Welcome to July 2024, more than four years post-Covid. Utah’s industrial real estate market, once riding the wave of hypergrowth driven by ecommerce and distribution giants, has undergone a dramatic transformation since its 2020-2022 run-up. Industrial companies that overcommitted during those years are now flooding the market with sublease space, marking an unprecedented turn in Utah’s industrial real estate scene.

A Surplus of Industrial Sublease Space

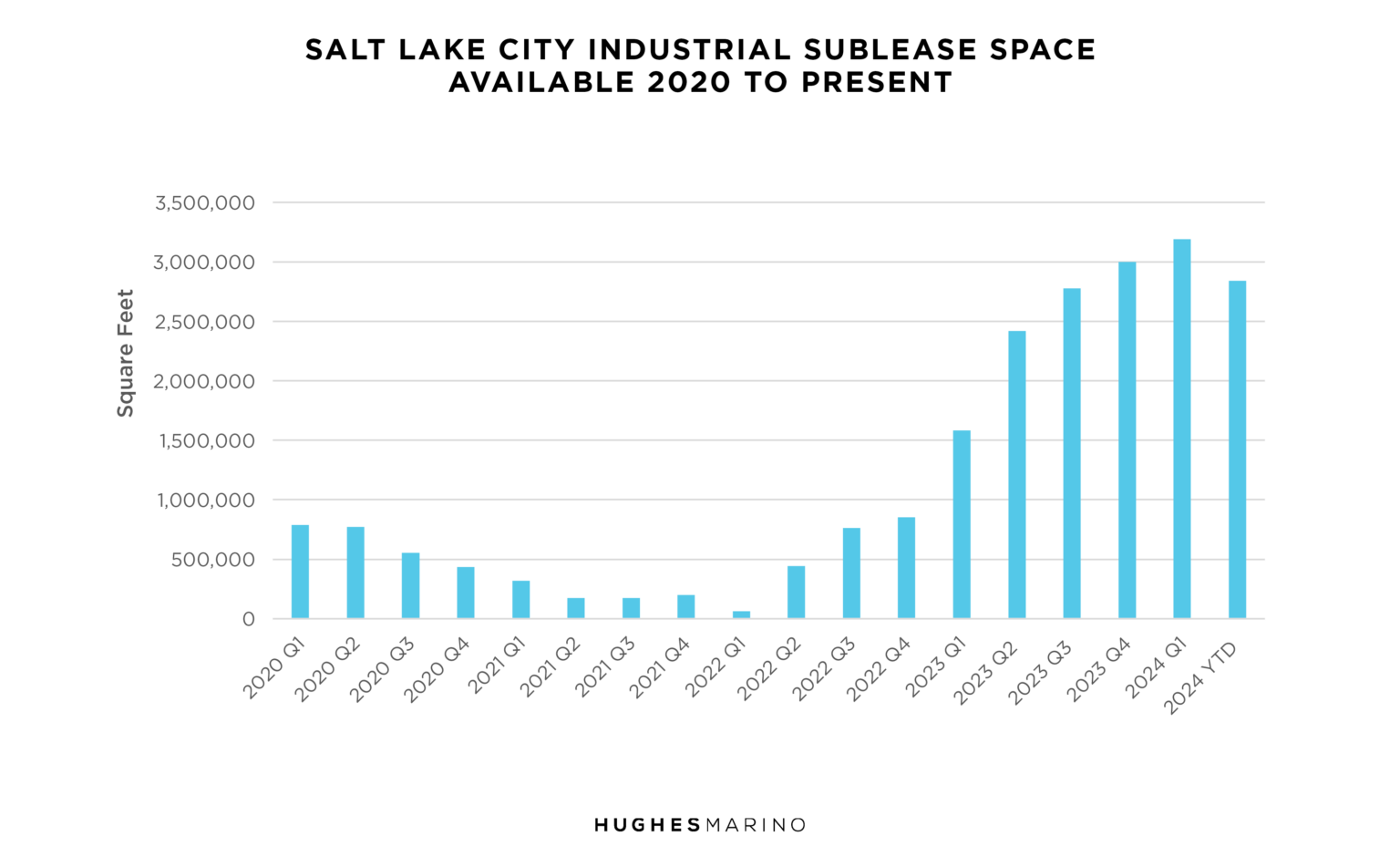

In 2024, Utah finds itself grappling with a record amount of industrial space available for sublease. Nearly 2.8 million square feet of industrial space is available for sublease in Salt Lake City alone, which is a staggering 45x increase from the 2022 low of 62,000 square feet. This influx of sublease space offers opportunities for those looking for discounted, often fully equipped and racked industrial facilities, but it also signals a dramatic shift in the industrial real estate landscape.

The surge in sublease supply, which spiked at a historically unprecedented rate in 2023, has only accelerated into 2024 and is now leveling off as astute tenants, and the tenant advisors like us that are representing them, pick these values off the market. Developers, who anticipated continued growth and overbuilt accordingly, are now left with empty buildings as demand has cooled, and have found overnight that their biggest competitors are other tenants versus other landlords.

Utah’s Industrial Availability Rate

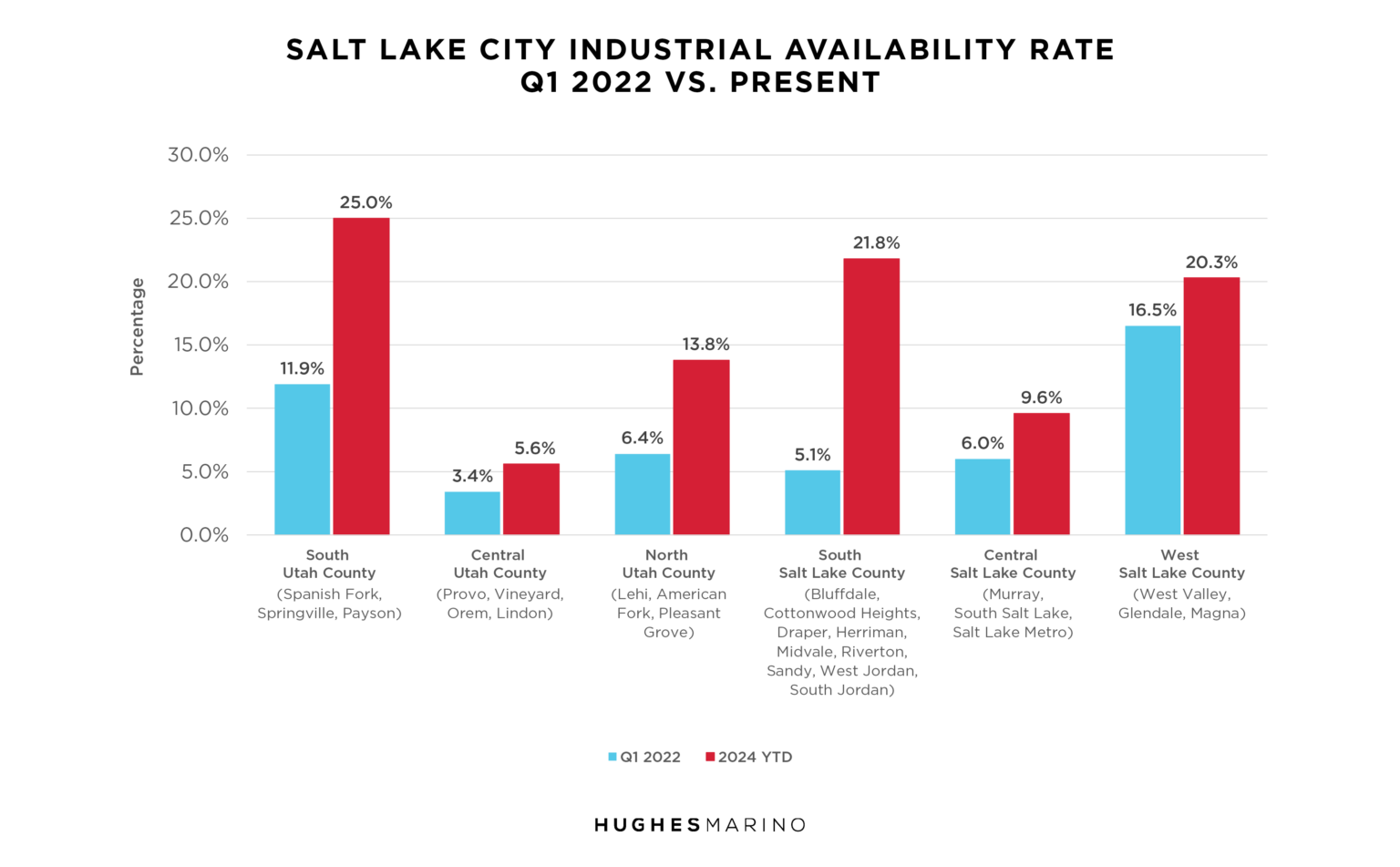

With this flood of sublease space, coupled with developers overbuilding the market, Utah’s industrial real estate market has seen a significant increase in availability rates. South Salt Lake County has seen more than a tripling in availability while Spanish Fork and Lehi industrial markets are well over a 100% increase from the pre-Covid days. The substantial uptick in availability rates over the last two years has created a shift from the landlord-favorable environment that characterized the 2020-2022 pandemic years.

Navigating the New Industrial Landscape

Despite the increase in availability, asking rents for industrial space in Utah have remained relatively stable. This disconnect between rising availability and stable rents can be attributed to landlords and their conflicted full-service brokers conspiring to maintain price levels, obscuring the true state of the market. However, the current market conditions offer a new opportunity for tenants seeking industrial space to challenge yesterday’s market, if they are armed with the facts and represented by a tenant representation advocate that is willing to challenge the status quo.

Given the dramatic changes in the industrial real estate market, working with a tenant advocate who understands the current environment and can navigate the complexities of the market is crucial. Traditional brokerage firms with teams of dual agents that represent both landlords and tenants, don’t serve tenants’ best interests as the landlord is the dominant customers in this David and Goliath industry. Tenants deserve representation who only have their interests in mind to ensure they make informed decisions and capitalize on the emerging opportunities.

Marketing statistics provided by CoStar.