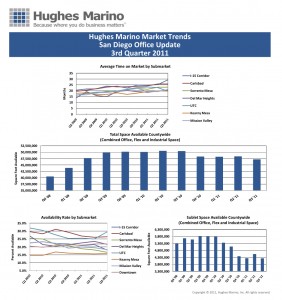

The third quarter showed continued stability in the commercial real estate market, as San Diego employers held firm with headcounts, and even added jobs in certain sectors of the local economy including life science and technology industries.  In evidence of these marginal employment gains, Q3 saw the biggest single drop in availability this year in San Diego County, as just over 1.1M square feet of office, lab and industrial space came off the market. This certainly helps to reduce the overall supply problem, but the market remains soft with over 47 million square feet of space available in San Diego County (see dashboard report). The good news is that there is overall job creation occurring.

In evidence of these marginal employment gains, Q3 saw the biggest single drop in availability this year in San Diego County, as just over 1.1M square feet of office, lab and industrial space came off the market. This certainly helps to reduce the overall supply problem, but the market remains soft with over 47 million square feet of space available in San Diego County (see dashboard report). The good news is that there is overall job creation occurring.

Fourth quarter of this year will be flat, but 2012 should provide for continued healing, taking another 1-2M square feet off the market. However, when compared to the healthy market of vintage 2006, we are still carrying an extra 20M square feet of available space., so the region still has a long way to go as before we can consider the market healed. It will take another 2-3 years with continuing moderate employment gains for landlords to get any pricing power back, and that will only occur if the market can absorb another 4-5M square feet over that time. Another sign of stability in the job market and the commercial real estate sector is that the total supply of sublease space on the market has remained flat for the year. San Diego County now has the same amount of aggregate sublease space on the market as it did in 2006, so sublease supply is back in line with a healthy and balanced market. Sublease availability should continue to shrink as Amylin in UTC is likely to be successful in disposing of some of its excess space, and the HP sublease in Del Mar Heights of over 104,000 sf will expire in March 2012, cutting sublease space availability in Del Mar Heights in half.

Downtown is up 110,000 square feet of positive net absorption year-to-date 2011, but with the opening of the Federal Courthouse in 2012, most, if not all, of that gain will be lost as federal agencies vacate third party leased buildings downtown and move into the new courthouse facility. While there continues to be business failures and business service sector shrinkage, downtown’s tech community is starting to get some growth traction. We predict with the early 2012 opening of downtown’s EvoNexus free incubator space for tech companies, there will be a surge of new start-ups taking advantage of the downtown amenities. The pervasive parking charges long associated with downtown office space can be offset by employer tax benefits as a result of the State of California sponsored Enterprise Zone throughout downtown, and Hughes Marino’s new Tax Credit Services is helping our clients to realize these savings. Downtown is once again becoming a very attractive location to build a business.

The most noticeable negative trends are that time on the market continues to be high and still rising in Carlsbad and the I-15 corridor, as some older and Class B properties continue to stagnate the market. UTC also took a hit this quarter as a flood of 2 and 3 story space in Eastgate Technology Park, along Towne Centre Drive, came back to market as available. It will be a considerable blow to UTC if LPL Financial moves forward with its rumored build to suit high rise, next to La Jolla Commons at the I-805, and vacates another approximately six buildings along the Towne Centre Drive corridor. Availability in UTC spiked back to 29.5%, the highest in the County. Meanwhile, Sorrento Mesa continues to move down in availability percentage, ending the quarter at 16.6%, the lowest in 6 years. Bullish Sorrento Mesa Class A office building owners have moved their asking rents up to $2.75 net of electricity, creating a true aberration as tenants can get better and cheaper space in UTC, where there is also better mass transit, housing, freeway ingress/egress and amenities—UTC is on sale today! Downtown’s Class A buildings continue to pull tenants from B and C alternatives with rental rates in the $1.75-$2.00 full-service (inclusive of utilities + janitorial) – making it one of the most attractively priced options in the County.

© 2011 Hughes Marino, Inc. All rights reserved.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.