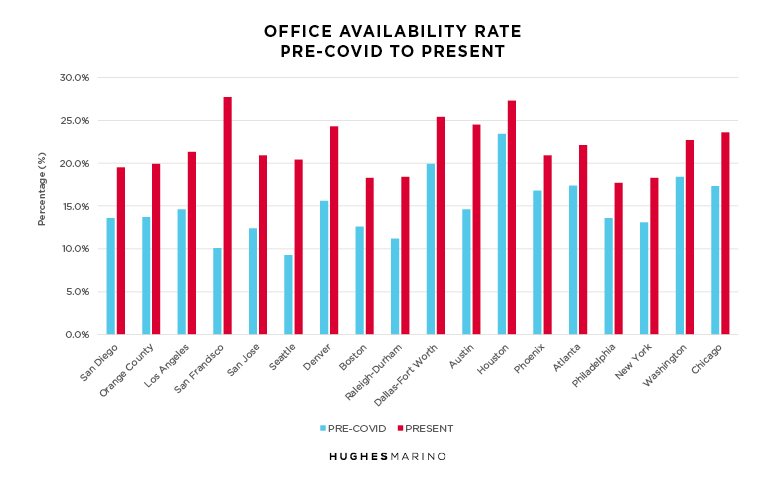

After more than two years of confusion, delusion and information suppression, the real estate industry seems to finally agree that the office sector in all major metro areas is in freefall. Three years of remote working, and the widespread adoption of hybrid work models, has resulted in most companies getting smaller as their leases expire, causing availability rate spikes that we haven’t seen in over 20 years. Add to that over 250,000,000 ft.² of office space on the market for sublease across the U.S—2 ½ times normal equilibrium—plus ongoing widespread layoffs across the tech sector, it’s evident the office sector is near collapse. The extent of the damage done to the office sector over the last three years is shown by the following graph comparing pre-Covid 19 conditions to present.

With interest rates up, loans coming due and lenders looking to invoke covenants around loan to value ratios, foreclosures have already started to ripple through the office sector. Our economy hasn’t seen anything like this since the early 90’s, so it is no surprise that the market has had a difficult time digesting its new reality. What’s possible to happen is that hundreds and hundreds of U.S. office buildings become foreclosed upon and the office asset class devalues by 30%, and more than 50% in some submarkets. While this is going to take three more years to play out, just like it did from 1991 to 1995, it’s likely to have significant financial consequences to the banking and finance sector, as approximately 75% of office building debt is held by regional banks.

As a business owner or executive team member running a company, how can you as the occupant of these office buildings—the commercial real estate tenant—take advantage of this pending freefall?

Opportunities for tenants with leases expiring in 2023-2024:

If your lease expires in the next 18 months, chances are you’re going to get smaller and look to relocate. If retaining what you have is in consideration, your landlord will be desperate to keep you, but you need to create leverage. There are tremendous values already on the sublease market and from other landlords that are lowering rent expectations, while offering moving incentives and large free rent packages. Never negotiate a lease renewal without going to market and creating optionality.

If your lease expires from late 2024-2025:

While you might not yet be on the critical path to relocate, there is an opportunity to restructure your lease. Having done hundreds of restructurings through the prior three economic corrections of the early 90’s, The Dot Com Bust and the 2008 Global Financial Crisis, we can position a tenant to shed excess space, lower the rent, reset the operating expense base year and negotiate allowances to remodel the space in exchange for a longer-term early extension of the lease. The mechanics of getting this right are complex, but ultimately the threat of relocation at the end of the term is the risk that landlords cannot stomach in this declining market.

If you have more than two years on your lease:

If you occupy at least 25% of your building and have strong financial statements, you might be in a great position to purchase the debt on the building at a discount upon a foreclosure or receivership. There are going to be tremendous opportunities for some tenants to buy their real estate at twenty to thirty cents on the dollar of pre-Covid pricing. Already some office buildings are 40% to 50% vacant. Once you find yourself being one of the only tenants in the building, the valuation of that asset will be unlike anything we’ve ever seen in almost three decades. Get ready for it and be prepared to be opportunistic.

It might be that your company is not actively using all of the space. Your best strategy to reduce costs is to put the extra space on the market for sublease. While demand for office space is anemic, well-priced subleases are moving. The success factor is to offer the space at least 20% to 30% less than the building owner, even 50% in Downtown San Francisco, Downtown Seattle and other downtown submarkets. Price the space to get activity as ultimately there is a market clearing price whereby even if you get fifty cents on the dollar, losing the dollar is what’s happening as the result of inaction.

The office market is setting up for the most opportunistic environment we’ve seen for tenants in decades. As with the early 90s, we’re probably only two years into a five-year bottom. Those business owners and executive teams that are strategic around their real estate, and who engage objective, seasoned and proactive representation to help them execute, are going to be the beneficiaries of this downturn.

Marketing statistics provided by CoStar Group.