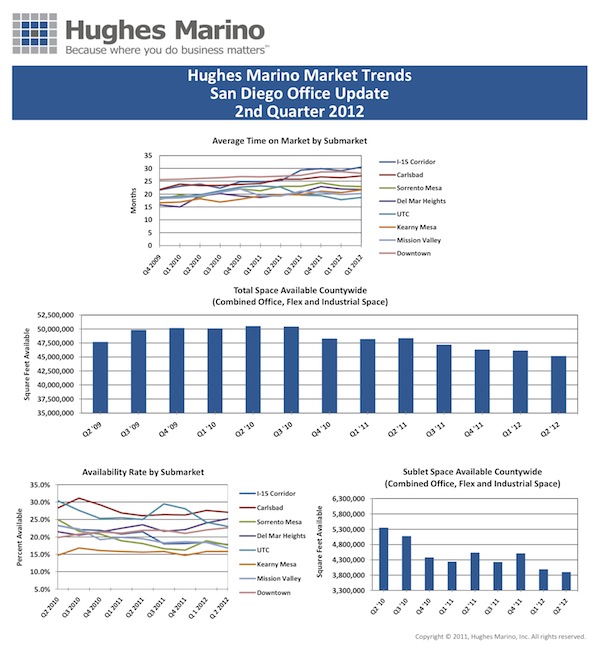

2012 is shaping up to be the recovery year that we forecasted it would be. At the beginning of this year, Hughes Marino forecasted 2012 would peel 2M square feet of net square footage off the market. In the 2nd quarter, 979,000 square feet of office, lab and industrial space came off the market in San Diego County. Year to date, 1.162M square feet has come off the market. This positive swing that began back during the second half of 2010 will continue through this year, and into 2013, as many of our active client transactions will result in expansions, and relatively few companies are planning to take less space when their leases expire this year or next. In addition to this continued absorption of space, the amount of sublease space on the market continues to trend down, being at the lowest level since early 2006. The effects of this correction are beginning to be felt. Rents are trending up for Class A space, while rents for Class B space are trailing. Rents for wet lab space are trending up, as they are for high quality R&D space. We are seeing erosion in free rent as well, while often still at a month free per year of lease term, there is less free rent offered in Class A office leases. By the end of 2013, it would be possible that free rent will have virtually disappeared as a market concession – with the only likely exception being downtown.

The most improved markets continue to be the I-15 corridor, Sorrento Mesa, Mission Valley and UTC. Downtown and Carlsbad continue to be stagnant. Del Mar Heights is the only market in the region that has reversed course, ending the quarter at 25.2% availability, the highest in over 2 years. A year ago, we examined how Del Mar Heights landlords were getting ahead of themselves and the market, pricing rents at the highest in the entire County. There are landlords now with asking rents at $3.90 per square foot, and with expectations that rents will go into the $4.00 range by next year. While a unique tenant might pay these prices for a large build to suit facility, these puffed up asking rents have scared tenants out of the submarket. Tech companies like Bank of Internet, Covario, Legend 3D and ServiceNow have left the Del Mar Heights market entirely, collectively leasing 210,000 square feet elsewhere, and leaving entire vacant buildings and floors in their wakes.

Downtown continues to have some challenges on the horizon, including a mass consolidation of the Federal Government into the soon-to-open in early 2013 Federal Courthouse building on Broadway – as well as Latham & Watkins moving to Carmel Valley and other large tenants consolidating or relocating to suburban locations. Ironically, downtown is the least expensive market, even factoring in parking charges, given that all of downtown is in the California Enterprise Zone – which typically provides for 1.5x parking charges back to companies in the form of tax credits and refunds as an incentive to operate in downtown. That, coupled with the immense shopping, dining and living options, create a value that runs counter to the stagnant growth we’ve been seeing.

© 2012 Hughes Marino, Inc. All rights reserved.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.