By David Marino

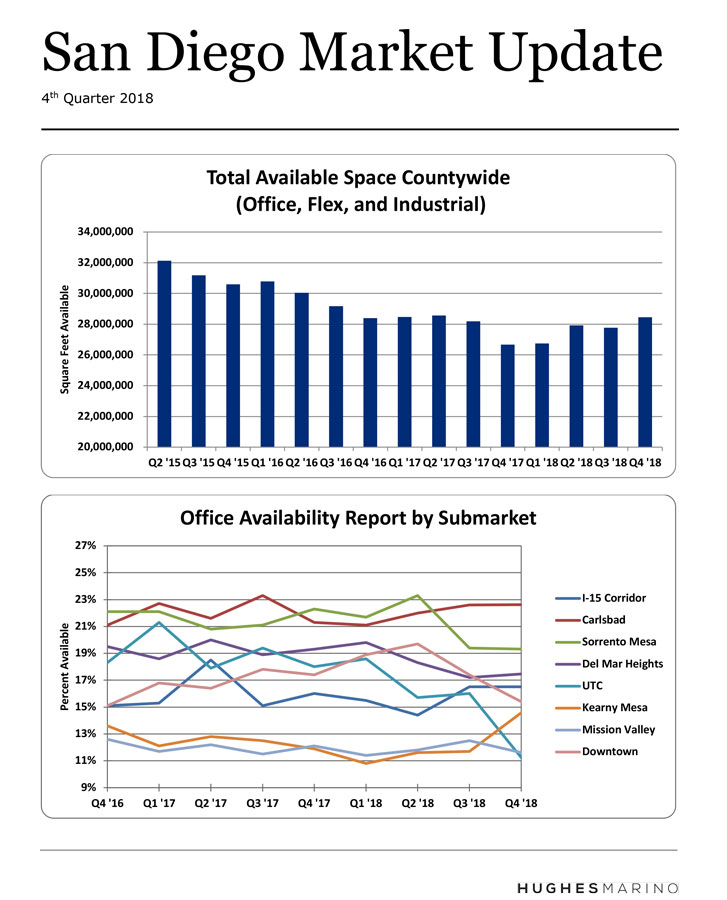

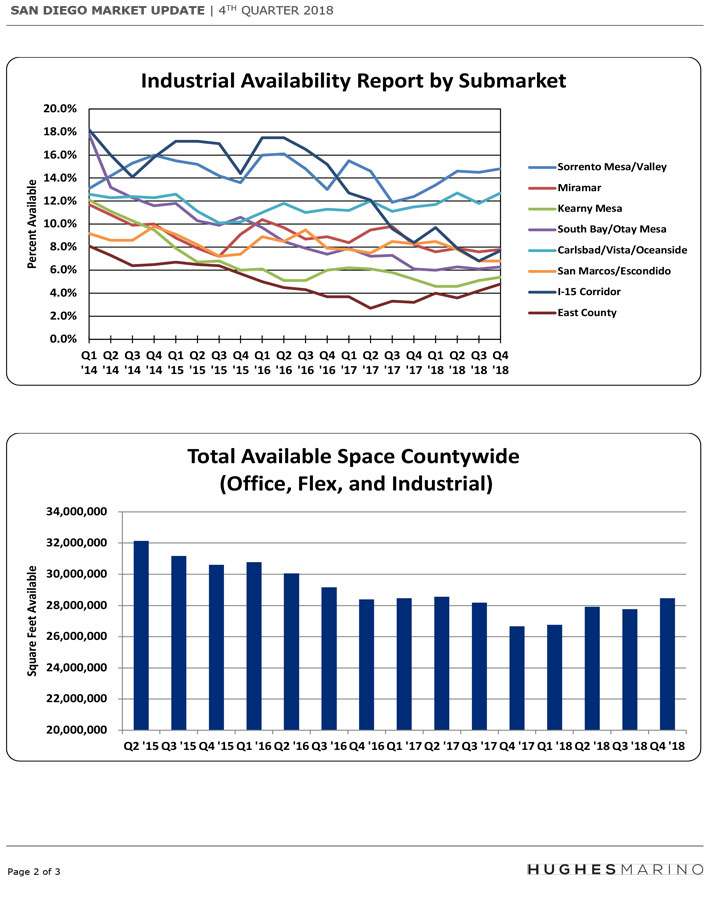

2018 was the first year in 8 years where San Diego County showed an increase of combined office, lab and industrial space above the prior year, bumping up 1.78 million square feet above year end 2017. After several years of annual space availability reductions, 2018 surprised everyone with this increase of total space available. The year also ended with 530,000 square feet more sublease space than year-end 2017, accounting for 30% of the total increase. Generally, these two statistics would be early indicators of a potential supply problem and looming downturn, but real time activity in the market does not make us concerned about the year to come. For the first time in our reporting, there is a mild disconnect with the data and what we are experiencing real time.

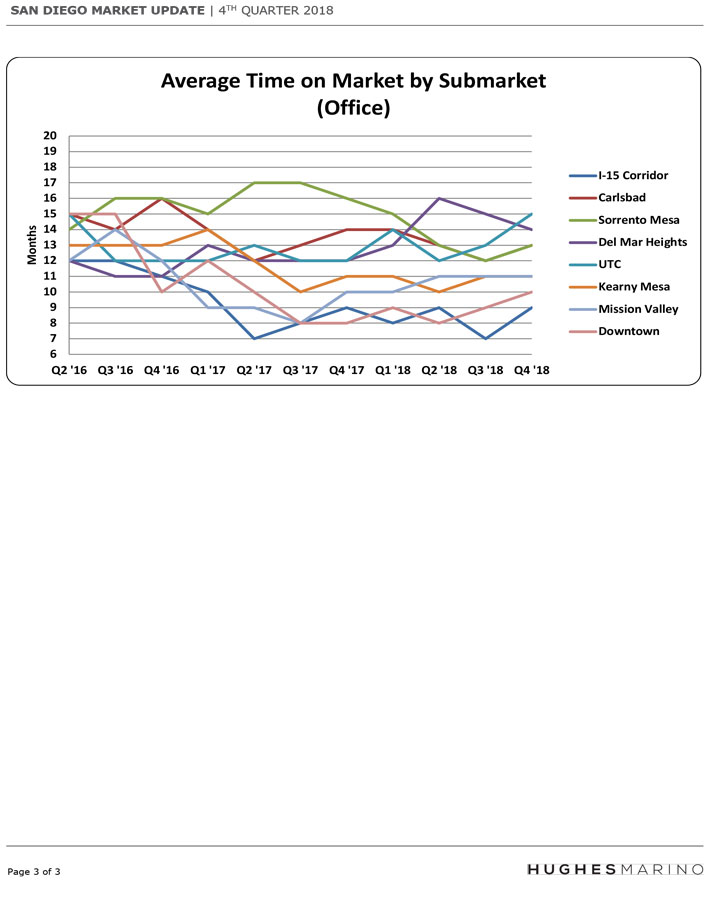

Several major San Diego County submarkets ended 2018 substantially better than they started. Particularly notable is UTC which went from 18% availability to 11.2% availability over the course of 2018. UTC has become the go-to place for professional and financial service, technology and biotech companies. UTC’s superior amenities with the recent UTC Mall expansion and freeway accessibility have made it the place many tenants want to call home. We project that 2019 will see even more compression of availability as Apple is in negotiations for 90,000 square feet, and expanding Hughes Marino clients such as SmartDrive, Kyriba and Platform Science will lease over 100,000 square feet combined in the first quarter of 2019. Hughes Marino client, Samumed, completed its 75,000 square foot expansion in 2018, taking the largest UTC biotech building off the market. ServiceNow has already preleased 38,000 square feet that they won’t even get possession of until the 4th quarter of 2019 for their ongoing growth. The market is so tight that The Irvine Company, owner of 80% of the UTC office market, doesn’t have a single full floor or multi-floor combination left in their portfolio, and almost every Irvine Company building is over 96% leased, with 8 of their high-rise buildings being 100% leased. This is unprecedented in the history of UTC. UTC availability will go into the single digits for the first time in well over a decade by the end of this quarter, and rents will hockey stick in the latter half of 2019 and into 2020 as a result.

Sorrento Mesa and Downtown San Diego also ended the year slightly improved with Sorrento Mesa shaving off 3 percentage points of availability and downtown 2%, both ending 2018 at 19.3% and 15.4% availability respectively. Sorrento Mesa has improved over the past year as a number of technology and medical device companies have done expansions, including Dexcom for 100,000 square feet and Curology moving from UTC to Sorrento for 65,000 square feet. As UTC continues to tighten, more tenants will look at Sorrento Mesa for larger blocks of space, particularly over 20,000 square feet. We expect several major companies to complete transactions between 40,000 and 60,000 square feet in Sorrento Mesa in the next quarter and that availability will continue to trend down over 2019. Downtown San Diego remains hot for companies of all industries, and while there are shortages of big blocks of space for tenants that require multi-floor solutions today, there is soon to be a surplus of new and refurbished buildings hitting the market in the next few years (with new product coming online as early as December 2019).

On the industrial front, every major submarket around the county remains in the single digits of availability except Sorrento Mesa and Carlsbad/Vista/Oceanside. Carlsbad, Vista and Oceanside have been particularly stung lately by significant new speculative construction exceeding 2 million square feet as well as by a number of mergers and acquisitions that have caused local companies to shed their facilities. Companies like SKLZ, Denso Wireless, DJO, Teamwork Athletic, and Hay House have all vacated six-digit sized facilities due to M&A or moving out of state to lower cost markets. Sorrento Mesa and Sorrento Valley have a double-digit occupancy as a significant amount of lab space is included in the industrial availability percentage. As UTC and Torrey Pines tighten for available lab space, Sorrento Mesa has become the value market for biotech companies that need to expand in 2019.

While the government shutdown, trade war and bouncy stock market have some worried as we go into 2019, job creation in San Diego remains robust and we expect 2019 to be a strong year for growth, offsetting the losses in 2018.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.