The San Diego County office market vacancy rate dropped to 13.1 percent in the third quarter as leasing doubled to 837,273 square feet from the second quarter, CoStar Group reports.

The second quarter rate was 13.6 percent on 352,979 square feet of new leased space after three quarters stuck at 13.9 percent.

But the apparent improvement was uneven across the county with suburban markets outperforming the traditional downtown central business district.

The increase was led by big transactions, such as Illumina moving into 159,272 square feet, TD Ameritrade into 111,318 square feet and SkinMedica into 70,052. square feet, according to CoStar.

But the latest rate was still far above the annual low of 8.2 percent in 2005 — and that explains the continuing low level of construction.

Developers typically wait until the vacancy rate nears 10 percent before greenlighting new projects.

In the quarter that ended Sept. 30, the total construction under way stood at 1.2 million square feet, a far cry from the 5 million square feet in 2006.

But the overall county figures mask major differences between submarkets.

Among the major office markets, downtown’s vacancy rate for 275 buildings with 13.5 million square feet remained high at 17.1 percent, having netted only 14,385 square feet of new leases all year. The average annual quoted rental rate was $24.97 per square foot.

Class A buildings with the best location, amenities and highest rents had a vacancy rate of 17.5 percent and 62,248 square feet of new leased space in the third quarter. Class B buildings were at 19.7 percent and Class C at 10.9 percent.

Suburban markets did better than downtown in keeping down vacancies:

- Kearny Mesa: 10.9 million square feet in 287 buildings, vacancy rate of 10.2 percent, rental rate of $20.56.

- Sorrento Mesa: 9 million square feet in 136 buildings, vacancy rate of 11.1 percent, rental rate of $24.90.

- UTC: 7.6 million square feet in 84 buildings, vacancy rate of 10.8 percent, rental rate of $30.18.

- Mission Valley: 7 million square feet in 138 buildings, vacancy rate of 13 percent, rental rate of $24.02.

Hughes Marino broker Scot Ginsburg said as the market has tightened in some places and buildings, landlords have pulled back from offering concessions, such as lower rents and higher tenant improvement allowances.

Hughes Marino broker Scot Ginsburg said as the market has tightened in some places and buildings, landlords have pulled back from offering concessions, such as lower rents and higher tenant improvement allowances.

“In Class A buildings, it’s slim that you’re going to find a landlord willing to do that unless the building under certain circumstances is somewhat vacant,” Ginsburg said.

He said Class B buildings offer more opportunity for deals. For example, in Carlsbad Class B buildings that earlier charged $2.30 per square foot per month are now offering rents in the $1.50-$1.60 range.

But he warned, “That window is shortly narrowing.”

Ginsburg said 2013 will likely duplicate 2012’s slow absorption of space but in 2014 and 2015, the market may tighten substantially.

However, he said downtown continues to struggle to fill space, even the best Class A space in certain buildings.

“The companies I work with, the larger tech base, are more indicative of moving outside downtown because that’s where most of the talent lives, where most of the customers are,” he said.

But for startups led by younger entrepreneurs, he said, downtown is often the preferred location because of the bustling urban lifestyle.

Construction has yielded 444,193 square feet of new office space so far this year with nearly 1.2 million square feet of new space under way.

The largest project under construction regionally was La Jolla Commons II, a 414,575-square-foot tower west of Interstate 805 and north of La Jolla Village Drive. All the space has been pre-leased to locally based LPL Financial, the nation’s largest independent broker-dealer for financial planning and investment.

Sixteen office buildings changed hands in the second quarter for a combined total of $164.8 million. Third quarter sales won’t be reported until early next year.

They included the Irvine Co.’s purchase of the Centerside I building in Mission Valley from TIAA-CREF for $52 million or $256.27 per square foot and Legacy Partners Commercial’s purchase of the building at 10578 Science Center Drive on Torrey Pines Mesa from Pfizer for $51.3 million or $306.58 per square foot.

Nationally, CoStar said the overall vacancy rate on 484,511 buildings with 10.2 billion square feet was 12.1 percent and the average quoted rental rate was $21.42.

For selected markets with 7.7 billion square feet, the rate was 12.7 percent, the sixth quarter showing a decline.

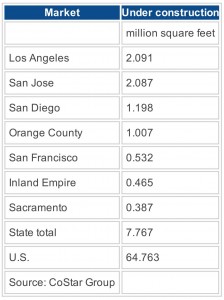

San Diego ranked 13th in the amount of square feet under construction. New York City was first at 10.9 million square feet and other California markets were as follows:

Scot Ginsburg is an executive managing director of Hughes Marino, a global corporate real estate advisory firm that specializes representing tenants and buyers. Contact Scot at 1-844-662-6635 or scot.ginsburg@hughesmarino.com to learn more.