Four years post-Covid, and we are still scratching the surface of the ramifications of the pandemic on the commercial market. Part of the reason it’s going to get worse is that half of all office leases that were signed pre-Covid have still not expired, whereby half of office tenants still have yet to address the excess space they are carrying as a result of remote and hybrid working. The negative effect on office space demand has been severe, as most people have read and intuitively recognize. But how bad really is the commercial market in Salt Lake City?

Vacancy Versus Availability

It is common to see office market data reported on total vacancy by the traditional brokerage firms that represent both landlords and tenants in a conflicted manner. Although vacancy can be a useful measuring stick in a tight market, it tells an incomplete story of what the market truly looks like as the market has softened, and we need to consider all office space that is “available.” Total availability includes all space that is on the market for lease or sublease, whether it is occupied or vacant. For comparison, imagine that you are in the market to buy a home. You would want to see all homes on the market that fit your needs and specifications, including homes that are currently occupied but are for sale (as most are!).

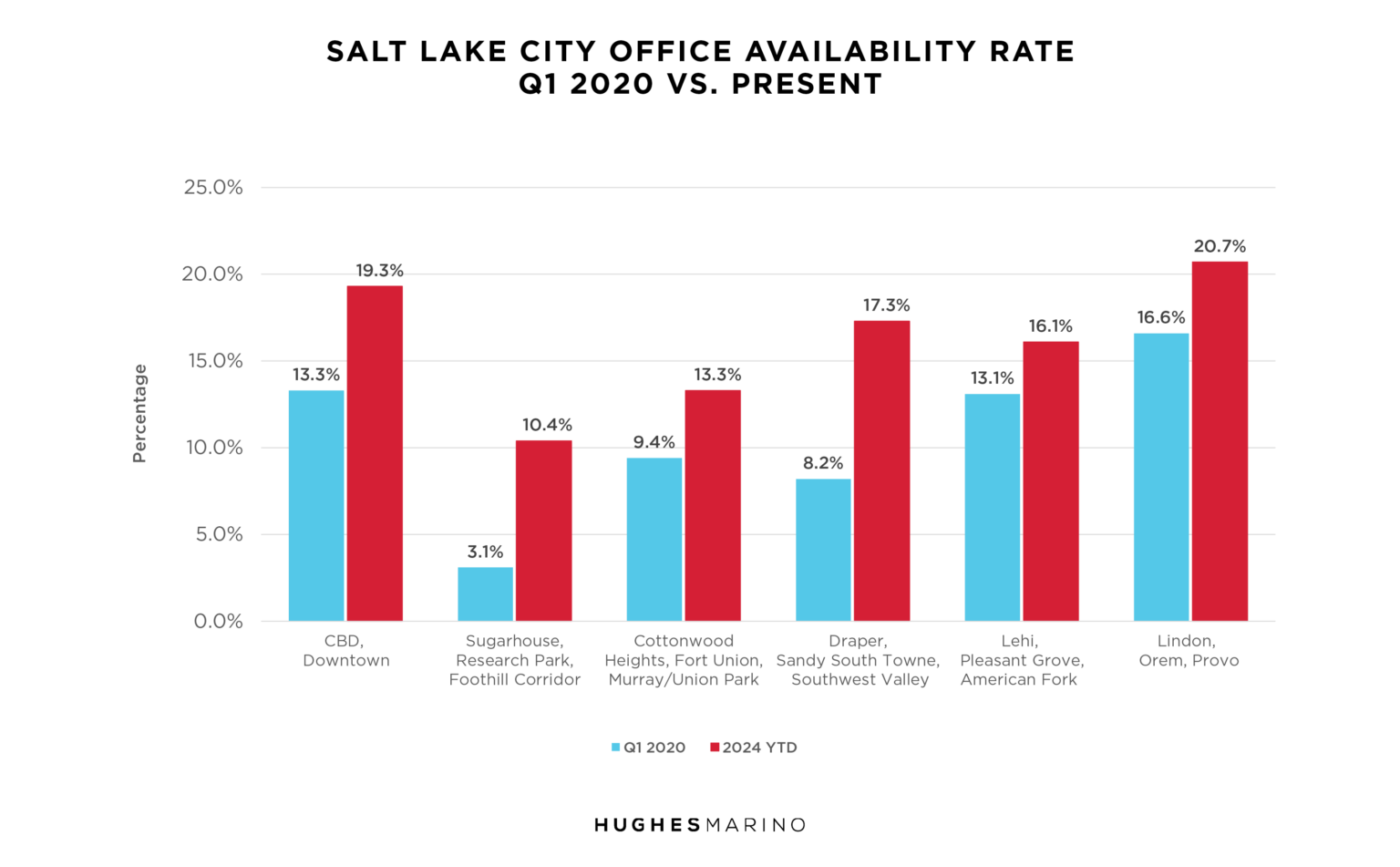

In the Salt Lake City metro area, we are seeing availability rates increase at a significant rate across all of the key submarkets. As seen in the chart below, availability in Downtown Salt Lake has increased 45%, 22% in Lehi and American Fork, and more than doubled in Draper and Sandy from pre-Covid to today.

As we consider where the office market goes from here, we are yet to see availability rates hit their peak. Pre-Covid office leases most commonly ranged from 5 to 10 years of term, and half of those leases have yet to expire post-Covid. As companies across the Valley approach their lease expirations, most are downsizing their office space given hybrid and remote work schedules have led to only a fraction of their employees being in the office each day. We will continue to see availability rates climb from Downtown to Provo as many of the remaining companies with leases yet to expire downsize over the coming years.

Sublease Space

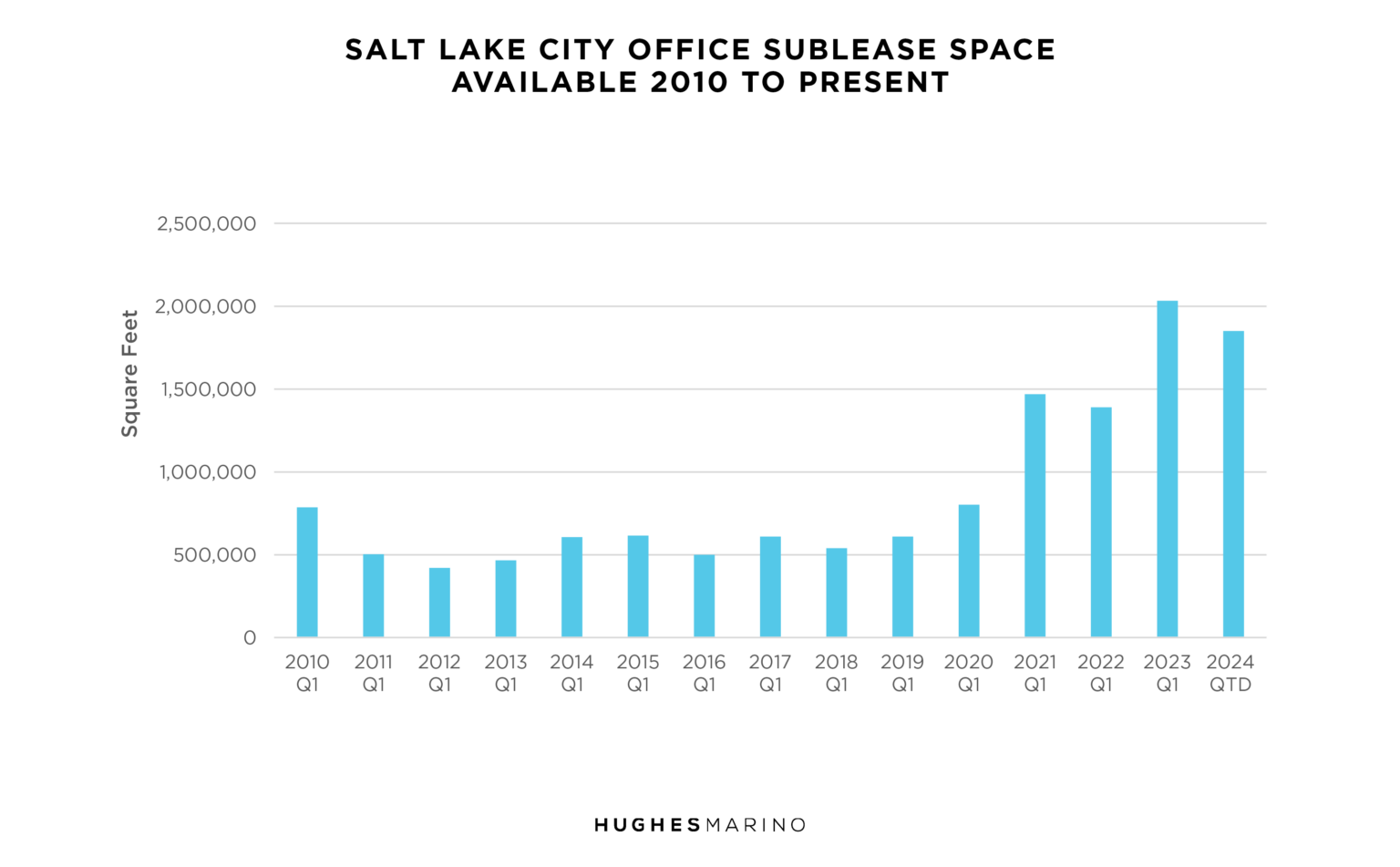

Another large contributor to the increasing availability rate is the increase in available sublease space. The chart below documents available office sublease space in Salt Lake, which has increased dramatically since the start of Covid to now historic highs. From pre-Covid to today, we have seen a 2.5x increase in the amount of available sublease space on the market. Sublease inventory at cheaper rents and shorter terms is not only the leading edge indicator of a soft market, but also a landlord’s worst nightmare. Many of the office space tenants that we are representing are looking exclusively at sublease spaces, and we are negotiating great deals on beautifully built-out furnished space at big discounts to market, with more flexible length of terms. This is what landlords have to contend with when trying to lease out their competing vacant space at yesterday’s prices, and tenants have become landlords’ biggest competition.

While these trends are gloomy for landlords, the softening of the office market is great news for business owners and executive teams with leases expiring in the next few years, as tenants will be able to build significant leverage at the bargaining table.

Market statistics provided by CoStar Group.