Author: David Marino

-

What Business Leaders Need To Know About U.S. Office Markets In 2024

on

By David Marino Four years post-Covid, most employers and employees are now living the new normal—they are remote, hybrid or distributed, working where they thrive and often coming into the office three or four days a week. Right now, many companies have no formal policy as to days in the office, and most companies are…

-

The first quarter 2012 commercial real estate statistics bear out our 2011 forecasts of an early market correction that we were advising would begin in 2012. The aggregate amount of sublease space on the market continues to trend down, as does total availability county-wide. 2012 has the potential to still show net absorption of 2M square feet for the year,…

-

Real estate is typically the second largest fixed cost line item on a company’s expense statement after payroll. Company owners and management teams diligently seek to manage and reduce these real estate costs in every way possible. Doing more with less represents increasing productivity and profitability. But there is a larger and often missed opportunity with corporate real estate that…

-

Over the last four years of the commercial real estate recession, most tenants’ leases in San Diego County have expired. When faced with that event, there has been a tremendous migration of tenants in all office submarkets moving from Class B buildings to Class A buildings. Tenants that signed leases for Class B space in 2003-2006, signed as the market…

-

San Diego’s commercial real estate market finished 2011 showing positive signs of a recovering market. Employment growth began to have an impact on occupancy rates for both the office and industrial sectors – as nearly 865,000 square feet of office, lab and industrial space was leased. The total net absorption for 2011 in San Diego was about 1,957,000 square feet.…

-

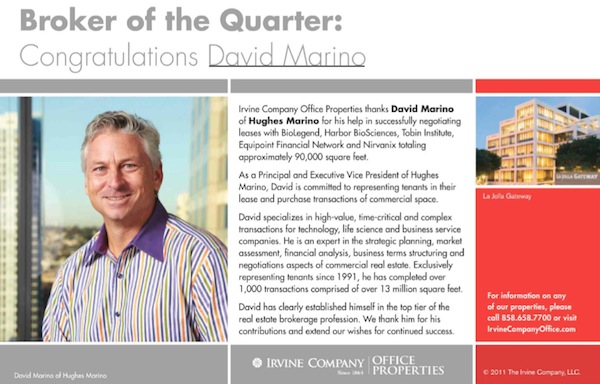

Irvine Company Office Properties thanks David Marino of Hughes Marino for his help in successfully negotiating leases with BioLegend, Harbor BioSciences, Tobin Institute, Equipoint Financial Network and Nirvanix totaling approximately 90,000 square feet.

-

One’s stand on an improving commercial real estate market all depends on where one sits. For tenants, an improving commercial market results in higher rents, fewer concessions and less flexibility. For a landlord, it results in higher income, less costs and more stability. But whether you are a winner or loser in an improved commercial real estate market, the fact…

-

The commercial real estate market ended in 2011 with strong signs of a recovery in the making. The recovery of the job market is starting to fill up office space, and the supply chain that requires industrial space is on the mend too. In the 4th quarter, 865,000 square feet of office, lab and industrial space came off the market,…

-

Rising commercial real estate deals point not yet to a boom but at least to a recovering San Diego economy this year — with more jobs, higher lease rates and, ultimately, new major construction, local business executives learned Tuesday. David Marino, principal at the Hughes Marino commercial brokerage, said 2012 looks brighter than 2011.

-

The bottom line is that commercial real estate tenants don’t typically look for only the cheapest space in a vacuum–it’s not just about rent. Tenants want to pay the least possible rent for a building that meets their bundled minimum standards for location, cultural fit, quality, amenities and expandability. Business owners want to pay the least possible rent for space…

-

Hughes Marino congratulates principal and executive vice president David Marino for his election to CommNexus San Diego’s Board of Directors. Community leadership is a key component of our company culture at Hughes Marino, and we are pleased to recognize David and support his efforts on behalf of CommNexus. CommNexus is a non-profit organization dedicated to fostering the growth of the…