The Inland Empire Covid Run-Up

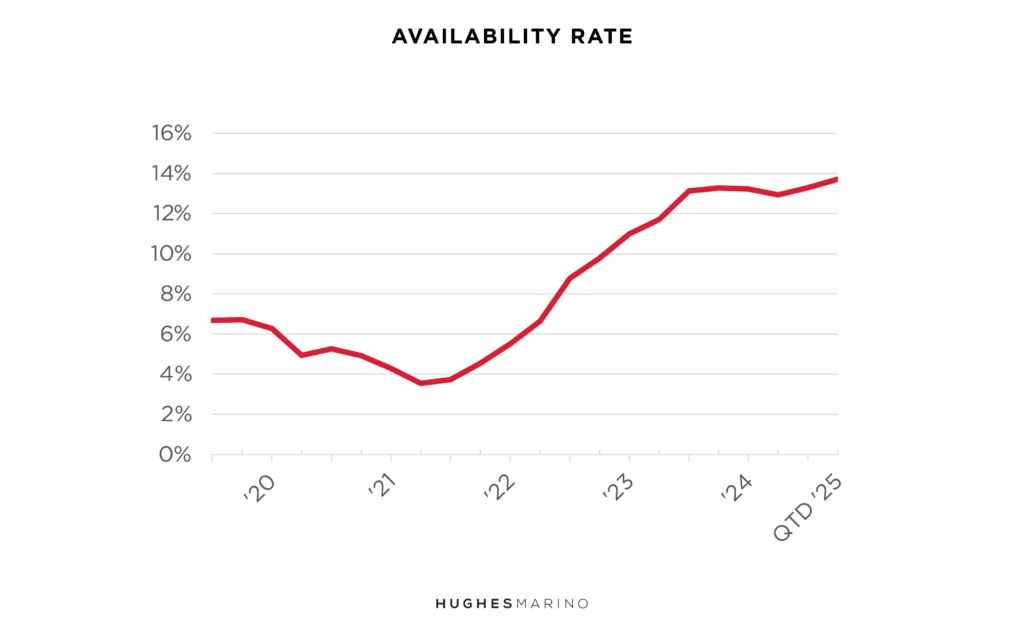

If you are a business owner or executive team member operating an industrial distribution or manufacturing company in the Inland Empire, you’re probably still picking off the scar tissue from the run-up of industrial rents from 2020 through 2022. The outbreak of Covid in second quarter of 2020 created a run on industrial real estate in the fall of 2020. This was caused by consumers going online to shop and the ports flooding with inbound consumer products that needed to be pumped out of our Southern California warehouses. Pre-Covid, industrial availability rate in the Inland Empire was a healthy 7%. In less than a year and a half, availability rates had gone down to a historic low below 4%, rental rates increased 50% to 90% depending which submarket you’re in, and competition for large blocks of space forced many tenants to sign 7 to 10 year leases where companies were conventionally signing five-year terms.

Commercial Availability Explodes

In response to this historic demand surge, developers began construction on tens of millions of square feet of industrial space throughout the region. Just as those developers began flooding the market with new construction in 2022, Inland Empire tenants began to see a cooling off of consumer online purchasing, and availability rates by the end of 2022 had clipped up to their pre-Covid level as all of the new construction began to deliver. The chart below shows the reality of the Inland Empire, whereby availability rates have been hockey-sticking every year since 2022 and is now double its pre-Covid rate.

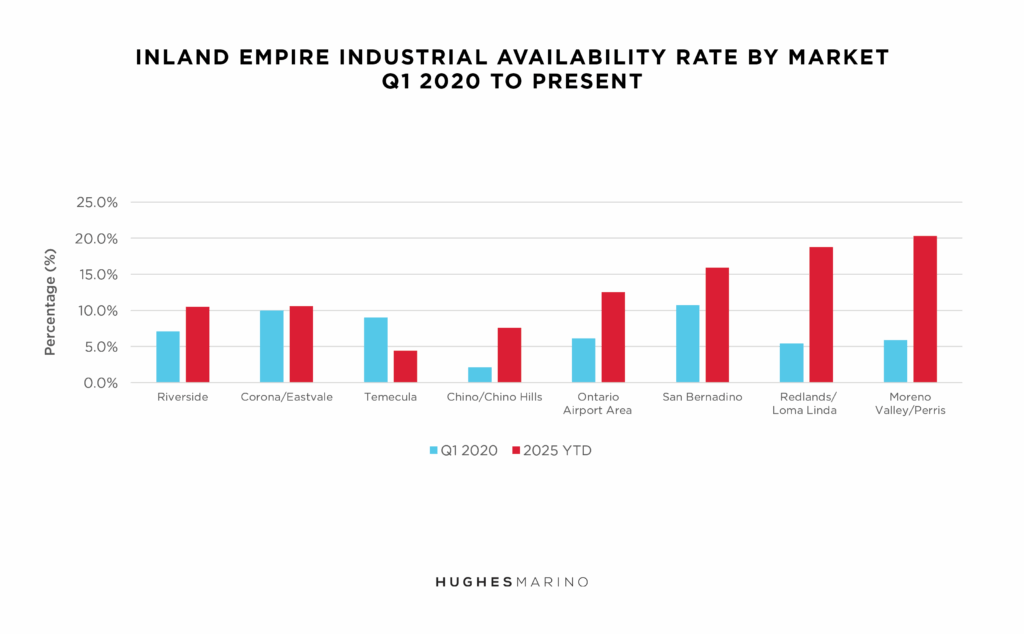

Digging into major submarket detail, the bar chart below represents each submarket’s pre-Covid availability rate, relative to today.

Riverside and San Bernardino are both up 50% compared to pre-Covid. The Ontario Airport area has doubled compared to pre-Covid, and Chino/Chino Hills, Redlands/Loma Linda and Moreno Valley/Perris are all 250% over their pre-Covid rate. Corona/Eastvale has returned to their pre-Covid level, and only Temecula is less than the pre-Covid availability rate simply because there was less development interest in the Temecula area during the 2020 to 2022 speculative construction boom.

Manipulations by the Brokerage Community

You’re probably asking, “How come I didn’t know this until now?” Commercial real estate landlord brokers distort the measure of the market by using “vacancy rates“ instead of “availability rates.” If you’re looking through the tenants’ lens, which we have done for over three decades, you need to include all space for lease or sublease that a tenant has to consider, including buildings under construction, occupied subleases and space for lease that’s not yet vacant—all categories of available space that the landlord brokerage industry conveniently excludes from “vacancy.” This is just one of many ways that the big landlord brokerage firms rig the market in favor of landlords to the detriment of tenants.

Sublease Inventory Explodes to Historic Levels

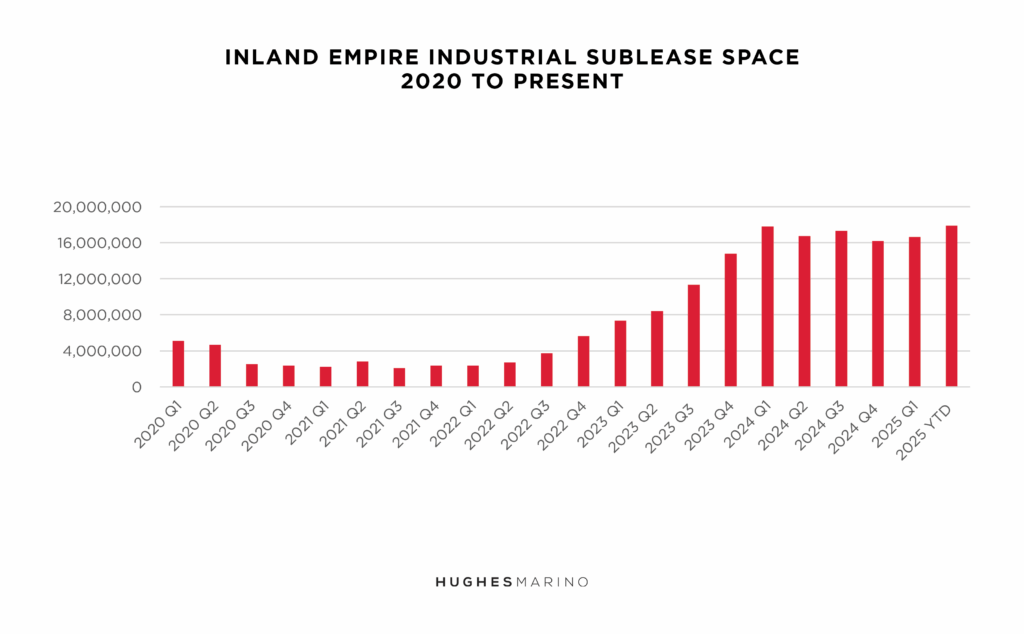

What also has been hidden from business owners is the extent to which sublease inventory is dragging the market down. While sublease inventory in the Inland Empire was relatively tight at 5,000,000 square feet before Covid, as e-commerce companies and 3PLs began a feeding frenzy for space at the end of 2020 through the middle of 2022, sublease inventory virtually evaporated from the market with a low of 2,000,000 square feet. However, as the same industries begin rationalizing their portfolios and space over-commitments in 2023, sublease inventory begin spiking well beyond the pre-Covid rate, hitting a historic high of 18,000,000 square feet at the beginning of 2024…and is stuck there.

These subleases can generally be had at 20% to 30% below market, for shorter terms than landlords might be demanding, and are often offered plug-and-play, fully furnished and racked. The reality is that until this flood of space comes off the market, landlords simply don’t have any pricing power.

Tenants Have More Options Than Ever

To put some real numbers around this, a tenant needing 25,000-50,000 square feet of industrial space has 132 options in the Inland Empire today (28 are subleases). A tenant needing 50,000-100,000 square feet has 123 options (32 are subleases). A tenant needing 100,000-300,000 square feet has 136 options (39 are subleases). A business owner needing 300,000 square feet or more has 72 options (19 are subleases). Never in history have Inland Empire tenants, of any size, had more building options for lease and sublease.

Yet Landlords and Their Brokers Still Push High Prices

You’re probably wondering why prices haven’t come crashing down given all of this resetting of the market—shouldn’t rents be back down to their pre-Covid level, or less? While we’re seeing slight decreases in asking rents, the landlord brokerage firms have found another way to rig the market against the commercial real estate tenant. While landlords don’t formally collude, they indirectly share a tremendous amount of information and anchor off each other’s pricing. With the brokerage community working as landlords’ proxies, and too frequently acting as conflicted dual agents representing both the landlord and the tenant in the same transaction, landlords have full transparency as to what each other is doing in real time, and often what buildings a tenant is looking at. Brokers publish every lease transaction within their company internal databases, and that data is commoditized and traded with other brokers, and shared with other landlords the same big brokerage firms represent. Tenants’ confidential information rarely stays that way for very long, and landlords know who’s doing deals, and at what terms, while tenants are lured into thinking prices are the same as they were back in 2022.

What Business Owners and Executive Teams Need to Do Now

Any serious negotiation requires accurate information, leverage and the right mindset. Trying to represent yourself in this dynamic market with the flood of options—and landlords and their landlord listing brokers working against you—is a fool’s errand. Tenants need to engage a tenant representation company as their business partner, and as their advocate whose interests are aligned with theirs when considering expansion, relocation or lease renewal/restructuring. Ultimately, the “customer” in a relationship is the party that pays for a good or service. The tenant writing a rent check is the customer in the landlord/tenant relationship, but tenants have never been treated where “the customer is king.” It’s time for tenants to take their power back by fully vetting and understanding the realities and extraordinary opportunities that today’s market presents for you. At Hughes Marino, with one of our co-founders being from the Inland Empire, we have a three-decade track record of delivering results for tenants, as they are our entire firm’s customer, and not being conflicted with trying to represent landlords with any kinds of services at the same time.

Marketing statistics provided by CoStar Group.