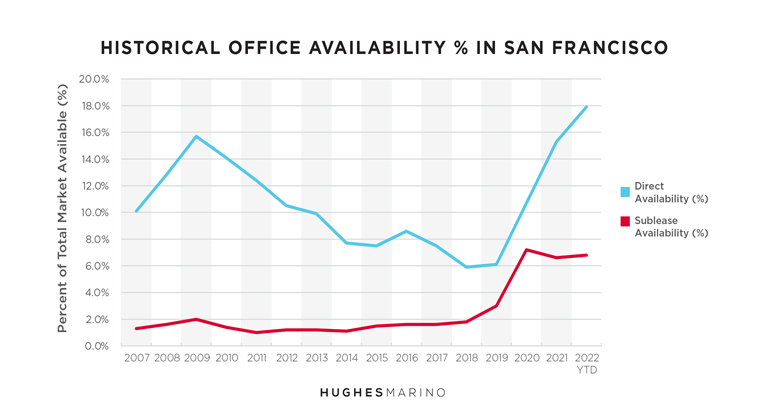

The San Francisco office market is in crisis. While sublease space year-to-date is up from 2021 in every US metro area, San Francisco has been the most impacted by the broad adoption of hybrid and fully remote work models. While the initial dumping of office space for sublease peaked in availability at 10 million SF in first quarter 2001, sublease availability has stalled at 8,000,000 SF each quarter since, and exacerbates as new companies each month come to the realization that their office space commitments are excessive, or even unnecessary. These are remarkable data points as the historic high-water mark for sublease availability was during the 2001 Tech Wreck at 5,000,000 SF.

Landlords Have Their Own Problems

What is further staggering is that this sublease inventory makes up approximately 27% of the total San Francisco office space availability, the highest percentage in the entire country—San Francisco tenants have become landlords’ biggest competitors. Adding to the historic glut of sublease space, landlords also have a historic surplus of office space for lease now with 23,000,000 SF on the market. That is almost double of any historic precedent, and has been growing by approximately 1,000,000 SF every quarter since the beginning of 2021, with no real end in sight.

What will ultimately prove most impactful on San Francisco office landlords—and finally drag down the artificially propped up market asking rents—is approximately 40% of all San Francisco spaces offered for sublease are set to expire by the end of 2024. While landlords are cozy collecting rent on today’s 8.6M SF of sublease offerings, every month some of those subleases will expire and the space will revert back to landlords to lease.

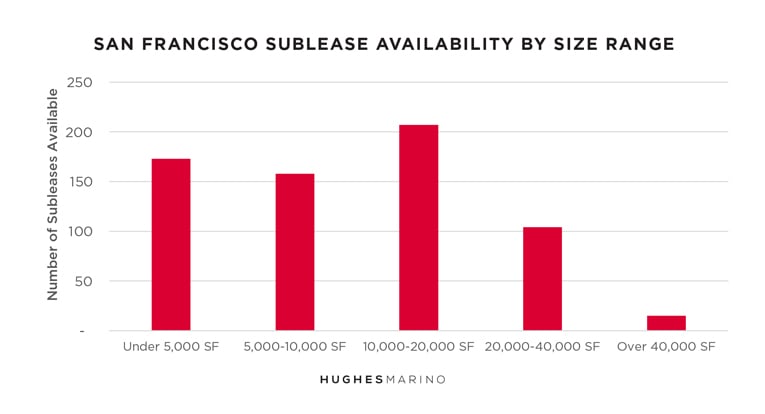

Sublease Opportunities for Small to Medium Sized Businesses Dominate

What is so exciting about these opportunities is that the bulk of the sublease inventory—82% of the 657 subleases in San Francisco today—are 20,000 SF and below. For a company looking for a small space under 5,000 SF, there are 173 options—there are 207 options if a tenant needs between 10,000 and 20,000 SF. For the tenants that make up the bulk of the San Francisco market by numbers, the world is your oyster! Additionally, for larger companies that are sending many of their employees remote and looking to downsize, the market has plentiful good options to get smaller versus negotiating with your landlord, or letting a traditional landlord broker make you feel captive or limited.

While landlords and their full-service brokerage firms that represent primarily landlords and sometimes tenants try to support the glass floor on pricing, Hughes Marino is uniquely positioned to leverage tenants into the market with a view to a better future, and to test the market for discovery. It takes a tenant-side perspective to make market conditions work best for the tenants’ benefit, as brokers at the full-service landlord firms hear the constant drumbeat of an alternative reality that the office market is active and improving—when in fact it’s not. As San Francisco tenants consider their leasing needs over the next two to three years, they need to understand that they have historically high leverage, and that the market is rapidly accelerating to become a tenants’ market. Tenants will have more options and leverage than ever before, whether it means moving to a well-below market sublease, downsizing in place and reducing footprint, or for those needing to expand, more options and better pricing than we have seen in a decade.

Marketing statistics provided by CoStar Group.