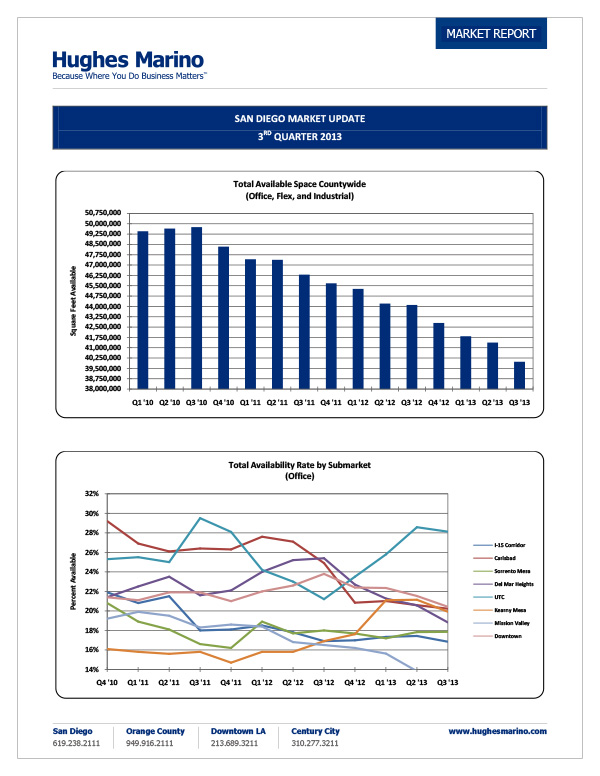

The San Diego County commercial real estate market continued to show dramatic improvement in the third quarter of 2013 as another 1.4 million square feet of office, lab, and industrial space was absorbed. It was a record quarter in the economic recovery that we have had, with a decline in space availability not seen since 2010. Based on the space demands that we are actively working with for 270 Hughes Marino clients looking to sign leases in the next year, we expect positive net absorption will continue through the rest of the year and well into 2014. The reality is that most companies, across all industries, are stable or have intentions to lease more space than they currently have.

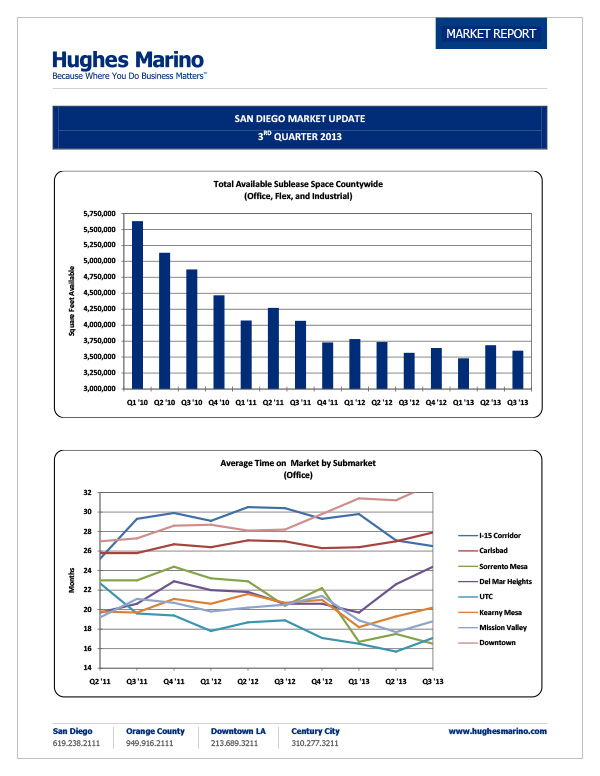

As it relates to total sublease space, it appears that the market has found a healthy equilibrium at approximately 3.5 million square feet, which has been consistent now for almost two years. The first sign of a worsening economy would be if the total sublease availability trend line started to move upward. We will be watching that statistic closely, but at this time we have no expectation that any cold and flu season for Southern California’s companies is on the horizon.

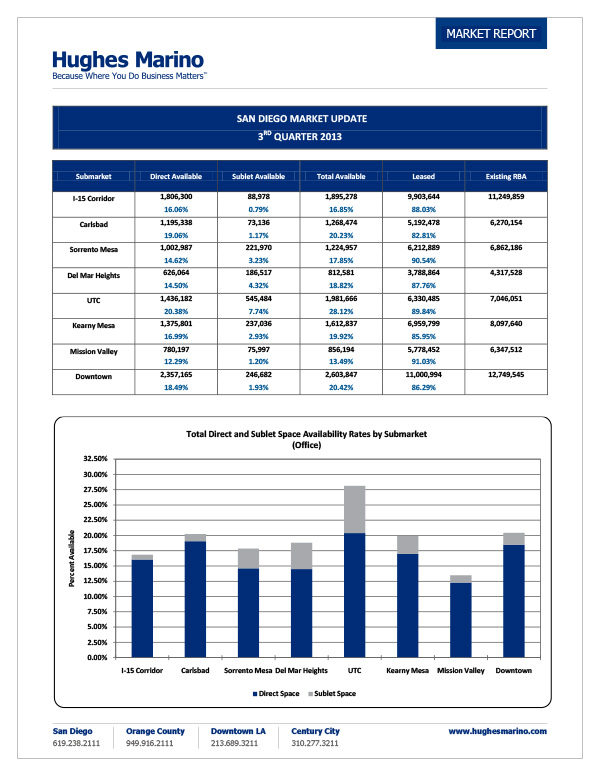

As it relates to individual submarkets, the most dramatic improvement is in Del Mar Heights as availability rates in the last year have gone from just over 25% to now 18.8%. This is the first quarter that Downtown San Diego has made some headway, as availability was just under 24% a year ago, and now ends the quarter at 20.4%. This improvement can be attributed to the central business district’s Class A product, which saw the majority of the positive activity, with many of the top buildings now having less than 10% availability. On the other end of the spectrum, Class B towers in downtown continue to take a beating with several high-rise Class B & C towers having more than 40% availability. Mission Valley also shows continuing improvement with availability rates that have gone from just over 16% a year ago, to now 13.5% — the lowest in the region. With significant upward price pressure driving Class A rents in Mission Valley up to $2.60 net of electricity per square foot, we think tenants will start to consider moving Downtown or may look at Class B Mission Valley options or moving to Kearny Mesa as an alternative.

UTC would appear to be the only submarket getting worse with availability at 28%, but fully one-fourth of that availability is sublease space that has been put on the market, primarily by Amylin. It’s comprised of highly specialized and dated biotech lab space in buildings that are classified as office, so it is not affecting the office market. Notwithstanding the macro data that implies UTC is very soft, large blocks of space over 10,000 square feet in the Class A high rises are in short supply, and upward pressure on rents continues throughout the submarket.

In the last year, every suburban market has seen decreased time on the market, with the exception of Del Mar Heights, lagging the rest of the suburban submarkets at 24 months. Downtown vacancies have also become lengthened where the average time on the market is now 33 months.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.