The Good, The Bad and The Ugly…

The Good—Much of the Damage Has Been Realized

Three and a half years past the March 2020 COVID shut down, the United States’ commercial office markets are battered. Back in 2020, we reported early signs of this coming commercial real estate meltdown, given the immediate adoption and effectiveness of remote work and the spiking of office sublease inventory. Now it’s reported weekly by the regular pundits that these market conditions have become realized. The good news is that bulk of the damage has already been done.

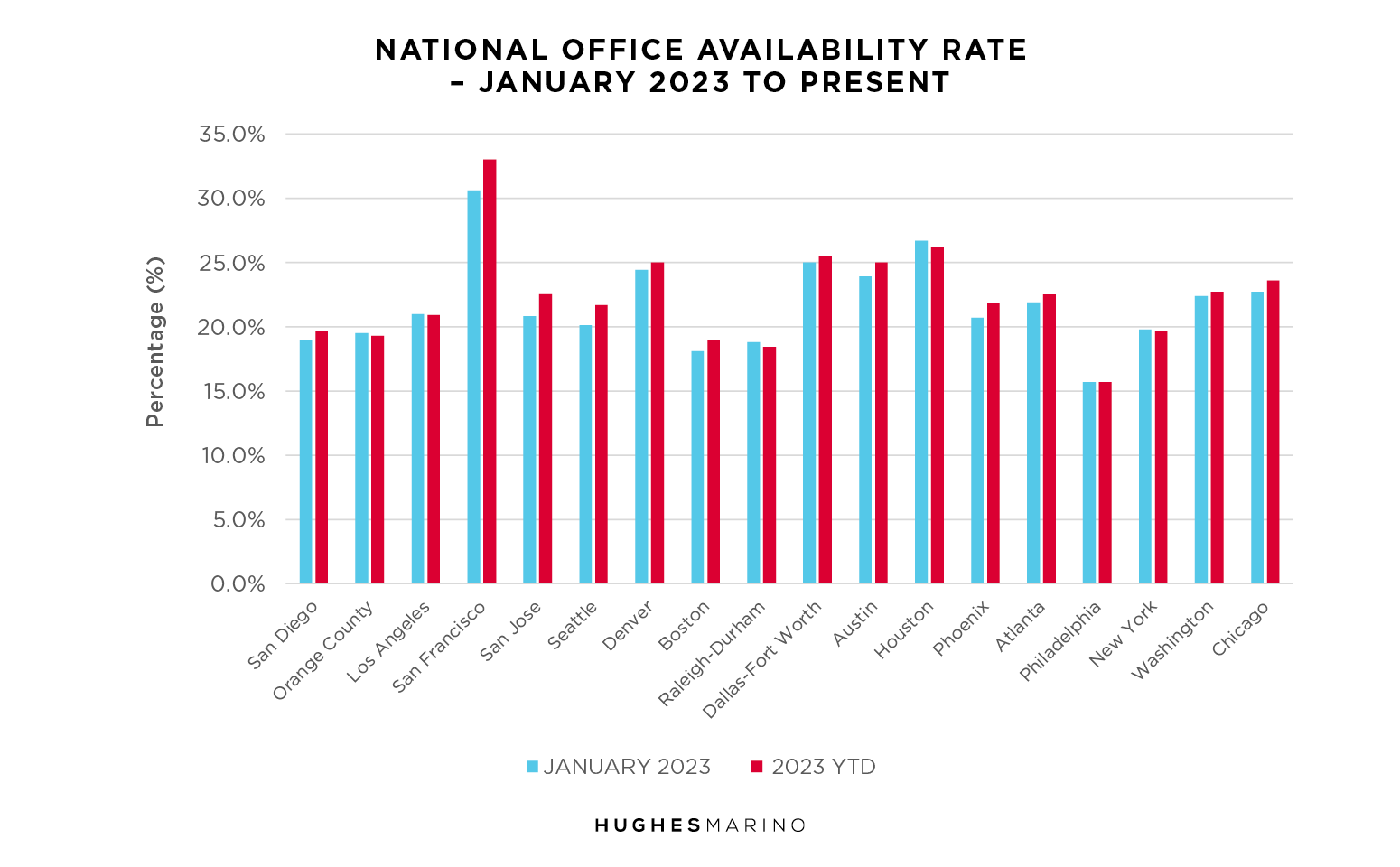

While certain markets like San Francisco, San Jose and Phoenix have annualized availability rates still climbing by 1.5% to 3%, most of the major office markets have had effectively no—or nominal—increases in availability year-to-date.

Note that we are measuring “availability” and not “vacancy.” Availability captures all of the collective space that’s on the market for lease and sublease in existing buildings and those under construction, whereas “vacancy” just measures a subset of only space for lease or sublease that is “vacant” in existing buildings. When you think critically, “vacancy” as used by landlords and their promoting dual agent brokers looking to prop up the market, is a gross mismeasurement and underrepresentation of the available space market. When a tenant is looking to lease space, they don’t just look at vacant space—they look at all space that meets their requirements. Just like if you were looking to purchase a home, you would ask your agent to show you all homes for sale that met your criteria, most of which would be occupied, and not just vacant homes for sale.

In commercial real estate, the spread between availability and vacancy is extreme in a declining market. In some markets like Chicago, Washington D.C. and Boston, availability is 4% to 7% percentage points higher than vacancy—in San Francisco, the vacancy rate is 26.3% and availability is 33%! In times of market decline like we’re in now, availability tells us with transparency where the market really is, and more so where it is going.

The Bad—It Will Be a Difficult Market for Landlords

for Many Years

Less than half of all commercial leases have expired in the last three and a half years since the COVID lockdown began. That is because commercial office leases generally range from five to seven years in term, so many have yet to expire. Further, the two years before COVID had historically tight office markets in some major metro areas, forcing many tenants there to sign eight to ten year leases. Estimates are that approximately 60% of all major commercial real estate leases around the country still have yet to expire.

As tenant representatives and advisors, we visit thousands of companies a year throughout the United States, in every industry and every size range. Tragically, most companies with leases yet to expire visibly have anywhere from 10% to 60% more office space than they will ever need. The future extent of hybrid and remote working has already been realized by most companies, whether by formal policy, or just de facto circumstances. It’s only logical to conclude that as the remaining office leases across the country expire between 2024 and 2029, that there will be hundreds of millions of square feet of office space coming back to the market, adding another percentage point or two annually to availability rates in most metro areas. If we fast-forward five years, even those markets that have taken their lumps and appear to have stabilized with availability in the 20% range will find that their availability rate will rise into the 25% to 30% range.

The Ugly—For Some Tenants and Most Landlords

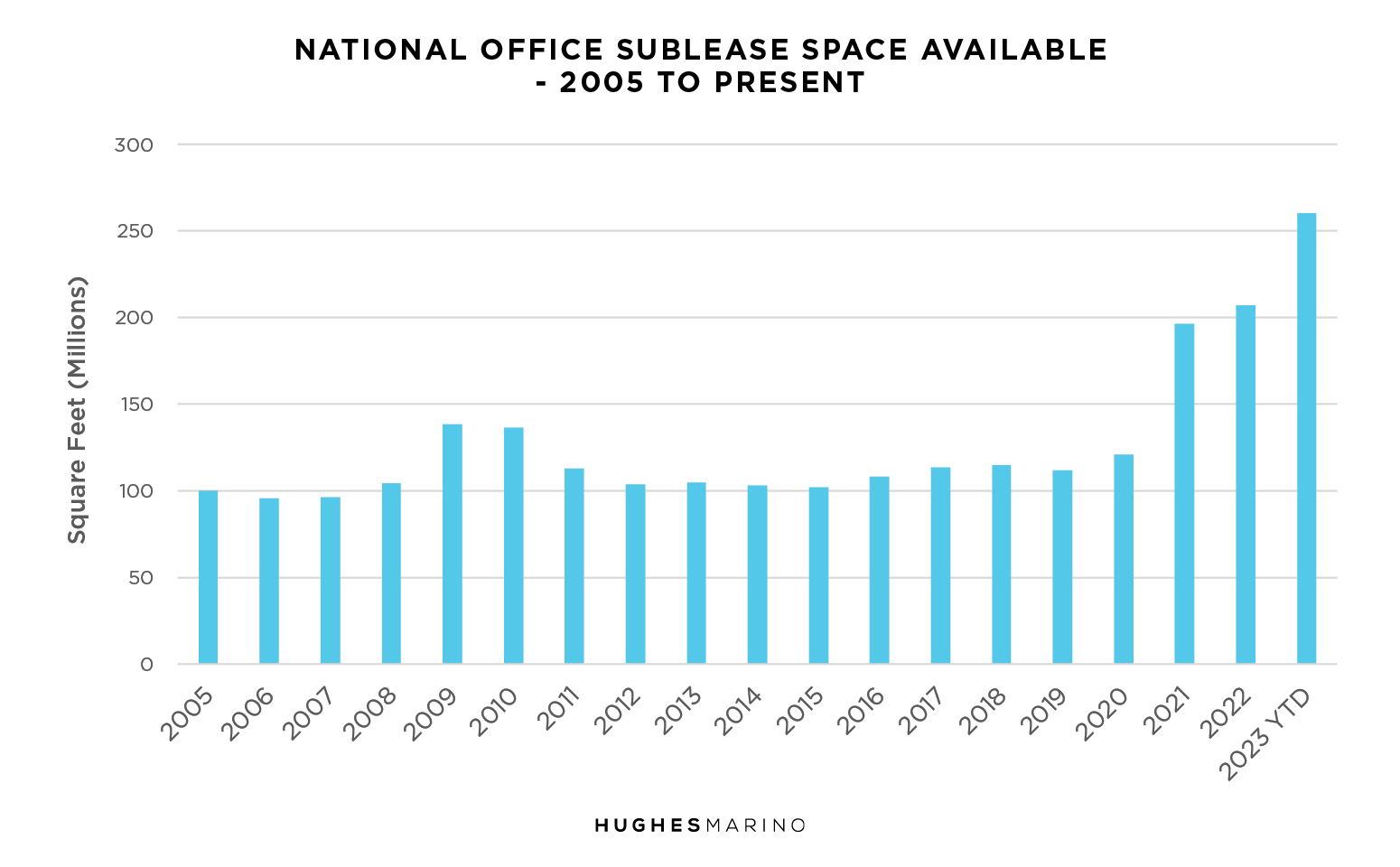

Over the last three years, Corporate America has put their excess space on the market for sublease at unprecedented amounts. Historically, there has been an equilibrium where approximately 100M SF of office space has been on the market for sublease throughout the United States. 2021 saw a historic spike in available sublease space, which has expanded to a now record-setting 265M SF. Consider that every day subleases get leased, or the lease itself expires and the sublease space reverts back to the building owner—but more subleases keep coming on the market than are coming off. Where this ends and when, is just an unknown.

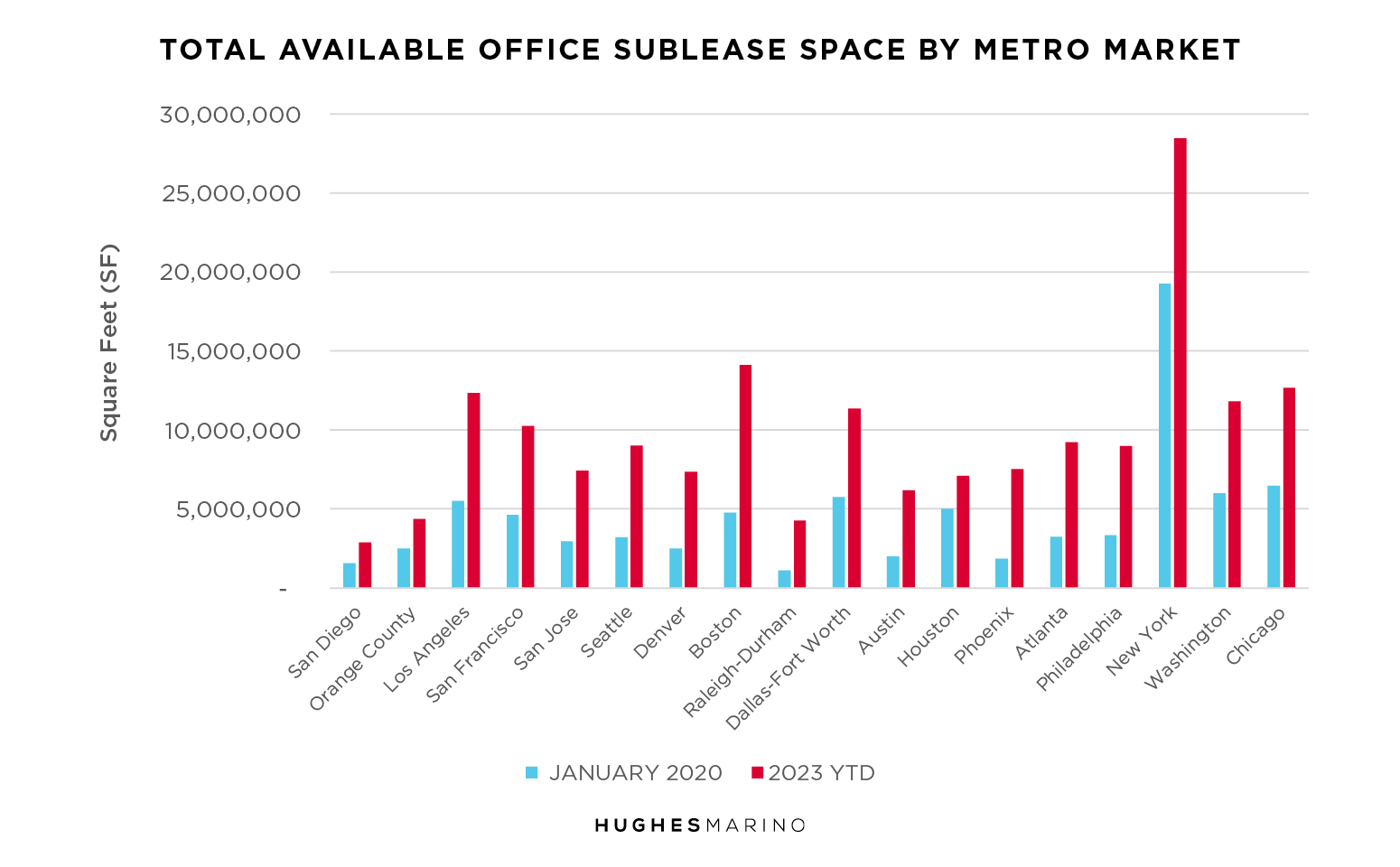

This spiking supply glut is bad news for companies trying to unload space, as there is very little offsetting demand. Sadly, a lot of tenants are going to ride their leases to the end, and thousands of subleases around the country have already been on the market for two or three years. The problem is more extreme in some metro areas than others, with the chart below showing the total square footage of office space on the market for sublease pre-COVID to present in each area.

Tenants have become landlords’ biggest competitors. Many landlords face competing subleases in their own building at 20% to 40% discounts to what the building owner is trying to lease space at, or worse. The glut of sublease space has gutted any pricing power that landlords might have had as they have collectively tried—backstopped by their full-service dual agent listing brokers to stabilize the marketplace. It’s inevitable that prices will come sliding down, as both availability incrementally increases for another five years.

The BIG UGLY for some landlords will be the total loss of their assets as the market gets worse. There have already been major commercial office building foreclosures, and hundreds more office buildings around the country have already received notices of default or are in violation of their loan covenants.

These foreclosures will be resold at deep discounts ranging from 30% to 80% of their pre-COVID value. While office rents will be slowly coming down during this decline because of the supply and demand imbalance, the shrewd buyers of these foreclosed buildings with their newfound beneficial cost basis will become predatory and cannibalize the existing tenant base to get their underperforming buildings leased up. Once this cycle begins, it’s almost impossible to undo until the market ultimately devolves to some kind of new market equilibrium for both rents and underlying values.

But More Good!

The good news for commercial real estate tenants that do want office space is that the market is filled with tremendous values in both the sublease market and with your landlord, but only if your advisor/representative has a good understanding of what’s really going on in the market, and not one that’s artificially propped up by vacancy rate statistics. A lot of landlords and their brokers are still posturing that things aren’t that bad, so doing the hard work of going to market and establishing your value is essential. For every tenant that has a lease expiring in the next five years, the values are going to be there for many years to come.

Marketing statistics provided by CoStar Group.