. While there are great values for early-stage startup or restart companies of less than 10,000 square feet, the market is particularly soft for larger space, where demand is simultaneously most anemic. If your company needs 15,000-25,000 square feet of wet lab in either Torrey Pines or Sorrento Mesa today, you have 43 properties that have 61 options available for you in that size range. If you need 30,000-40,000 square feet of wet lab space, there are 35 buildings that can satisfy your requirement. Needing 40,000 square feet or more? There are still 30 building options! Many of these options have been on the market for more than a year, and a surprising number for more than two years, particularly most of the wet lab conversions and new speculative construction.

What can life science tenants expect in the coming years? While landlords and their landlord leasing brokers attempt to maintain the opaqueness and have yet to lower asking prices, lease terms have materially softened for tenants. Rental rates are off by 20%-25%, free rent is commonly equal to a month per year of lease term and tenant improvement concession packages are whatever is required for the tenant’s build out. More importantly, with the flood of second-generation space and sublease space, tenants can now sign much more flexible commitments from 2-3 years…even on renewals…and don’t have to be tied up in long-term contracts during these times of uncertainty. The critical mistake tenants make is to work “direct” with their landlord or through their landlord’s leasing broker proxy—that is not how you are going to learn what your options are, and what can be crafted and negotiated for you in today’s market. Proven by multiple life science client projects our team is advising on, landlords’ motivations are heightened, and creativity, transparency, independence and leverage rules the day.

Marketing statistics provided by CoStar Group.