By David Marino

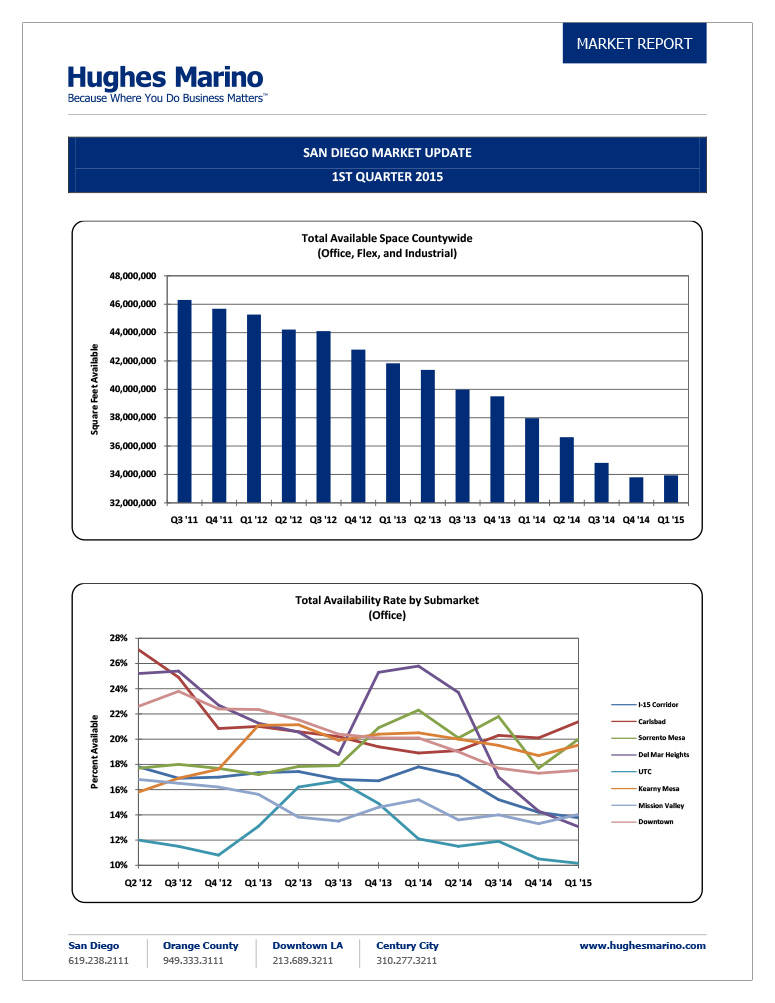

San Diego County commercial real estate numbers are spotty for the first quarter of 2015, as the consistent decline in supply over the last five years appears to have bottomed out. The total available supply of office, lab and industrial space for the county was 33.8 million square feet at the end of 2014, and actually increased slightly in the first quarter of 2015.

Of concern, there is no single explanation for this slowdown, as most of the buildings under construction in the region have yet to be completed and have not been added into inventory, and there is no single company or industry that has shed space in the region. However, there is 1.2 million square feet of space under construction in the county — mostly office space — which will be completed in 2015. That is not a material amount of supply given the size of the region, so we don’t see a coming supply hangover due to new construction.

Separately, larger companies are currently shedding excess space that has yet to hit the market, such at Motorola Mobility in Sorrento Mesa for 115,000 square feet, Sony with a 275,000 square foot building in Rancho Bernardo, Cohu giving up approximately 200,000 square feet of their existing building in Poway, Soitec with 165,000 square feet in Rancho Bernardo, BMS with 150,000 square feet in UTC, and Sempra vacating 310,000 square feet in Downtown, as the company moves into its new headquarters building near Petco Park. We will be monitoring the total supply of space closely over the coming two quarters, as our client demands tell us that there is strong tenant expansion in the pipeline, and that, overall, a few million square feet should come off the market in the region this year. While 2015 will be bumpy, we believe that it will end as another recovery year.

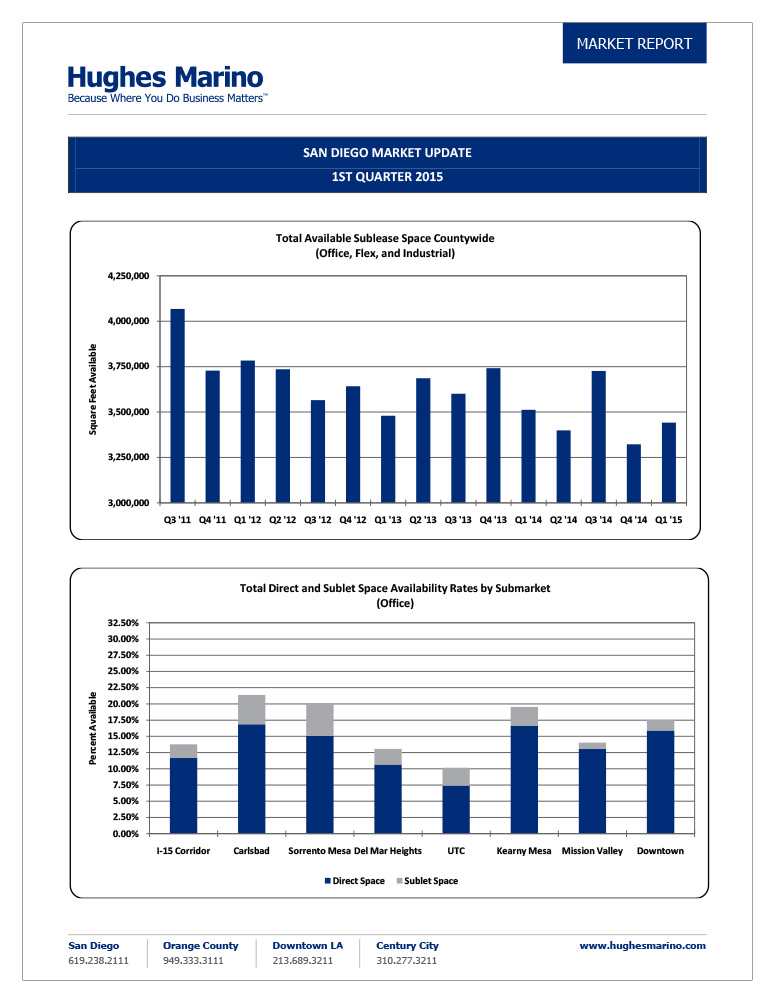

Aggregate sublease space availability in the county continues to be in the 3.4 million square feet range. We carefully monitor this important item, as any kind of material and sustained increase in the amount of sublease space is a “canary in the coal mine,” indicating that companies are shedding space due to either business consolidation or an unexpected downturn in their business. Notwithstanding, we expect the amount of sublease space on the market to decline throughout 2015 as tenants seek good value that can be uniquely had in subleases relative to the landlord community pushing to continually raise rental rates throughout the year.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.