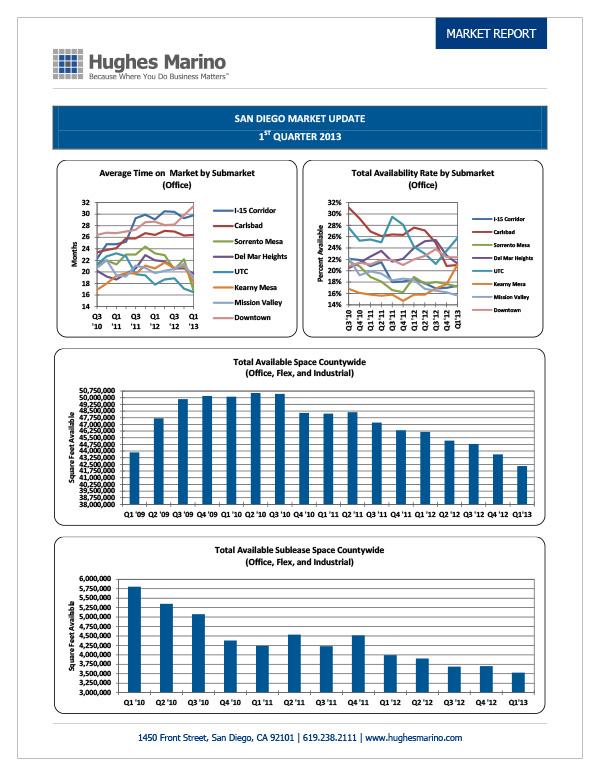

The broad commercial real estate market continues to show signs of a gradual recovery. In the first quarter, 169,000 sf of office, lab and industrial space came off the market. The total amount of sublease inventory continues to go down as well. All of these high-level indicators are the ones to watch for continuing improvement or a potential stall. Hughes Marino expects that we should see continued declines in availability, but potentially stabilization in the amount of sublease inventory on the market, as we continue through 2013.

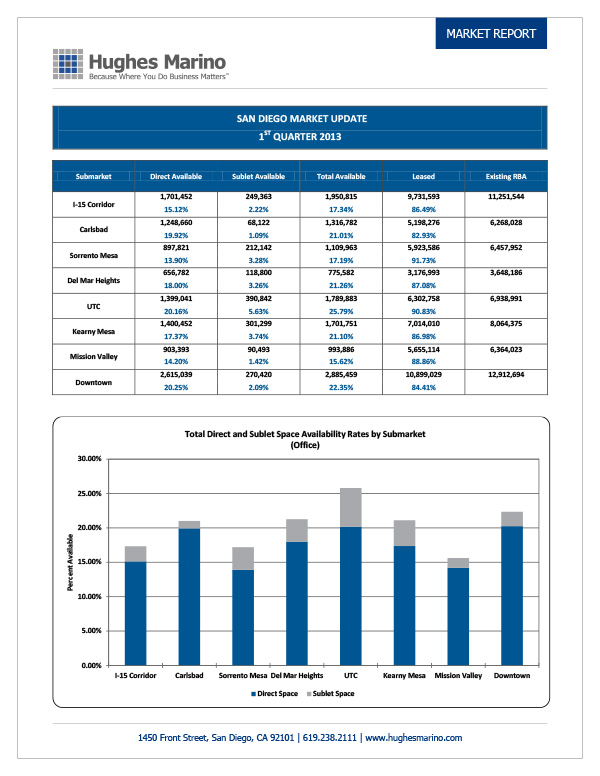

In the short-term, we expect sublease space to increase in UTC where Amylin Already has over 375,000 sf of space for sublease, and will be bringing more inventory to market later this year. Most of the space is older vintage lab space with dated tenant improvements, also with parking that cannot accommodate office users. Another 113,000 square feet of sublease inventory is the former Illumina campus, also with specialized lab facilities. Currently, 22% of all of the available inventory in UTC is sublease space, but these subleases do not compete with the general availability for standard office tenants.

In Kearny Mesa, cricket communications has put their entire 200,000 square-foot facility on the market. While the explanation is that the company needs to downsize, rumors about a potential merger whereby the entire facility would not be required have surfaced. This one significant Cricket sublease has spiked availability in Kearny Mesa, and created a bit of a distortion of increased availability in that submarket. However, overall office availability rates continue to nudge downward in most of the other submarkets.

Downtown remains sluggish with 2.8 million sf of available space (22.5%). Several large companies have committed to relocate to the suburbs (including Latham & Watkins – 80,000 sf and Golden Eagle Insurance – 50,000 sf). That, combined with some Federal government consolidations into the new Courthouse, and other anticipated government consolidations, is leaving downtown landlords frustrated. Sizeable net absorption continues to remain elusive.

Notwithstanding, the time that space sits on the market is also starting to finally trend downward in most markets, other than downtown and the I-15 Corridor, where things have continued to stagnate.

© 2013 Hughes Marino, Inc. All rights reserved.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.