A Hughes Marino: In the Know Series

By Alex Musetti & Will Tober

As corporate real estate advisors, we help businesses make the best possible real estate decisions they can and, for some companies, purchasing commercial real estate in lieu of leasing makes a lot of sense. For those businesses, it’s not only important to identify the right property, but to understand all of the financing options available to them so they can make an informed decision.

In part one of our series, we sat down with the Small Business Administration (SBA) to learn more about the resources available to local businesses through the SBA, specifically when it comes to purchasing commercial real estate. One of the most beneficial programs discussed was the SBA’s 504 loan program, which allows businesses to purchase a building with a 10% down payment. While this is often an attractive financing option for prospective buyers, there is a lot of mystery surrounding the process of obtaining a 504 loan and difficulty understanding how they are administered and who qualifies.

In part two, we pose these questions and more to Matt Davis, president of Southland Economic Development Corporation.

Q: What is a Certified Development Company?

A: A Certified Development Company (CDC) is a non-profit corporation certified and regulated by the Small Business Administration to package, process, close and service 504 loans. There are a small number of for-profit CDC’s that have been grandfathered in the current 504 program. CDC’s are mission-driven organizations that also offer other economic development products and services.

Q: How does a CDC interact with the SBA?

A: There are a couple of ways CDC’s interact with SBA. Loan applications are submitted, reviewed and approved digitally by SBA. CDC’s also interact with SBA since they are the industry’s primary regulator. The SBA reviews information collected from the CDC to ensure compliance.

Q: Explain the SBA 504 loan program. How does it work?

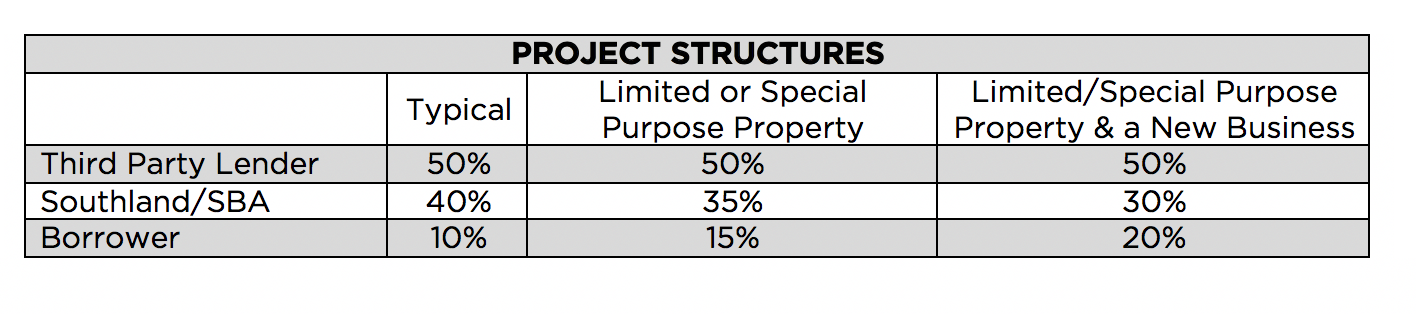

A: The 504 loan program is specifically used to finance or refinance fixed assets. The overwhelming majority of projects involve real estate. The program breaks up the financing between a bank (or non-bank lender) and the SBA. Typically, projects are structured as follows: 50% Bank, 40% SBA, 10% Borrower. The program allows the bank (or non-bank lender) to offer more competitive pricing since the risk is minimized with Loan-to-Value Ratios (LTVs) lower than conventional financing.

Q: Can you walk us through an example?

A: Certainly. This chart below illustrates the typical financing breakdown as well as a couple different unique scenarios like when a new business is purchasing a special purpose property.

Q: Who qualifies? How do you find out if you qualify?

A: The short answer is a credit worthy, for-profit business that plans to occupy (or utilize) the asset being financed. For real estate projects, borrowers need to occupy at least 51% of the property. In order to find out if you qualify, you should contact a CDC who can review your situation.

Q: What types of assets qualify under the 504?

A: Acquisition of vacant land, building construction, acquisition of existing buildings, major renovations and/or additions to existing buildings, marine facility acquisition (including fishing vessels and commercial boats), purchases of capital equipment (including heavy machinery), and associated costs such as title and insurance, legal fees, appraisals, environmental reports, architect fees, surveys, equipment installation, points on the bridge loan, furniture and fixtures.

Q: Can a business owner utilize a 504 for refinancing a loan?

A: Yes, the SBA now allows 504 loans to be used to refinance existing debt on any property that would have originally qualified for a traditional 504.

Q: What about funding limits for a project?

A: According to the Office of the Comptroller of the Currency (OCC): “The SBA does not limit a project’s size or the total loan amount that a bank and CDC can jointly finance under this program. The SBA does, however, limit a CDC’s financing participation to 40 percent of the total project cost—a maximum of $5 million for most businesses and $5.5 million for small manufacturers or specific types of energy-efficient projects.”

Q: Is the lending rate reasonable?

A: Absolutely, even now with the Federal Reserve tightening monetary policy, the 504 rate in September of 2018 is 5.25 percent.

Q: What’s the most common misconception about the program?

A: The most common misconception is that the process is cumbersome. If you are dealing with seasoned professionals the process runs smoothly. Once all the necessary documentation is collected, approvals can take as little as one business day.

Q: How many CDCs exist nationally?

A: The OCC notes that “there are about 252 CDC’s nationwide.”

Q: Lastly, tell us about Southland?

A: Southland EDC is a non-profit Certified Development Company chartered to assist the small business community of California and has done so since 1980. Our mission is simple: Be a resource to local small businesses in an effort to foster job creation and retention through the U.S. Small Business Administration’s 504 loan program.

Certified Development Companies are a critical component in the process of connecting business owners to capital for their fixed asset financing needs.

In Part Three of our series, we examine the role of mortgage brokers in the facilitation of SBA 504 loans.

As always, Hughes Marino brokers will walk clients through the multiple options available to them, to make certain their commercial real estate solution is the perfect fit.

Alex Musetti is a senior vice president of Hughes Marino, a global corporate real estate advisory firm that exclusively represents tenants and buyers. Contact Alex at 1-844-662-6635 or alex@hughesmarino.com to learn more.

Will Tober is a senior managing director at Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact Will at 1-844-662-6635 or will@hughesmarino.com to learn more.