A white-hot market showing no signs of slowing down

(until it hits a wall)

By John Jarvis

Year End Summary

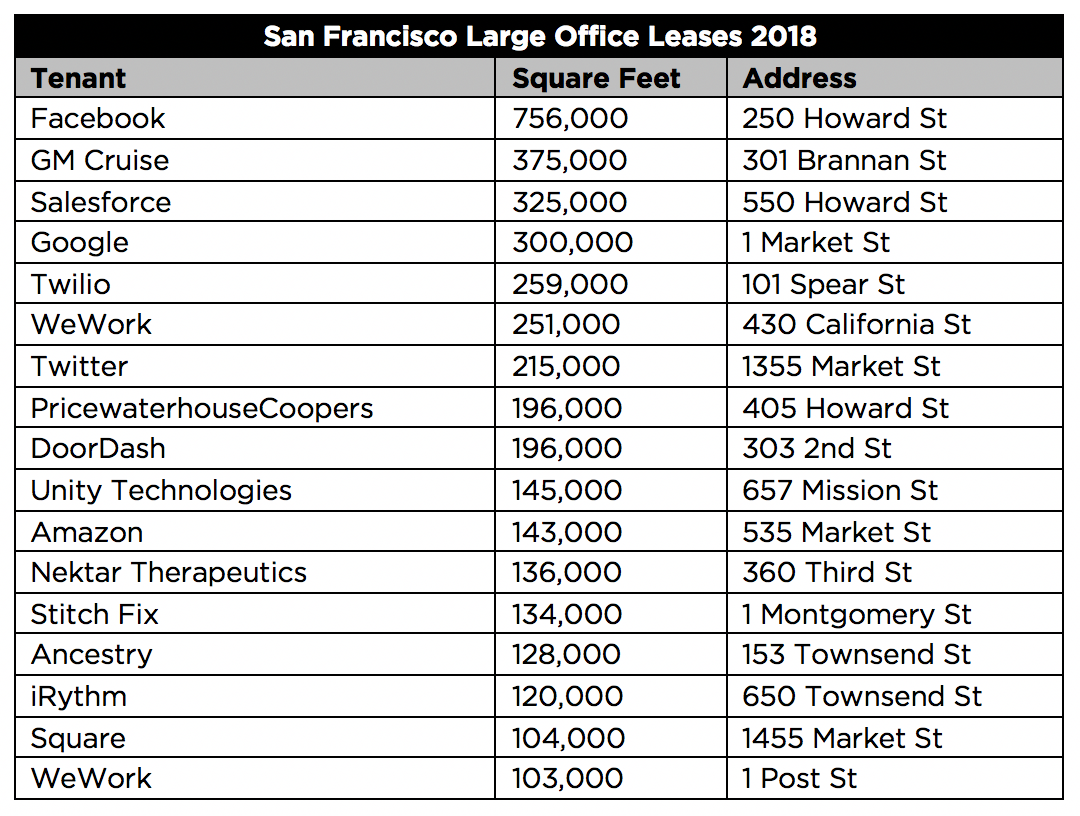

The San Francisco office leasing market set an all-time record in 2018, driven in large part by the biggest leases signed by the biggest companies, with leases signed for just over 11.9 million square feet. The previous high-water mark was in 2014 when leases were signed totaling 11.8 million square feet. The vacancy rate now stands at a ridiculous 4 percent, the lowest level since 2000 (which makes for an interesting reference point).

The market does not expect the same volume of large transactions in 2019, at least in part because there aren’t enough large blocks of available space.

There may be new product coming online in central SOMA, where the city has finalized their rezoning and proposed projects now total over 5.5 million square feet.

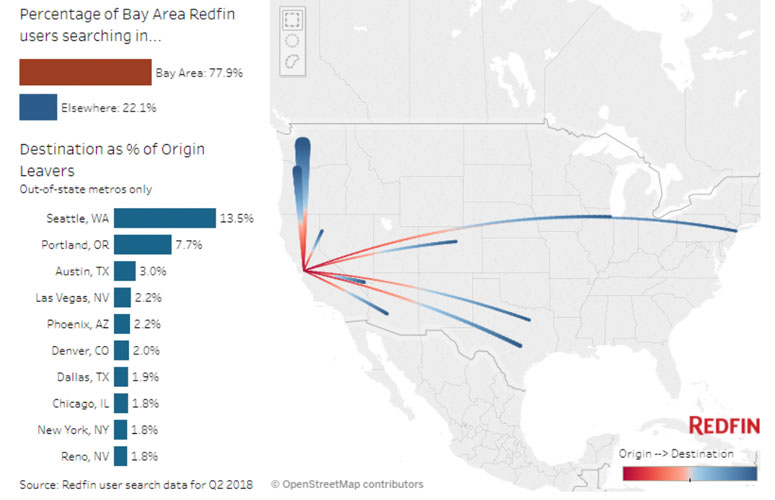

As expected, there were plenty of stories about companies leaving the Bay Area and blaming the high cost of real estate, and the high cost of living generally, for their departure. Companies relocating their headquarters include McKesson, Depomed, Core-Mark, Bare Escentuals, Jamba Juice, Varo Money, Krave Jerky and Bechtel, while Charles Schwab, Lyft, New Relic and Slack are choosing to focus their expansion outside the Bay Area.

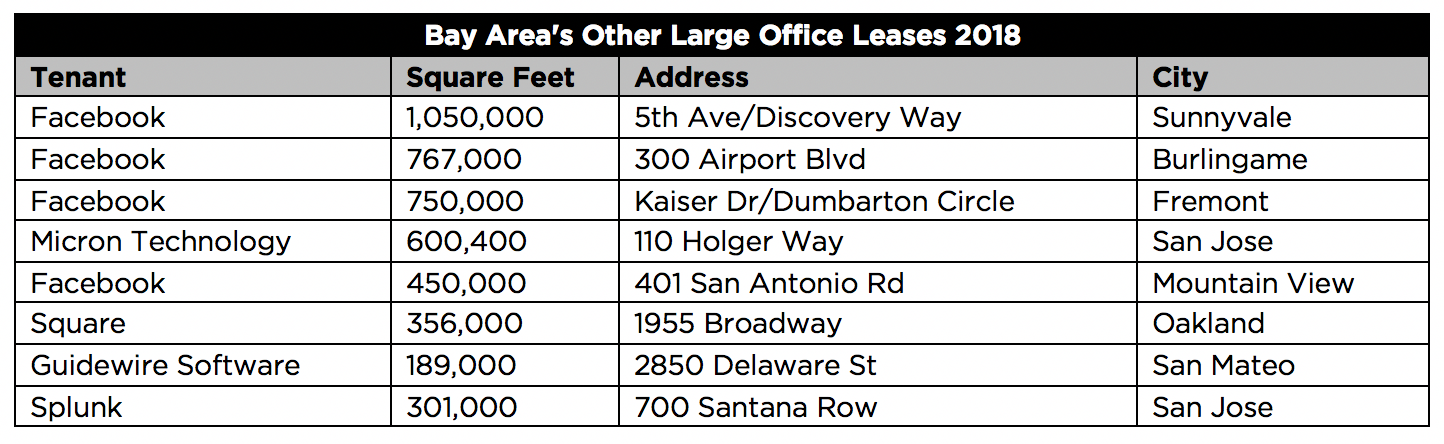

Speaking of the big guys, perhaps not wanting to be outdone by Facebook’s 3.2 million square foot Bay Area real estate binge in 2018, Google made news and noise by qualifying for both the first and the second largest land acquisitions in the entire United States in 2018. Google paid roughly $1 billion for the former LinkedIn headquarters in Mountain View, which transaction was second only to Google’s $2.4 Billion purchase of Manhattan’s Chelsea Market.

Redfin, a national real estate brokerage, has a cool tool for tracking where Bay Area home owners are searching for their relocation. Perhaps not surprising but nonetheless interesting to note on the below are the top four–Seattle, Portland, Austin and Las Vegas.

Predictions for 2019

I am not going to make any predictions for 2019. I have been suggesting for some time that historical market cycles range from 8-9 years, and that this market is in “extra innings.” So, I am not going to say it again. What I will point out is that when the market upcycle is being supported and exaggerated by the largest leases by the largest companies, we would all do well to remember that the same exaggerated effect can and will likely happen on the other half of the bell curve. Oh, and let’s not forget WeWork’s exposure to the market, with the sky-high rents they are obligated pay once their front-end loaded free rent burns off, which will almost certainly create problems as their short-term co-working lessees exercise their freedom to walk away. WeWork leases a lot of space, and if/when they get into trouble the market will feel it.

Parting Thought

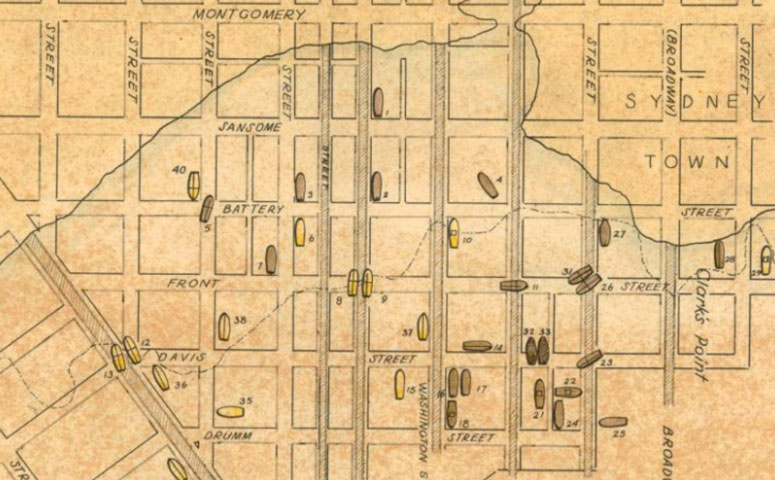

If I seem to be suggesting that there is trouble lurking beneath the surface, well, I suppose I am guilty as charged. And speaking of lurking beneath the surface, did you know that the financial district is built on landfill which covers old sunken ships? Here is a cool map to close out this report:

John Jarvis is a managing director at Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact John at 1-844-662-6635 or john@hughesmarino.com to learn more.