Free rent, cap rates and the illusion of the “market rental rate”

By John Jarvis

I am going to take a deep dive here down another rabbit hole and try to explain one of the more interesting and unusual aspects of commercial real estate. Let’s call it the “Free Rent Game.”

I am going to assume that you understand cap rates; what they are, how they function and how they exponentially super-charge the rent that tenants pay, i.e. cash flow, into the landlord’s equity. If you want to revisit a primer on cap rates, check out this article I wrote: Pennies, Nickels, Dimes and Dollars; The crazy alchemy of commercial real estate; how commercial landlords turn (your) pennies into (their) dollars.

I am also going to revisit a basic concept I have written about before, the notion that there really is no such thing as a “market rental rate” in commercial real estate. If you want a primer on this outlandish idea, check out this article I wrote: The Jarvis Value Model ©; Market pricing, the compromises we make and our insatiable quest for a great deal (aka value).

Now, with that out of the way, let’s dig in.

I negotiate real estate transactions for a living, both leases and purchases. I only represent one side of the transaction, the tenant or the owner-user buyer, aka the “space occupier,” and never the investors/landlords, which may explain why I am so fascinated by the various concessions offered by the building owners when I negotiate commercial leases. Free rent, for example.

A central tenet in economics is the idea that there is no such thing as a free lunch. In other words, there is always a price to be paid, even if that price isn’t obvious. We see this now in all things tech with the adage “If you aren’t paying for the product, you are the product!”

So what about free rent? Is it really free? Or does all that “free rent” really mean that the landlord is eating my lunch?

Because here is the thing–all that free rent is allowing the landlord to prop up or boost the contract rental rate. And when it comes time to sell or refinance the building, investors and lenders are generally willing to ignore (up to a point) the fact that the rent schedule was artificially inflated by a hefty, front-end-loaded concession package.

Tenants, generally, don’t mind playing along in this game. The front-end-loaded concession package means that the tenant benefits from the time value of money-savings today paid back later, over time–not a bad deal, and the NPV of the total rent spend will be marginally lower because of the early free rent. Furthermore, on the company’s profit and loss statement, the lease economic terms are all averaged out and straight-lined anyway, so on their books the average annual rent spend including the up-front concession is accurately reflected.

Except there really is no such thing as a free lunch. And the price will be paid as asset values increase commensurate with the inflated contract rental rates, and subsequent investors will seek to maintain higher and higher contract rental rates to justify the inflated purchase prices.

OK, I am pretty deep into this rabbit hole now. Allow me to share a simple example to try and shed some light.

Suppose an office building is available for lease with an asking rental rate of $3.00 per square foot per month. Along comes a tenant who leases that building for a ten year lease term starting at the $3.00 PSF rate. They negotiated a great deal and got the entire first year as free rent! As mentioned previously, they are going to report the effective/average straight-line rent on their P&L, so all is good, no?

No.

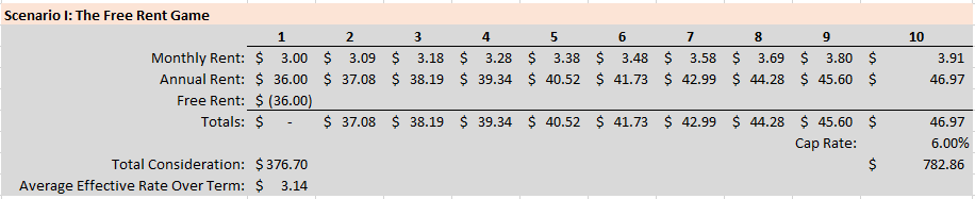

Here is a simple cash flow model depicting this transaction, all numbers shown on a per square foot basis, and including a 3% fixed annual cost of living increase:

In Scenario I above, total consideration paid over the term, after deducting the free rent, is $376.70 PSF, and the average/effective monthly rental rate is $3.14 PSF. Notice that the terminal building value, based on a 6% cap rate, will be $782.86 PSF, more on this in a moment.

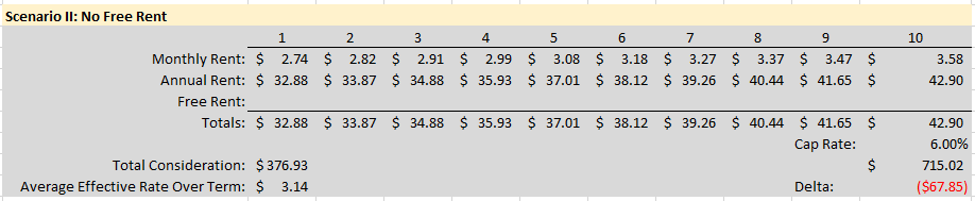

Now what would that rent schedule look like if we weren’t playing the free rent game? Here you go:

As you can see, a starting monthly rental rate of $2.74 PSF yields essentially the same average effective rental rate over the ten-year term. Can you spot the reasons why the landlord really doesn’t want to play it this way?

Reason #1: Terminal Valuation

These two transactions may be identical when presented on a tenant’s P&L, but they are very different in the eyes of the landlord. In Scenario I, the terminal building value based on a 6% cap rate will be $782.86 PSF. But in Scenario II, the terminal building value based on a 6% cap rate will be $715.02 PSF, a delta of -$67.85 PSF! If this building is 100,000 square feet, Scenario II will cost the landlord $6,784,820.56! That is the amount of value “propped up” by the free rent game, like some kind of phantom equity. And everyone is OK with this? (The total US CRE market has been estimated at $16 Trillion, so how much of that is phantom equity?)

Reason #2: The Renewing Tenant

Many times a tenant gets to the end of their lease term and they do not want to relocate, instead intending to exercise a renewal option and stay in the building, perhaps for another ten years. Now look at the rental rate in the final lease year under both scenarios. Would you rather go into a lease renewal negotiation with your rental rate in your final lease year at $3.80 PSF or $3.47 PSF? Do you think landlords haven’t thought about this? For example, have you ever noticed the language in many standard form leases that states the new, “market rental rate” for an extended term shall be in no event less than the rental rate in the final lease year? Yep, that’s why.

Reason #3: Fixed Annual Increases

Remember those fixed 3% annual rent increases? If you are the landlord, would you rather those 3% increases be calculated on a starting rate of $3.00 PSF or $2.74? The larger number, of course. And the difference? It comes to about an extra $0.01 PSF per month each and every year to the landlord. Yeah, now we are really deep in this hole, worrying about mere pennies. Except, if we have learned anything, remember, pennies paid by the tenant translate into dollars for the landlord. That $0.01 PSF per month is $0.12 PSF per year, and with a 6% cap rate applied, that $0.12 is worth $2 PSF to the landlord. Once again, if the building is 100,000 SF, that is $200,000 to the landlord, and they will happily accept it.

If you are still with me on this deep dive, thank you my spelunking friend.

And my point is this…don’t you think this is just a little bit crazy? Most of the players in this game–at least the investors, the landlords, the lenders–they all understand this gambit very well. And they all play along, willing to buy and sell and finance buildings based on the illusion of these inflated “market rental rates.”

But do the tenants understand this game? Some do, many don’t. Do they care? Maybe not. I think they should.

But then again, this is what I do all day every day, negotiating commercial real estate transactions and protecting the interest of the occupiers in this game designed by the property owners. Which is why I write articles like this in an attempt to educate the marketplace.

Now let’s get out of here before the rabbit get’s back. Have you never seen Monty Python and the Holy Grail?

John Jarvis is a managing director at Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact John at 1-844-662-6635 or john@hughesmarino.com to learn more.