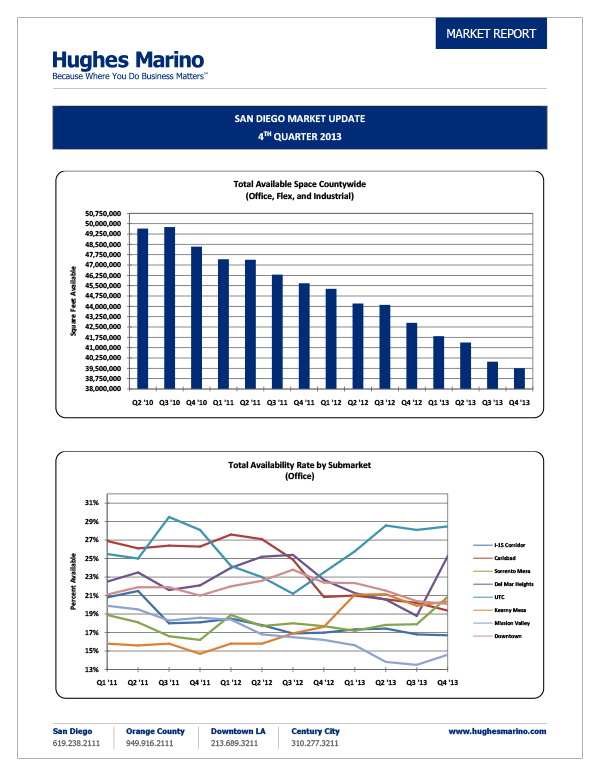

2013 ended with a near-record recovery of the commercial real estate market. In all, almost 3.3 million SF of office, lab and industrial space was absorbed throughout San Diego county in 2013. That comes on the heels of 2.87 million in 2012 and 2.6 million in 2011. All told, over the last three years, 8.8 million SF of total net space has come off the market.

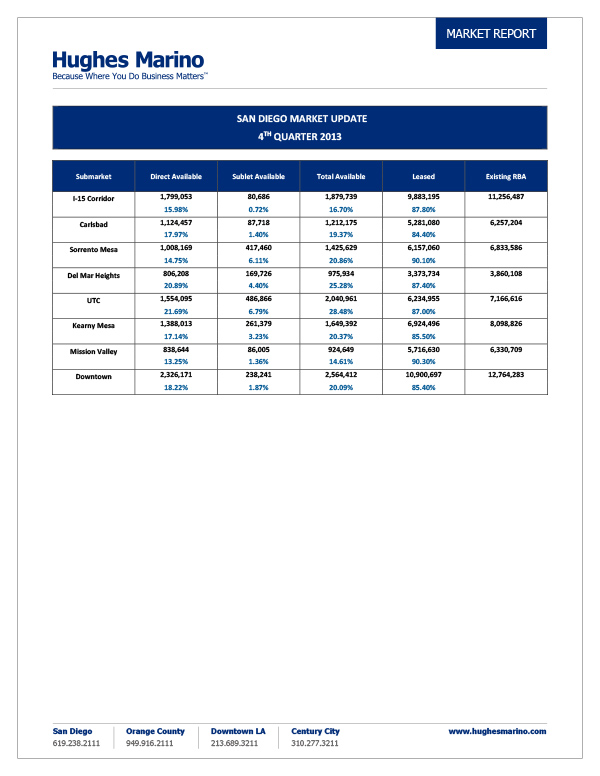

While downtown ended the year with a total availability close to 20%, this submarket continues to show signs of recovery. Unfortunately for Class B building owners, most of the occupancy improvement can be attributed to higher-end buildings with overall Class A availability under 15% and Class B still over 30% available. The rental rate downtown also increased a notch to an average asking rate of $2.25 per square foot per month, which is still well below the historic high of $2.75 we saw in 2007. The 800-pound downtown Class-A building gorilla, The Irvine Company, with its six Class A downtown buildings, saw its vacancy rate drop to less than 8 percent overall – about half of what it was as little as a year ago.

Beyond downtown, the markets trending most favorably are the I-15 corridor and Mission Valley. UTC is lagging, but that is only because of a glut of Class B office space in Campus Point, and also obsolete lab space left behind when Amylin vacated San Diego.

If you were to remove the Class B office space and lab space from the equation, suburban Class A availability rates are trending closer to 11% and larger blocks of space are in short supply. For example, today in UTC there are only three full floors of available office space. If there was a tenant with a multi-floor office requirement, there would be literally no options available and they would have to look to the Irvine Company’s new building coming online in mid-2015 for such availability. Incidentally, that project, known commonly as La Jolla Centre III, is in the process of being renamed and rebranded by the Irvine Company.

Sorrento Mesa has actually taken a bump in the wrong direction, mostly due to the increased availability caused by American Specialty Healthcare putting its 188,000 SF corporate campus on the market for sublease.

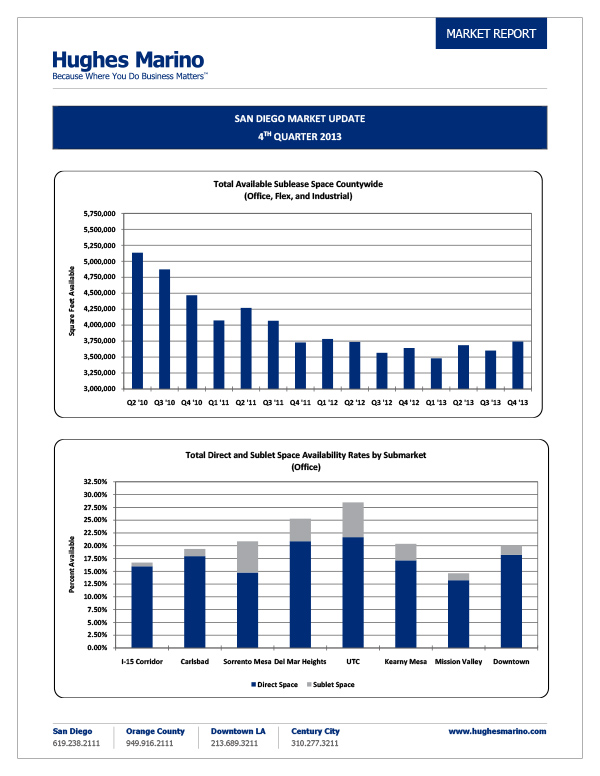

Meanwhile, overall sublease space availability seems to have hit a natural equilibrium at around 3.7 million SF in the region, which has been consistent now for almost 2.5 years. This is one measure we watch closely. When the economy becomes troubled, aggregate sublease availability in the region tends to clip up quickly and noticeably.

Notwithstanding, we forecast that 2014 will be a robust year in the San Diego regional economy as the client assignments we have underway are mostly stable or growth oriented. With this, we should have a fairly robust job market throughout 2014 and leading into 2015.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.