Who would’ve thought that two and a half years after March 2020 that COVID-19 would still be challenging how and where Corporate America gets its work done? In many major cities across the United States, employers are still grappling with what remote working and hybrid mean to them, and many companies continue to put excess office space up for sublease that just isn’t needed to support their office workforce. The reality is that no better statistic measures how Corporate America is responding to remote working than sublease availability data.

Sublease Availability Increases Across All Major Markets

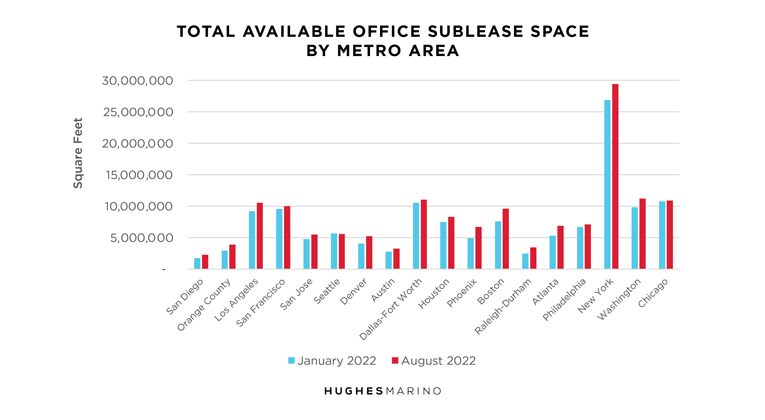

As compared to January of 2022, every major US office market today has more sublease space on the market than at the beginning of the year. Reflecting on 2021, every US market ended that year with more sublease space than in 2020 except Austin and San Diego, which were the only two major US markets that showed improvement in 2021 over 2020. But even that story has reversed as employers have determined that people aren’t returning to the office quite as much as they hoped, and unfortunately, office space for sublease has surged back to 2020 levels even in those markets. Consider that all of this has occurred during a time when some subleases revert to landlords each year through natural lease expirations, and other subleases come off the market every month due to subleasing success—yet the top line total inventories are still going up.

Tenants Now Compete with Landlords to Unload Space

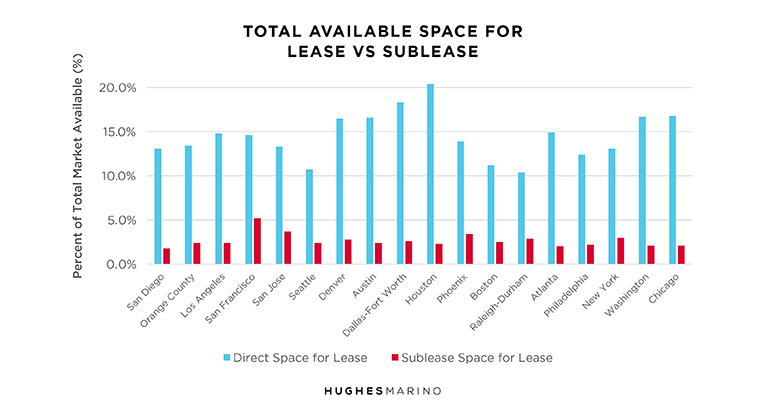

This ballooning of sublease space is a challenge for building owners as tenants have become landlords’ toughest competition. In this unregulated industry, landlords work together cooperatively—backstopped with helpful flows of information from the brokerage community—to price support the market, and no one wants to undercut prices and lead the market down. An accumulation of sublease space in the market causes landlords and their brokers to lose pricing power and control. In some major markets like New York, Phoenix and San Jose, the sublease inventory makes up 19-22% of the total amount of office space available. For example, in San Francisco, a total of 26% of the available office space is comprised of subleases. In other major markets such as Austin, Chicago, Dallas, Denver, San Francisco and Washington DC, when you add the amount of sublease space available for lease directly from landlords, you get shockingly high availability rates at 19% or above—23% in Houston.

While we are expecting Corporate America to create an equilibrium between remote working and their office footprint needs by the end of 2023—more than a year away—there is likely to be more unloading of office space for sublease between now and then. Sublease inventory conditions could become even worse if the US enters major recession territory, in which historically more office space becomes available for sublease as layoffs and cost reductions occur.

Opportunities for Tenants

What this means for tenants with leases expiring in the next two to three years is that you’re likely to see below-market opportunities to sublease space at significant discounts to what landlords are attempting to charge. Further, these subleases are generally shorter in length than what landlords demand, and are available move-in ready as most subleases can be negotiated as “plug and play” with all of the furniture and technology infrastructure intact.

While the big full-service brokerage firms that represent primarily landlords and sometimes tenants try to support the glass floor on pricing, Hughes Marino is uniquely positioned to leverage tenants into the market with full transparency to understand their breadth of choices, and to test the market for price discovery. It takes a tenant-side position to make market conditions work best for the tenants’ benefit, as brokers at the full-service landlord firms hear the constant drumbeat of an alternative reality that the office market is active and improving—when in fact it’s not. While there are pockets of tightness and outliers in certain submarkets around the country, the good news for tenants generally is that the market is still serving up abundant choices, and the market will be favorable for tenants for many years to come.

Marketing statistics provided by CoStar Group.