As an office tenant in Mission Valley, you may have noticed the numerous construction sites with tractors and crews at work. The area is undergoing significant changes, evolving from a 20th century back-office second tier submarket, to a vibrant business hub with new housing, upscale retail and the 35,000-seat Snapdragon stadium.

These developments are positive for businesses, driving more companies and people to the area and attracting further investment. However, the question remains—are these developments enough to justify the high office asking rents despite the increasingly vacant buildings?

Current Market Conditions

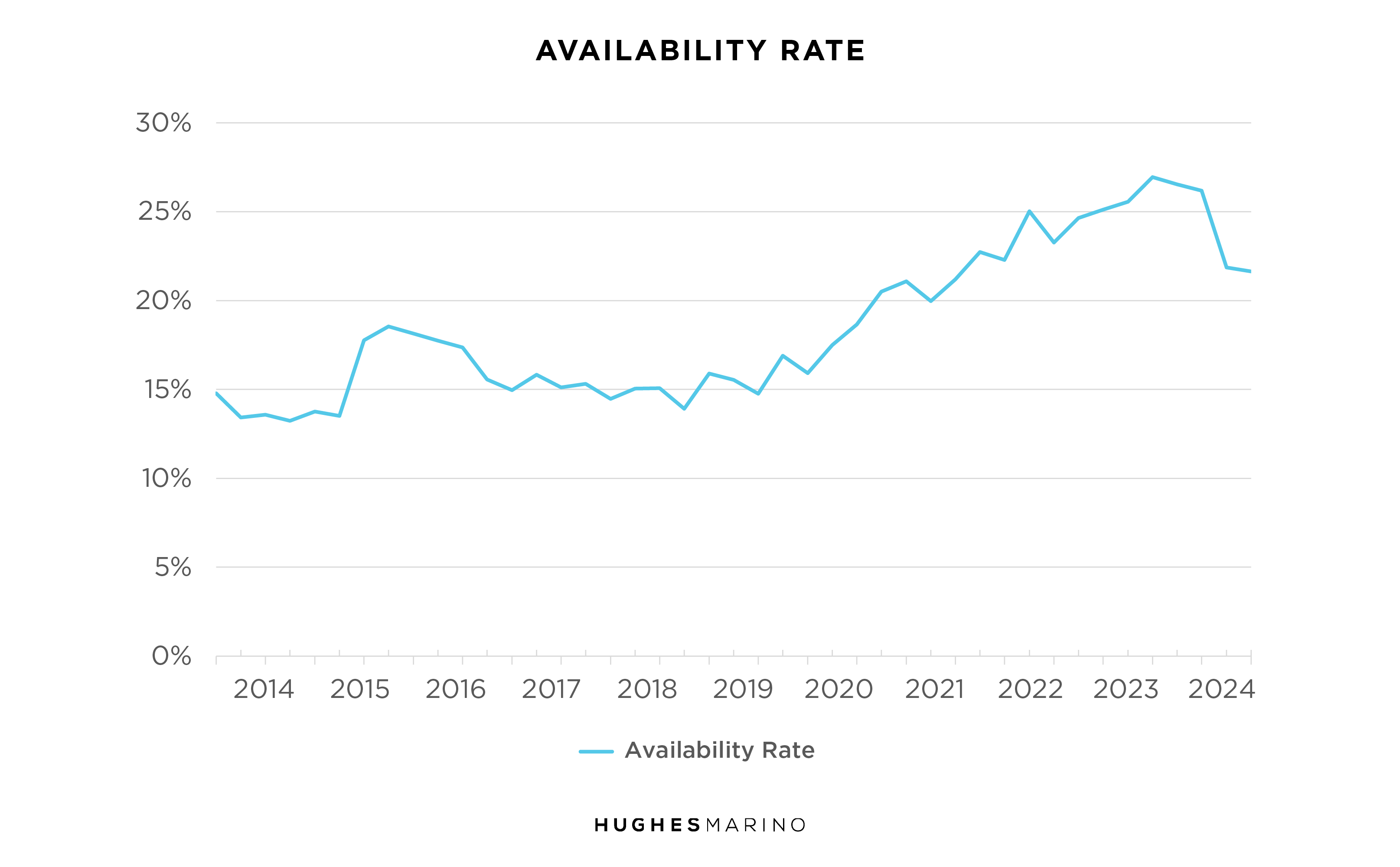

Mission Valley’s office availability has been increasing since Q1 2019, moving from 15.8% to today’s availability rate at 21.6%, a level not seen since the 2008 financial crisis. Viewing the chart below, the recent dip from 26.8% in Q2 2024 to 21.6% was due to the removal of an entire 150,000 square foot vacant office project at 9040 & 9050 Friars Rd, former HQ of Wawanesa Insurance, from the available inventory after it was sold to a residential developer that is going to demolish the office buildings and convert the site into multi-family residential. The project sold essentially for land value at $160 per square foot, a fraction of the pre-Covid value of closer to $265 per square foot. Until the removal of this inventory, the office market was approaching a 30% availability rate.

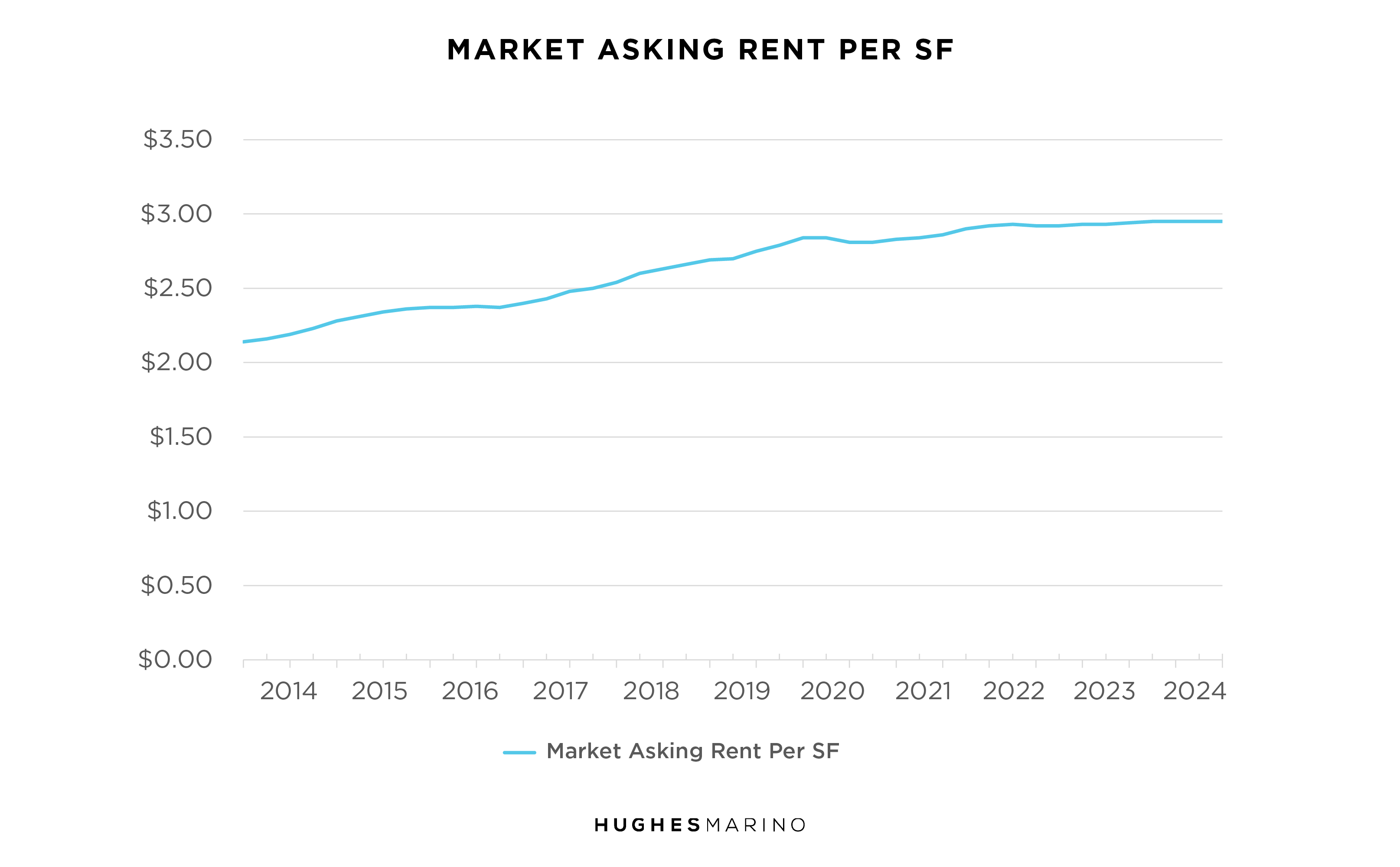

If availability essentially doubled in 5.5 years, why are asking rents still at all-time highs? View the below chart to see the slight dip in asking rents that occurred in 2020 before rising again. The reason rents haven’t decreased is because landlords anchor off of each other and their brokers are assigned to sell it to the market—landlords play the music and the brokerage community dances to it. Lease agreements are not publicly recorded, and actual rental rates and negotiated concessions are opaque to the tenant community. The brokerage industry, which represents landlords and acts as conflicted dual agents, provides landlords with complete information into each other’s activities, and there is no reason for any of them to lead the market down, as the collective benefit of keeping asking rents high makes tenants think that the market is better than it actually is. For more information on this topic, please view one of our latest blog posts here: Why Asking Rents for Commercial Real Estate Office Space Have Not Come Down.

Opportunities for Tenants

Tenants today have more options to lease office space in Mission Valley than at any time since the 2008 financial crisis. For instance, a 10,000 SF tenant could have 44 available spaces to select from, but a 5,000 SF tenant could have 88 availabilities to choose from—the smaller the tenant is, the more options they have. Despite the abundance of available space, most tenants don’t fully appreciate how soft the market is and how much leverage they have at the negotiating table. Therefore, it is crucial to engage representation that understands the true submarket dynamics, where the concessions can be uncovered and which landlords can bend more than others.

By staying informed and strategically navigating the evolving landscape, tenants can capitalize on the abundant opportunities in Mission Valley to secure favorable leasing terms, whether looking to relocate, renegotiate or renew their current lease, downsize or expand in the current market.

Marketing statistics provided by CoStar.

Kevin Beaumonte is a vice president at Hughes Marino, a global corporate real estate advisory firm that exclusively represents tenants and buyers. Contact Kevin at 1-844-662-6635 or kevin.beaumonte@hughesmarino.com to learn more.