By Hannah McNeil

As we enter the fourth year since the COVID pandemic shook the world, the Boston office market is still struggling to find its bottom. Each day we see another news article documenting the collapse of the office leasing market, not just in Boston, but across the country. In reality, many of those articles fail to report the full severity of conditions and the corresponding beneficial impact to follow for companies leasing office space in the greater

Boston area.

These are the top trends in the Boston office market:

- Hybrid work continues to remain ever popular, reducing the amount of office space most companies need. As a result, tenants are downsizing at lease expiration, or listing their space for sublease entirely if they have two or more years of term left.

- Flight to quality is currently a saving grace for highly amenitized top-quality, built-out space. These premier spaces in Class A and Trophy assets are continuing to lease at premium rates and long before shell space or Class B “generic” office space.

- Leasing volume continues to be anemic as available space sits on the market for months and months, and in many cases years—this utter lack of leasing activity has not been seen in more than two decades.

- On top of all this hard news, there is now also a glut of sublease space nearing 5M SF available—a record high.

- The market is entering a massive reset as trillions of dollars in loans are maturing over the next 2-3 years, triggering the trading of many assets into new ownership. Some buildings will enter foreclosure or, as we are already seeing today, many owners are highly motivated to dispose of underperforming assets now and they are doing so at significant discounts. Some examples being Synergy’s acquisition of 179 Lincoln Street and 101 Arch Street for a considerable fraction of their previous purchase prices.

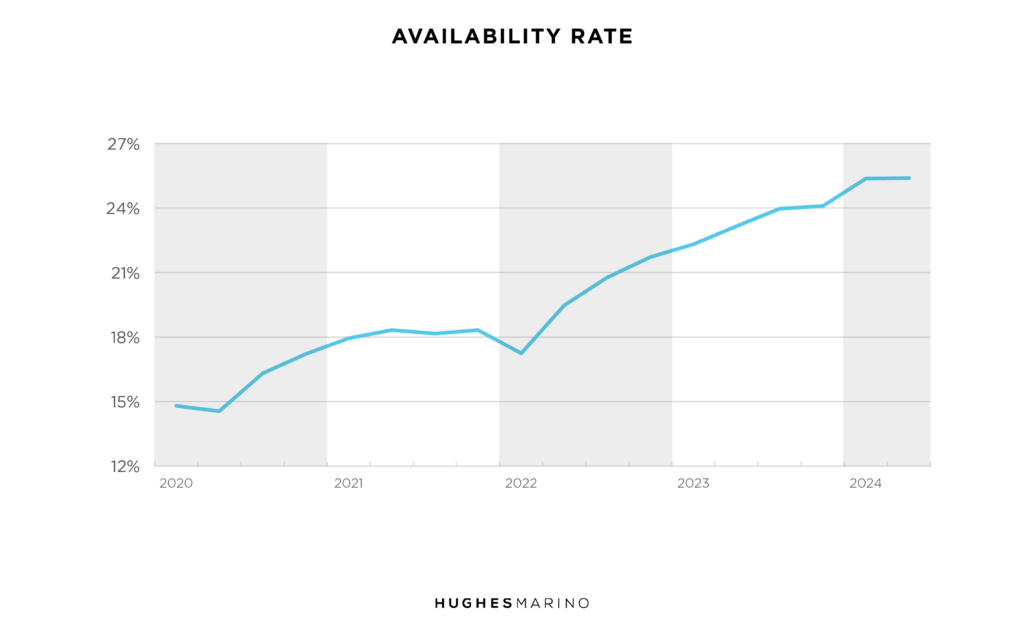

The below chart illustrates the Boston office availability rate trending from Q1 2020 to now. Note that we are measuring “availability” and not “vacancy.” Availability captures all the collective space that’s on the market for lease and sublease in existing buildings and those under construction, whereas “vacancy” just measures a subset of only space for lease or sublease that is actually “vacant” in existing buildings. When you think about it critically, “vacancy” as used by landlords and their promoting brokers is clearly looking to prop up the market, and it is a gross mismeasurement and underrepresentation of the actual market for available space.

Moving up and to the right from 15% in 2020 to 25.4% today, the availability rate has dramatically increased, and it is showing no signs of slowing down—this is a line that isn’t flattening out anytime soon. We forecast that availability will continue to increase over the next 3-4 years as more and more tenants get smaller when their leases expire, as a result of remote working and hybrid models.

And although these numbers collectively paint the Boston market out to be a graveyard, we can’t forget to highlight certain submarkets are highly outperforming others. Seaport and Back Bay are the two shining stars of city. Especially when narrowing in on Class A alone, landlords here are continuing to secure record high rents and experiencing no lack in demand.

While some companies are beginning to mandate employees return to the office—albeit generally only 2-3 days a week—many companies, particularly in the tech sector, are finding ways to operate on adopted remote or hybrid models. This largely explains the abundance of space that has become available on the sublease market. The total amount from downtown Boston to Back Bay is close to 5M SF—this is the equivalent of 10 new 500,000 SF office buildings dragging down the market. This is the highest figure ever recorded and about 35% higher than the amount of sublease space we saw during the 2000 dot com bubble. Most of this sublease space is high quality, built out in the last 5 years, fully furnished with integrated technology infrastructure all included at no extra cost and priced 20%-40% less than what landlords are hoping to charge for their direct space. Ironically, tenants have now become landlords’ biggest competitors.

While landlords are still receiving rent payments on these subleases, in most cases the companies who are writing those checks have determined the space is no longer of use to them. Come lease expiration, if it doesn’t get subleased before, this space will revert back to the landlords’ possession, making life even more difficult for building owners.

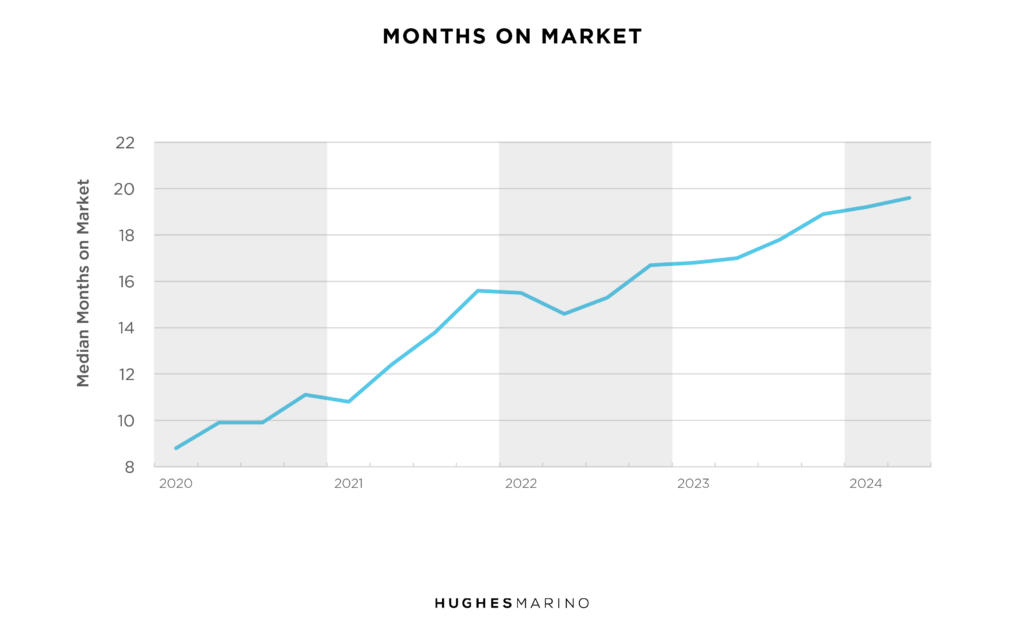

Not only is availability rate trending higher and higher due to companies downsizing upon lease expiration and flooding the market with sublease space, but so is the length of time that space sits on the market. Pre-COVID, office space in Boston had an average time on the market of nearly nine months. Fast forward to today, that length of time has doubled to 19 months. Consider that’s an average, and plenty of office suites have been on the market two, three and even four years.

So, what does this all mean for you as a tenant?

Historically low demand combined with spiking supply of quality office space add up to a perfect storm for landlords, and the perfect opportunity for tenants. We are squarely in a tenant’s market now and rents will start to decline for the next 3-4 years until we ultimately find some new normal in the future. However, on the way down there will be tremendous resistance to meeting the market as so many landlords with their investors and lenders backstopped by their brokers—are locked into old capital structures based on the old market. The only way to benefit from this softening market is for us to do the hard work of going to market in order to educate our tenant clients about the great outcomes available today. Whether your lease expires in one year or in five years from now, this is a market that will benefit your bottom line for many years to come.

Marketing statistics provided by CoStar Group.

Hannah McNeil is a vice president of Hughes Marino, an award-winning commercial real estate company specializing in tenant representation and building purchases with offices across the country. Contact Hannah at 1-617-356-0111 or hannah@hughesmarino.com to learn more.