By David Marino

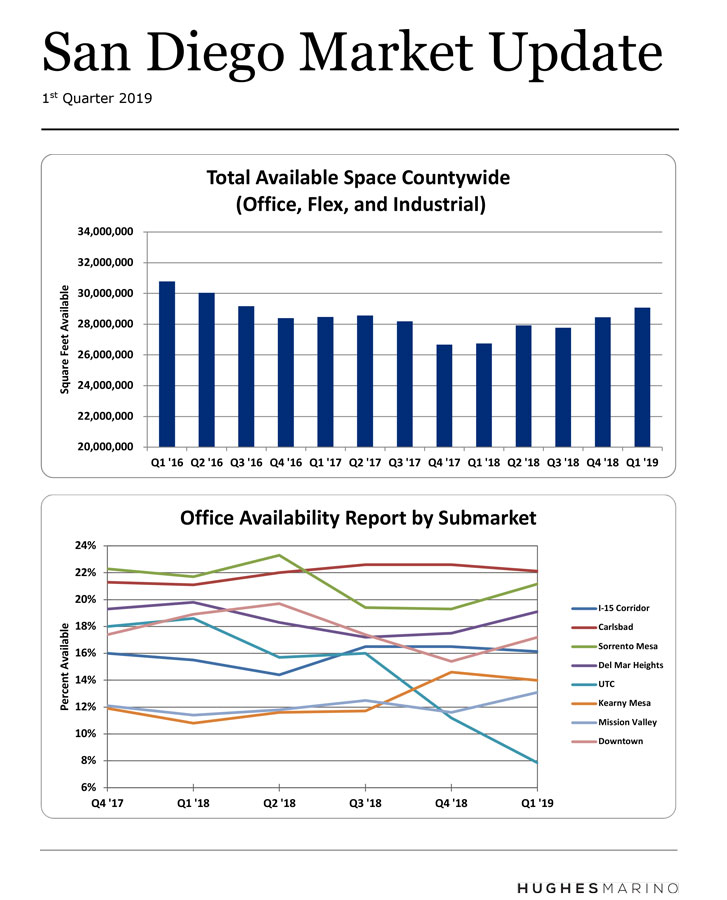

This first quarter of 2019 continued with a “ho-hum” reaction to the commercial real estate market in San Diego County, with one exception—the unprecedented recovery of both office and lab space in the UTC market. While total availability of all combined industrial, lab and office space countywide increased again slightly this last quarter, UTC alone had its availability rate literally cut in half from 16% at the end of 2018 to 8% at the end of the first quarter in 2019. Never before has a San Diego county office submarket improved so radically, so quickly, and broken away from the pack of all of the other submarkets. The UTC availability percentage is literally half of virtually every other submarket in the region, and a third relative to the languishing office markets of Carlsbad and Sorrento Mesa.

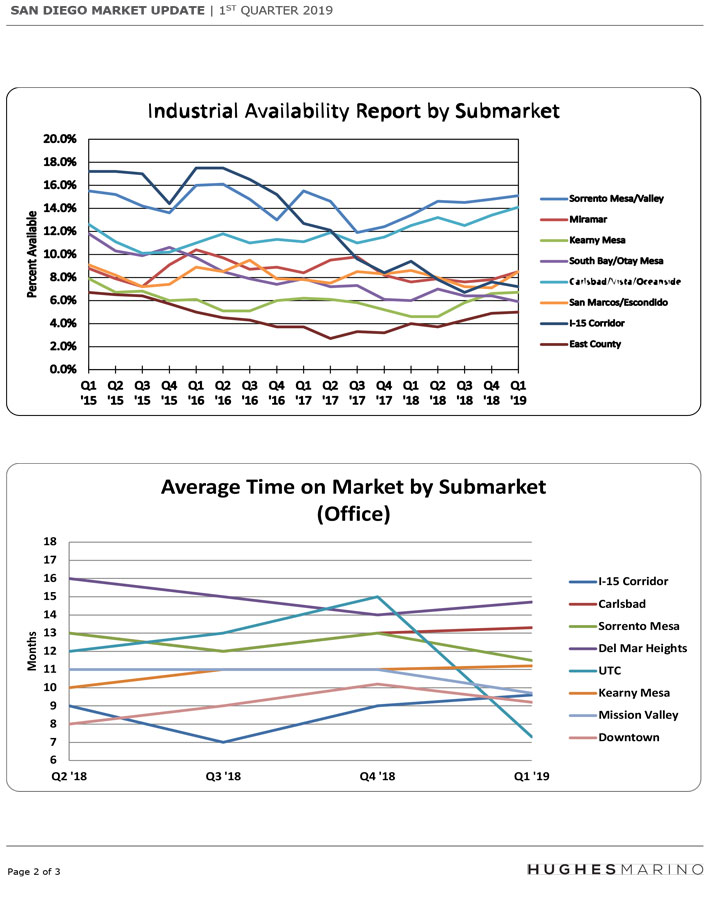

Major drivers include Apple’s lease of The Irvine Company’s 96,000 square-foot Eastgate Terrace building, which had been for lease for two years. Samumed’s leasing of the former Amylin Pharmaceuticals headquarters building of 74,000 square feet also made a big dent in availability, pulling a building off of the market that had been available for sublease since Amylin sold it to BMS years ago. These two significant events, along with another dozen financial services and technology company expansions in UTC have driven time on the market down from 15 months on average to 7.3 months this last quarter, the lowest in the county and one of the shortest in history. The UTC office market is so tight that 10 of UTC‘s Class A office buildings are 100% leased, and if you are a full floor office tenant between 15,000 and 25,000 square feet, there are only two office buildings that can accommodate your requirement today. If you are requiring two floors of contiguous Class A space, it literally does not exist!

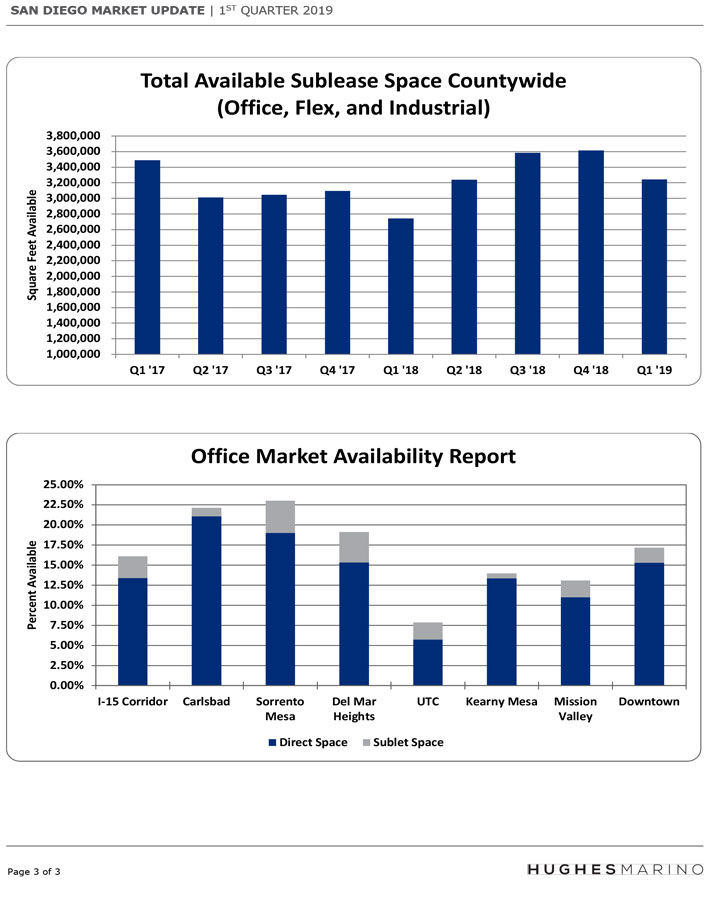

Every other office submarket in San Diego County has become somewhat anemic. Even tight markets like Kearny Mesa saw an uptick in office availability with Bridgepointe Education vacating their tower and moving to Arizona. While Sorrento Mesa should benefit from large tenant spillover because of the tightness of UTC adjacent, it just is not reflected in the numbers yet as availability rates have actually bumped up in Sorrento to 21.2% this last quarter. There’s one distortion in Del Mar Heights where there has been a flight to quality as Kilroy Realty’s new One Paseo project is almost 100% leased before construction is even finished at rental rates for $5.50 to $5.75 net of electricity, all on 10-year leases. While Del Mar Heights has a relatively high availability rate at 19.1%, there has been a flight to quality as tenants have moved from the generally sterile and lifeless 3 to 4 story buildings that lack amenities to Kilroy‘s new state-of-the-art Class A project with some of the best amenities in the region.

Downtown San Diego is in an “in between” time period while we wait for new developments to be completed. The Class A buildings (with good landlords) are well-leased (in the 95% to 100% leased range), while challenging buildings (namely, challenging landlords) are still hovering in the low 70% leased range. We’ll see what happens in the next few years as a flood of inventory hits the market.

The story for industrial space is a bit mixed as well, with availability rates generally ranging from 5% to 8% in most submarkets, and Sorrento Mesa in Carlsbad trailing the market at 15% and 14% respectively, trending up for the last year. When it comes to wet lab space, demand continues to be strong, fueled by the robust investment from venture-capital, strategic investors and the public markets. There doesn’t appear to be any end in sight as the big biotech landlords are planning and building major projects to accommodate the industry in hopes that the capital will continue to fuel all of the demand.

As it relates to sublease space, total availability has bounced around 3,000,000 square feet for several years now. As the economy remains stable, we have not seen a material increase, but neither a decrease. The most available sublease space relative to total availability is highest in Sorrento Mesa, Del Mar Heights and the I-15 Corridor. Sublease availability is tightest in Carlsbad and Kearny Mesa.

We are still bullish about the broader economy and job creation within San Diego County. However, the results are not being strongly felt in the broader office and industrial community. While there are bright spots in the biotech industry and also for UTC office space, the rest of the county should not experience any significant pressure on rent increases to come in 2019, presuming that you are properly represented, of course!

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.