In the words of Robert Earl Keen, “The Road Goes On Forever, and the Party Never Ends”

By John Jarvis

I am throwing in the towel. Waving the white flag. I give up trying to anticipate an end to this remarkable boom cycle.

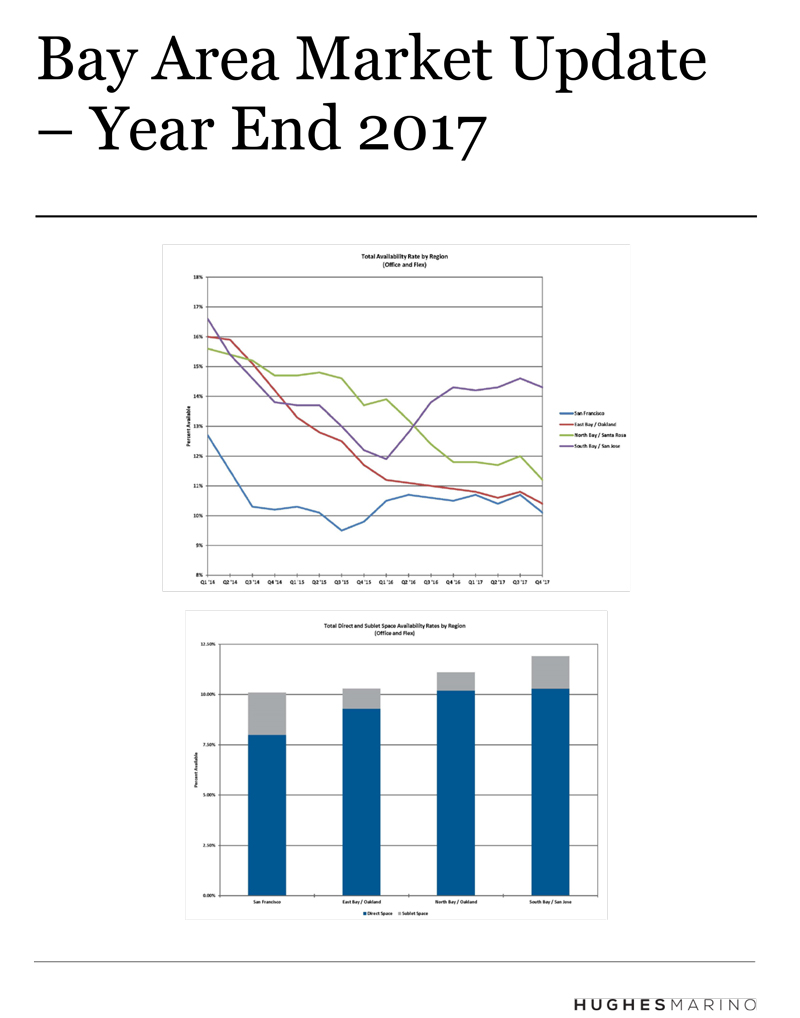

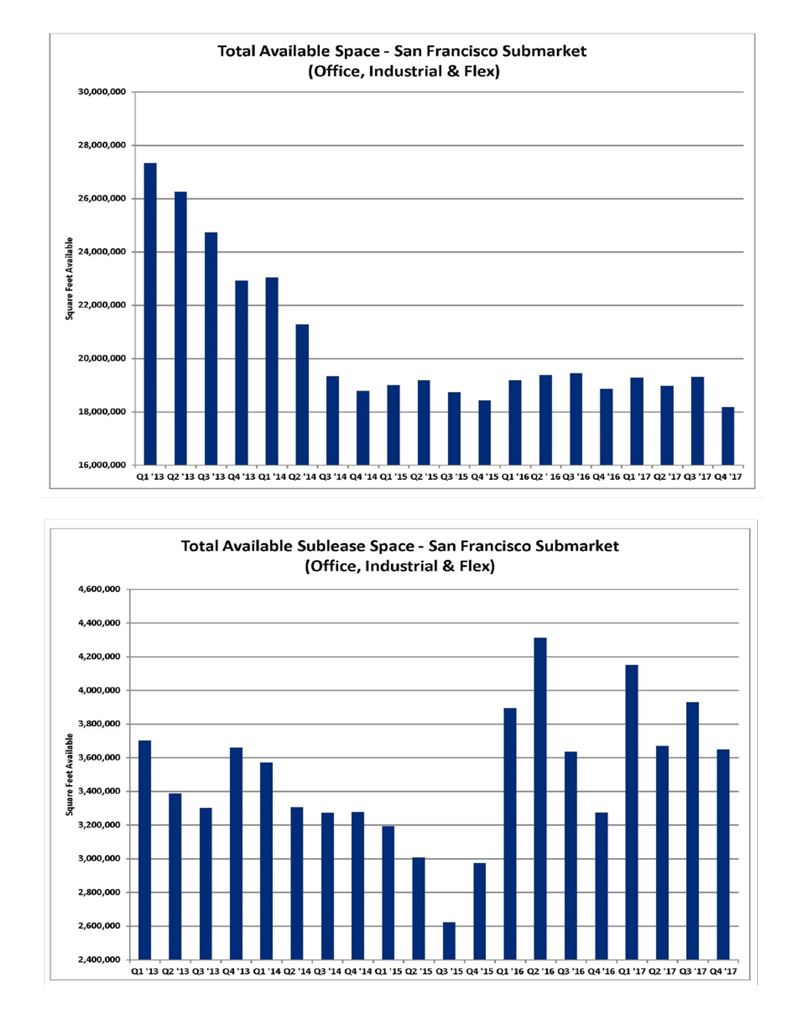

In 2016, we saw a spike in large blocks of available sublease space throughout the market, an indicator which would typically dampen market enthusiasm and foretell a levelling off, or dare I say it, a decline in rental rates. It didn’t happen. The large blocks of sublease space were quickly absorbed by large, established tech companies still hungry for space.

Heading into 2017 we saw another developing storm on the horizon—an upsurge in speculative new construction, and again, dare I say it, the potential for overbuilding which could lead to market softening and a decline in rental rates. It didn’t happen.

So apparently this road does go on forever, and the party never ends…

2017 Submarket Highlights & Notable Transactions:

San Francisco

- In the largest office lease ever signed in San Francisco, Dropbox took down a whopping 736,000 SF at Kilroy Realty’ Exchange on 16th, a speculative development project in Mission Bay.

- Salesforce added to its 714,000 SF commitment (originally made in 2014 and comprising 50% of then-renamed Salesforce Tower), leasing an additional 167,000 SF, bringing their total occupancy in the project to 881,000 SF.

- Uber reversed course with their Oakland ambitions and instead is consolidating in Mission Bay with a new 288,000 SF lease.

- Airbnb took down another 287,000 SF in the Zynga-owned building at 650 Townsend.

- At the beginning of the year, Slack leased 230,000 SF at 500 Howard St.

- Shortly after the company’s IPO, Okta signed a 10-year lease for 207,000 SF at 100 First Street with Kilroy Realty.

- AppDynamics, after acquisition by Cisco, doubled its space to 151,544 SF at 303 2nd with Kilroy Realty.

- The token non-tech company on this list, First Republic Bank leased 190,000 SF from Paramount at One Front Street in the Financial District.

- Amazon leased 180,000 SF at 525 Market Street from landlord NY State Teachers Retirement System.

- Google took down 166,460 SF at Rincon Center II with Hudson Pacific Properties.

- And as anticipated, Facebook signed their first ever San Francisco lease, totaling 436,000 SF at 181 Fremont in a building owned by Jay Paul.

San Mateo

- Franklin Templeton is adding 240,000 SF of office space in two new buildings at its headquarters campus in San Mateo.

Menlo Park

- Facebook leased the new 205,222 SF building at 100 Independence Drive with expectation that they will take down two additional buildings for another 500,000 SF. They also leased 135,307 SF at 162 Jefferson Drive earlier in the year.

- Pacific Biosciences of California took down a 180,000 SF building for their new headquarters at 1305 O’Brien Drive from landlord Tarlton Properties, Inc.

Redwood City

- While many law firms are cautiously tightening their belts, Goodwin Procter stepped up and signed a lease for 100,000 SF at Dostart Development’s speculative office project at 601 Marshall St.

Palo Alto

- Amazon took down all of Sobrato’s 214,000 SF project at 2100 University Ave, aka University Square, with plans to bring 1,300 new tech workers to East Palo Alto.

- In a bid to save costs, Hewlett Packard successor HPE will relocate its iconic headquarters from Palo Alto to Santa Clara. HP, Inc. says they will remain in Palo Alto.

- With their latest 2.3-acre acquisition, Stanford is now poised to move forward on a significant 43-acre development.

- On the heels of a very difficult year, Theranos put their 116,000 SF headquarters building up for sublease.

Mountain View

- WeWork signed their largest lease ever, 456,760 SF at The Village at San Antonio (originally slated for LinkedIn). If that sounds like a risky gambit for WeWork, it helps when Amazon immediately subleases half of it.

- Atlassian signed a lease for 117,944 SF at 321 and 331 Evelyn Ave.

Sunnyvale

- Google picked up another 52 Sunnyvale properties for more than $820 per SF in July. Google says they would like to build a one million SF office complex with a view towards multiple campuses in distinct locations rather than the sprawling maze of properties they currently occupy.

- Amazon was busy taking down space throughout the Bay Area, including a 350,000 SF lease in Moffett Towers II.

- Applied Materials signed a lease for 128,154 SF at 1140 E. Arques Avenue and also bought the 224,000 SF former Apple building known as Sunnyvale Research Center.

- German tech giant Bosch moved from Palo Alto to 104,470 SF at Oakmead Tower.

Santa Clara

- Palo Alto Networks moved into their new one million SF headquarters with room for up to 5,000 employees in the four-building campus.

- Amazon also took down 181,562 SF in a sublease from Ericsson at 2795 Augustine Drive.

- In the same project as Amazon, Veritas leased 144,902 SF with plans to relocate their headquarters from Mountain View.

San Jose

- Google continues to acquire and amass land near the SAP Center with plans for a transit-oriented development totaling 6 to 8 million SF of new development to house 15,000 – 20,000 employees. Big numbers.

- Microsoft acquired 65 acres just north of SR 237 with plans for up to one million SF of research and development space that could include a massive data center.

- Cavium, Inc. leased 118,000 SF at 2300 Orchard Parkway, after which Brookfield immediately sold the property to China-based Han’s Holding Group for $411 per SF.

- Adobe Systems has broken ground on a fourth downtown tower to add 700,000 SF and house up to 3,000 new employees, more than doubling the current headcount of 2,500.

- AvidBank signed a new lease at 1732 N. 1st Street and announced plans to relocate its headquarters from Palo Alto to San Jose.

- Super Micro Computer opened a new 182,000 SF office building in North San Jose and now owns/occupies over one million SF in the San Jose area.

Milpitas

- Cisco Systems continues to vacate leased buildings as they seek to consolidate into their owned office properties and gave the keys back to the landlord on five buildings in Milpitas.

Fremont

- Facebook, in addition to its Menlo Park expansion plans, and its first foray into the San Francisco office market, signed a new lease for 190,000 SF in Ardenwood.

- Tesla took down an additional 235,000 SF in two office buildings on Dumbarton Circle.

…but if a commercial real estate market correction were to occur in the Bay Area in the near future, these might be the reasons why:

- The current boom cycle has been fueled and sustained in a significant way by the historic low interest rate environment. 2018 is expected to see the end of quantitative easing and rising interest rates should correlate directly with property price declines.

- The Bay Area is beginning to stagger under the weight of its success, with infrastructure, traffic and housing all struggling to keep up and showing signs of stress. How this plays out remains to be seen, but there are limits to human tolerance.

- From a national perspective, the GOP juggernaut has deployed conservative economic policies, which have buoyed the stock market to all-time highs. Is this sustainable? We shall see. And the 2018 midterm elections could mark an inflection point.

And while big companies continue to take down big leases at big rents, never doubt that there are still landlords willing to negotiate on rate and terms, especially for tenants with good credit. The big deals may make the headlines, but most office buildings need a lot of small and mid-size companies to fill out their floors, and we find those landlords are still willing to sharpen their pencils to get deals done.

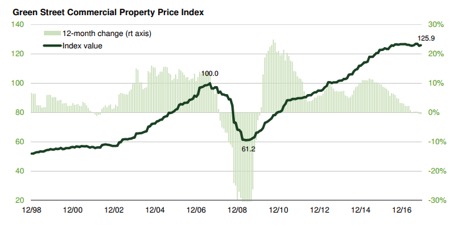

And one final image to contemplate, another great graph from Green Street Advisors for your consideration:

John Jarvis is a managing director at Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact John at 1-844-662-6635 or john@hughesmarino.com to learn more.