By David Marino

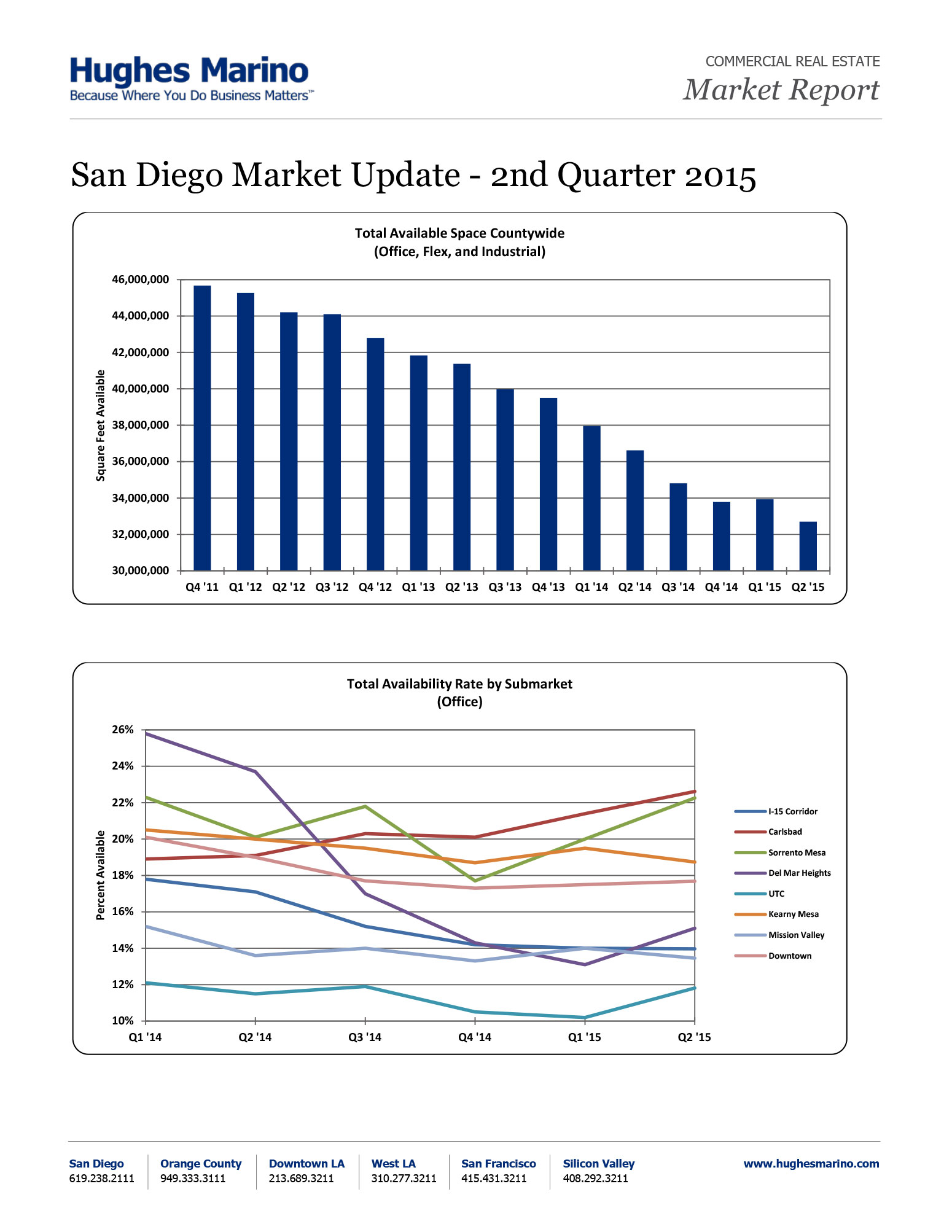

The commercial real estate market in San Diego County continued its strong recovery in Q2 2015. Coming on the heels of a flat first quarter, this past second quarter saw another 1,245,000 square feet of office, lab and industrial space come off the market throughout the region. To put that number in perspective, it amounts to 3.7% of all space available being filled in just one quarter. If absorption were to continue at this same rate, 14.5% of all available commercial space would come off the market in just one year.

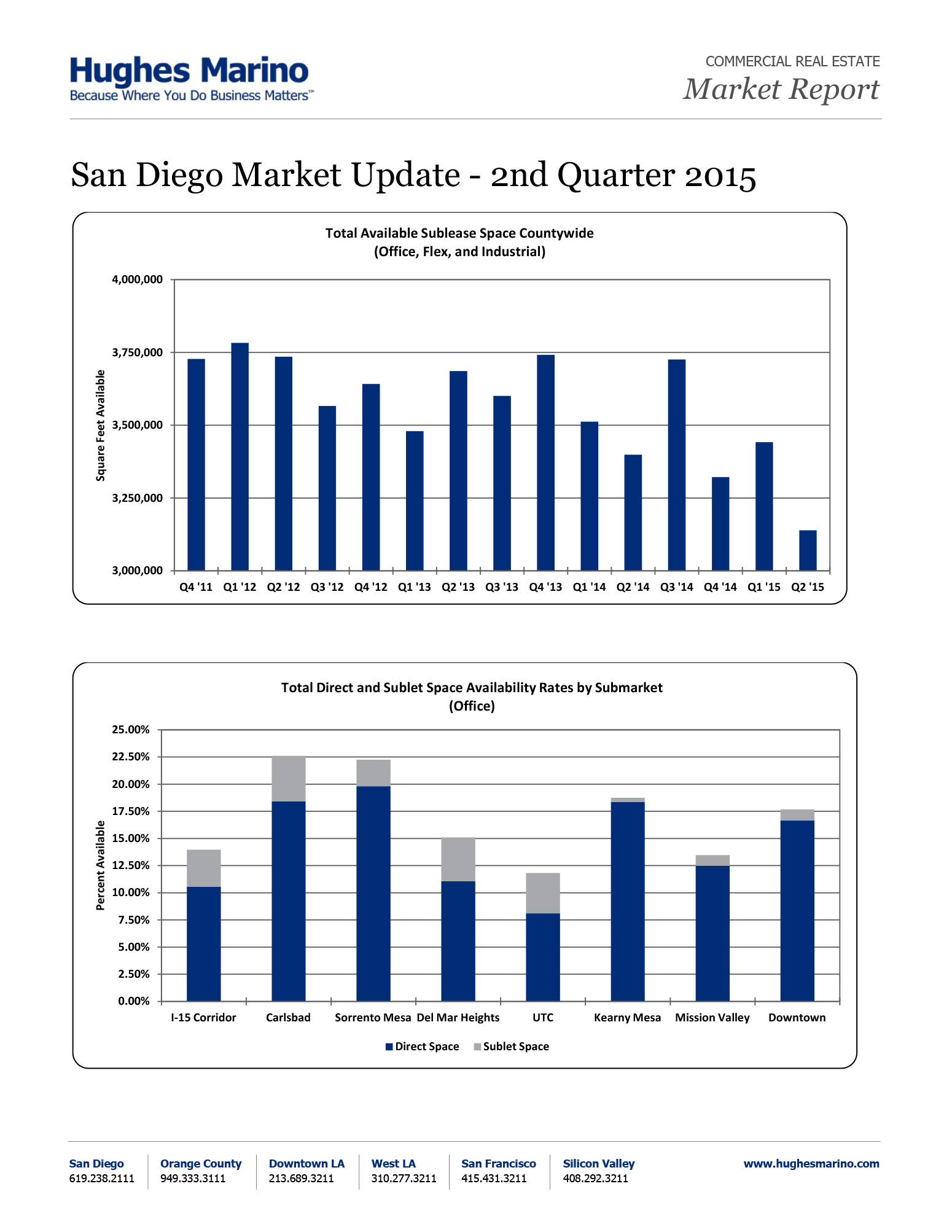

Robust job growth is driving the decline in office and lab space availability, and continued corporate health has pushed available sublease space down. Nearly a quarter of the space absorbed in Q2 was sublease space, with 300,000 square feet coming off the market, making sublease availability the lowest we have seen in years. Industrial space is filling up as well, with supply shortages seen in markets including Miramar, Kearny Mesa and Poway. Businesses seeking to expand their facilities are making bets on long-term leases to accommodate 2016 and 2017 growth expectations. We expect this strong demand to continue throughout the year, and into 2016.

The hot market for biotech IPOs and abundant private funding has driven unprecedented growth in the biotech sector. In UTC, buildings formerly occupied by office tenants are being converted into life science facilities, and three speculative biotech buildings have broken ground, which will provide 300,000 square feet of additional space. Companies like Illumina and Lilly are breaking ground on new facilities, as there are no existing buildings in UTC to support their growth. Lab space in Torrey Pines is also starting to fill up, and we can expect there to be a general shortage of wet lab space by 2017 if the sector continues to grow at the current pace.

Class A office space in UTC, Del Mar Heights and Downtown continues to see a decline in availability, particularly in large blocks over 20,000 square feet. Tenants looking for office subleases in Mission Valley, Kearny Mesa and Downtown are going to find their value options limited, while there are still choices to be had in the other major office submarkets. New development is on the horizon in Downtown, including Manchester Financial’s Pacific Gateway project and Cisterra’s 7th and Market site, which combined will add roughly 1.3 million square feet of top-notch office space to the area.

With the broad economic recovery in full swing, it was only a matter of time until landlords started winning, and we are definitely in a landlord’s market. There is tremendous optimism in the commercial real estate sector, as this San Diego regional recovery is being mirrored throughout Southern California. Unfortunately, the byproducts of this are rising rents, decreasing concessions, and the virtual elimination of free rent.

In the next two years, there will not be nearly enough new construction to offset the decline of available space, so tenants are going to have fewer choices, and may have to compete for space. Tenants will need to move through their site selection process quickly and efficiently if they want to control their options and get the best outcome from their negotiations.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.