By David Marino

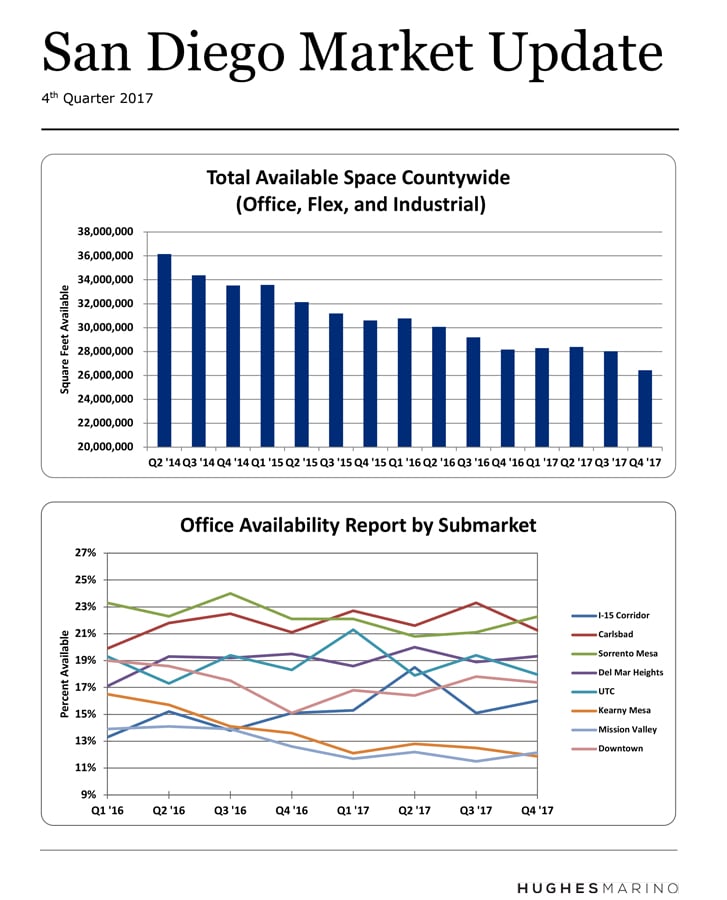

The first three quarters of 2017 looked as if last year was going to be flat after seven strong years of space absorption by San Diego companies. Unexpectedly, fourth quarter came in with 1.6 million square feet of net space being absorbed in San Diego County, ending the year at 1.74 million square feet of total net absorption. While slightly below the prior recovery years where anywhere from 2 to 5 million square feet came off the market annually, this still is a strong sign for our continued regional economic recovery.

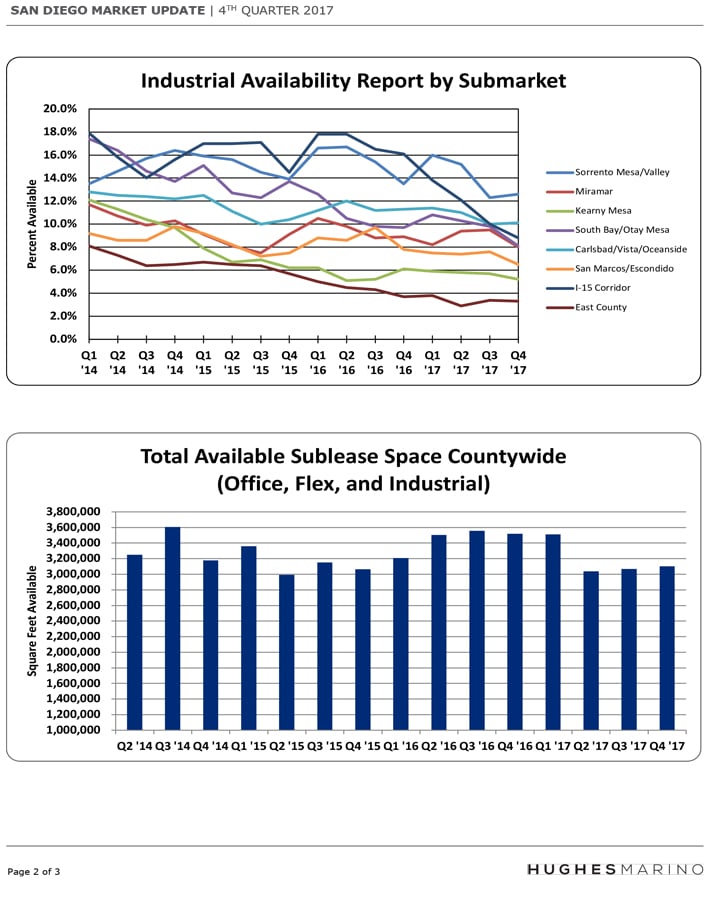

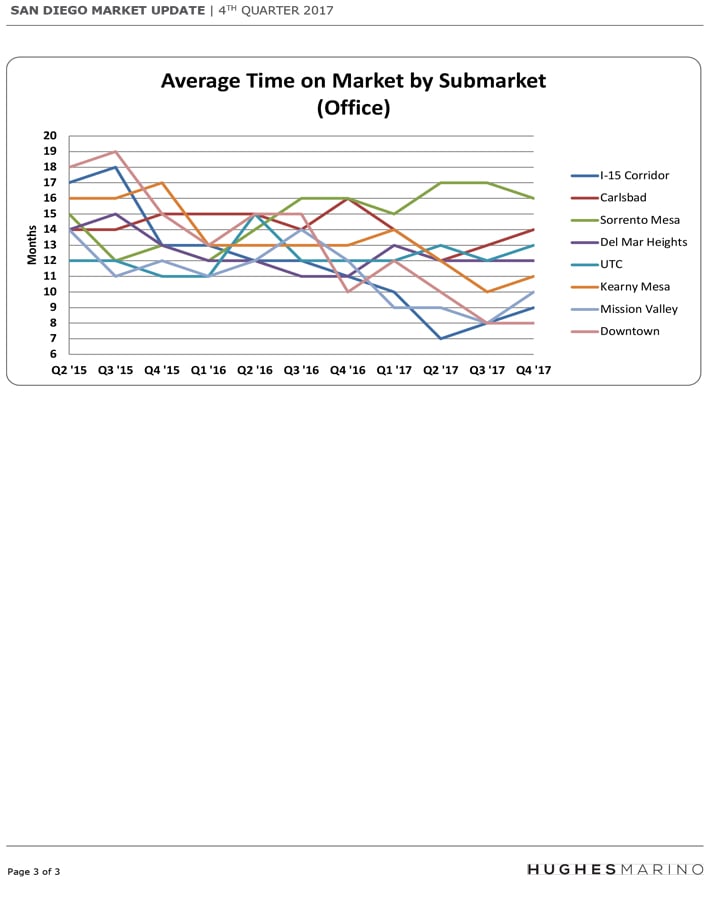

Of particular notability is the strong demand the region continues to see for industrial space. Availability rates continue to trend down in every part of the county with competition for space and supply shortages, particularly in the central county area for spaces over 20,000 square feet. For office space, it still continues to be a bumpy ride in the submarkets of Carlsbad, Sorrento Mesa, Del Mar Heights and UTC, with no clear end in sight. Demand for office space is stagnant in these markets, with no clear answer as to what will ultimately lead to a recovery in demand here.

Downtown is experiencing interesting times. Vacancy is at a 12-year low at 10.5%—and landlords are aggressively increasing rents as a result. This pushing, however, is starting to push tenants out of downtown—having the adverse effect they were hoping for. Coupled with the Thomas Jefferson Law School building coming on the market in East Village for 170,000 sf—and the former Executive Complex (1010 Second Avenue) being re-skinned and gutted (300,000+ sf), it will add 8+% of vacancy back onto the market.

As for the life science community, there is a severe shortage of good, well-located and attractive wet lab space, particularly for users under 10,000 square feet. Literally almost every space in that size range is spoken for and either under a letter of intent or in lease negotiations. In anticipation of this, some of the major developers, like Alexandria Realty, are already developing strategies to provide new incubator and startup spaces for the life science community that will be coming online later this year. In the meantime, things are tight and prices are being pushed up. Great opportunities exists for tenants that are above 40,000 square feet seeking lab space, particularly in Sorrento Mesa, where not only is office supply in a glut, but lab space may soon be as well.

We are bullish on 2018 being another recovery year as the overwhelming majority of the over 500 client transactions that we are working on as a company are looking to at least renew their lease or grow by as much as 20% to 30% beyond their current footprint capacity. We anticipate ongoing hiring and a strong economy in the San Diego County region that will lead to another 2 to 3 million square feet of space coming off the market this coming year, with only incremental amounts of new construction coming online keeping supply status quo.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.