Now over three years after the pandemic began, most companies have settled into the new reality of remote/hybrid working, finding themselves with excess office space. If magic wands existed, most business owners and executive teams would end their lease tomorrow and shed 20% to 80% of their space. But short of that, many companies are just perplexed by how to deal with the problem. For any company that could shed at least 50% to 80% of their current footprint, the answer lies with subleasing the entire space and downsizing elsewhere, thereby lowering the overall cost structure.

A Cost Reduction Case Study

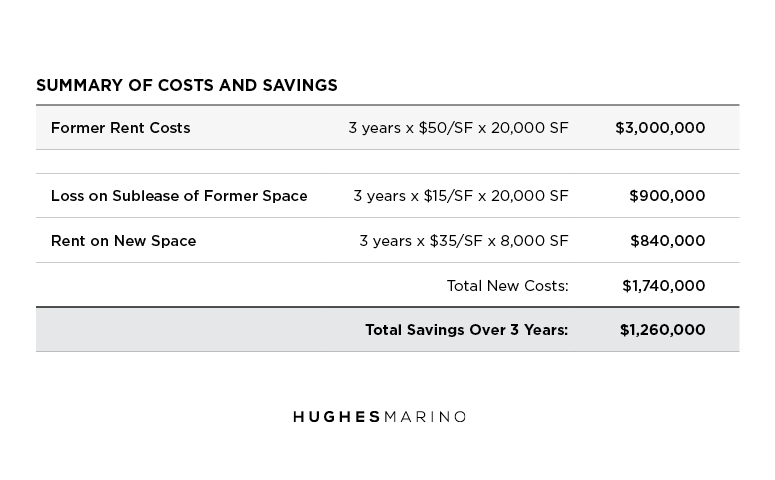

How does it work? Envision a company that takes a sublease loss of 30% of their remaining lease obligation, but is able to shed 60% of their space. Using a quantitative example, assume a 20,000 SF tenant paying $50 per SF per year under their lease could downsize to 8,000 SF, and they sublease their space with 3 years left on their lease. With the market softened, assume the tenant recovers a net after concessions/commissions sublease income of $35 per SF, for a net loss of $15 per SF per year. Over three years, that’s a total loss of $900,000 (3 years x $15/SF x 20,000 SF), but that tenant eliminates $3 million in rent obligation. Rightsizing elsewhere to 8,000 SF at $35 per SF over those same three years is a total new lease cost of $840,000. So, the new lease cost of $840,000 plus the $900,000 sublease loss is a total of $1,840,000 in total cost, in contrast to writing $3 million of rent checks for the oversized space. The total savings is $1,260,000!

The savings are even more compelling to the extent companies can get even smaller. In remote/hybrid working dominant downtown office markets like Seattle, San Francisco, Denver, New York and Chicago where rents are in freefall, you can take a loss of 35% or 45% on your remaining lease obligation, if you can downsize by 70% or 80%. The math still works if the square footage reduction percentage is materially more than the sublease loss percentage.

Other Qualitative Aspects of Downsizing Now

Beyond the real financial savings, there could be other benefits like changing submarkets and moving to a new more preferred location, or moving to a building with better amenities to help bring your team back to the office. Getting smaller could bring your team together with closer physical proximity between team members, whom are currently spread out across floors or across big open spaces with a lot of empty offices and workstations, killing morale.

Many commercial real estate tenants are unaware of the magnitude of savings that can be created by successfully subleasing their current space, and certainly landlords and landlord listing brokers don’t want to talk about strategies like this. Many companies that have their space on the market for sublease today have landlord listing brokers/agents doing the marketing at “withheld” pricing, because the brokers are afraid to offend the landlords that are their bread-and-butter customers. Subleases that are priced to show motivation at market clearing prices are coming off the market first. Given the plethora of options that tenants have today, if you’re in the sublease business, you need to price it to move it.

Time is of the Essence

The sooner you get the space on the market and the more aggressively you price it, the sooner you’re going to get rid of it to be able to exploit the opportunity to downsize this year, rather than writing rent checks for the next two to five years—the potential for savings are slipping through your fingers every month you delay the inevitable.

The opportunity’s financial analysis will be different for every tenant, depending on local office market conditions, the time remaining on the existing lease, and the percentage by which that company can downsize. Hughes Marino has created a simple one-page financial analysis to assess the potential savings under all of these dynamics. With no upfront cost, Hughes Marino can help a tenant determine whether they’re a candidate to take advantage of this savings opportunity and estimate with the magnitude of the financial impact to your bottom line, and also turnkey the process to shed the old obligation and get into a much more favorable one. Contact our team today to get in touch with a broker.