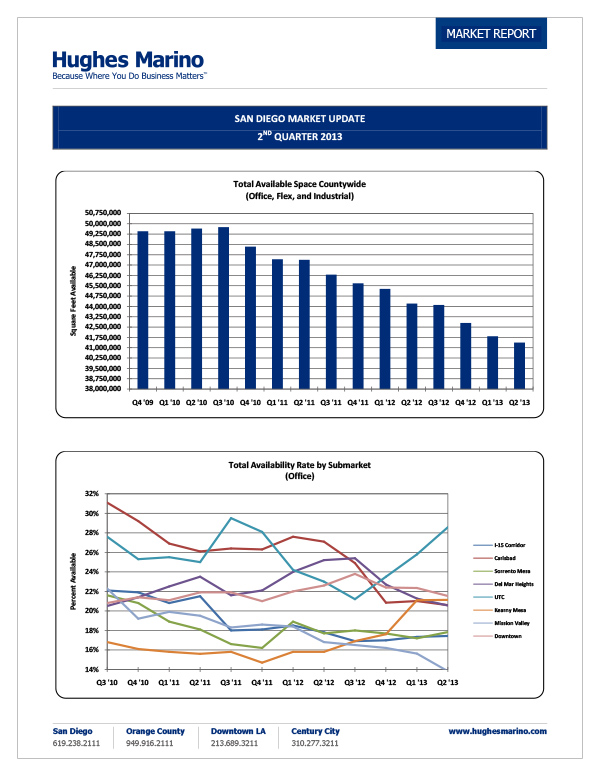

As we end second quarter 2013, half way through the year, 2013 is shaping up to be another strong recovery year for the San Diego County commercial real estate market. Another 460,000 square feet of office, lab, and industrial space came off the market in the second quarter. On top of the 966,000 square feet that came off the market in the first quarter of 2013, just over 1,400,000 square feet has come off the market year to date. That is equal to the same amount of net space that came off the market in the first half of 2012. For the last 8 quarters in a row, consistently 700,000 to 800,000 square feet of space has come off the market, creating a smooth recovery without any demand spiking or irrationality, or any foreseeable stall. Based on tenant demand in the market, and our own client activity, we believe that this trend will continue for many years to come. All sectors of the economy seem to be in recovery, even the life science industry and home building industry, which had been weathering tough storms for the last many years.

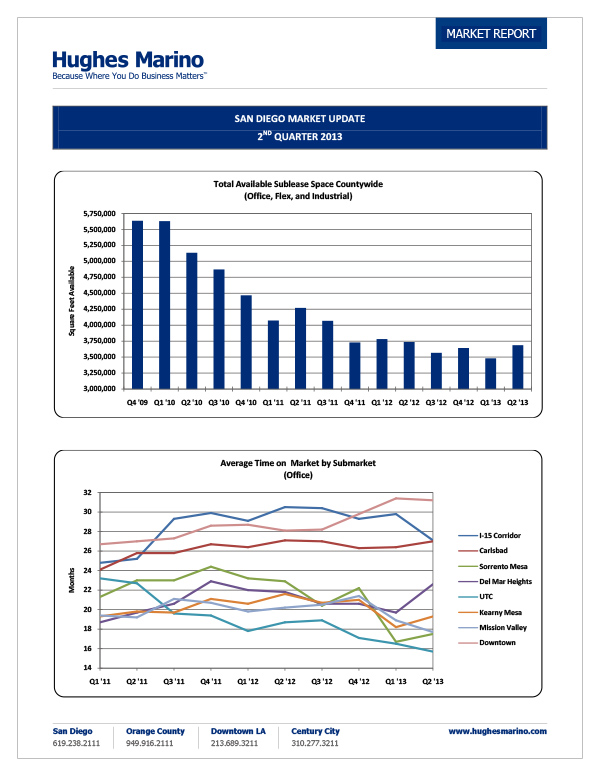

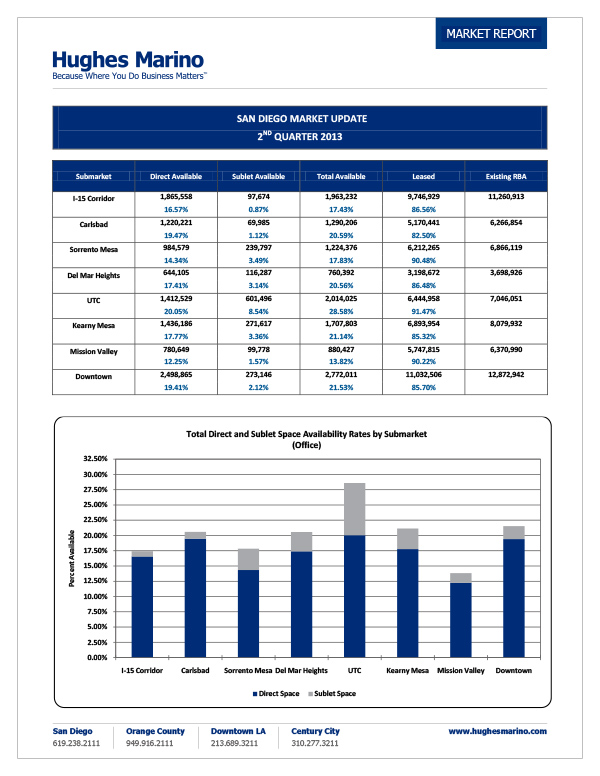

In terms of sublease space, were it not for Amylin in UTC trying to unload 500,000 square feet of space, and Cricket in Kearny Mesa looking to sublease their 200,000 square foot headquarters given their pending purchase by AT&T, aggregate sublease space on the market would be dramatically down as well. Take those two companies as outliers out of the math, and there would be less than 3,000,000 square feet of available sublease space on the market, which would be the lowest level seen since 2005. The health of San Diego companies is strong, and getting stronger!

Overall office availability continues to decline in every submarket with the exception of UTC and Kearny Mesa, only otherwise due in those markets to the Amylin and Cricket subleases respectively. Notwithstanding gradual improvement, all of the office submarkets are still trending from 14% to 22% availability (other than UTC, where Amylin sublease space has spiked the numbers unnaturally). This softness inhibits developers from building new buildings speculatively, and existing building availability needs to decrease by at least another 5% before we will see new speculative construction. More vitally, rental rates need to grow by 30% to 40% before we will see any significant surge in speculative construction as current market rents don’t support the costs of new construction.

Average time on the market continues to stall across the region. Carlsbad, Downtown and the I-15 corridor have troublesome average time on the market ranging from 27, 31 and 27 months respectively. These have been the trailing submarkets in the overall economic recovery for the region.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.