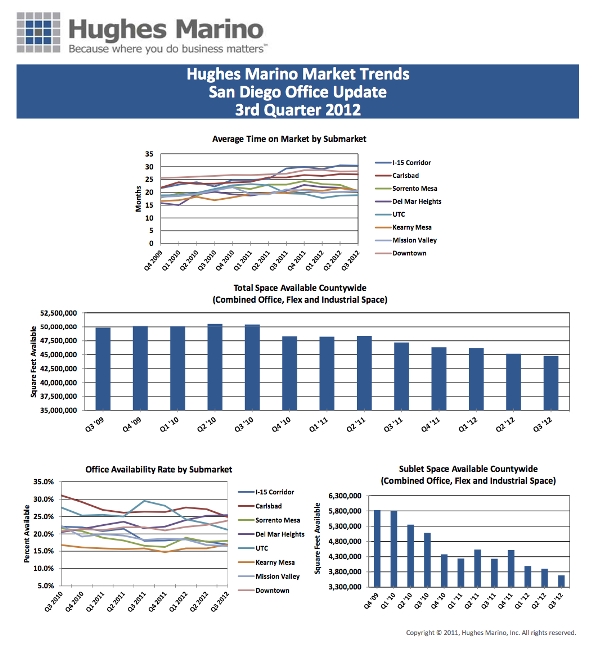

The San Diego regional commercial real estate recovery is tracking positively along with the long, slow broader national recovery. With the exception of downtown, we are entering the third year whereby commercial real estate statistics turned positive, beginning back in Q4 of 2010. Total availability in the region continues to shrink, with another 375,000 square feet of net space coming off the market in the third quarter of 2012. Year to date, 2012 has seen a total net absorption of 1.537M square feet of office, industrial and lab space. This absorption is outpacing 2011, where 1.092M square feet were absorbed during the first three quarters of last year. Based on active tenants in the market, and strong demand and growth in our own client base, we fully expect Q4 of 2012, and 2013, to be positive time periods for more net absorption, and a continued recovery. As another sign of improvement, total sublease space on the market is now only 3.687M square feet, which is the lowest level in the six years we have been tracking total sublease availability–back to pre 2006 levels. The lack of sublease space is a good sign for the health of our local companies, as fewer companies are sitting on excess space. Conversely, it also gives landlords more pricing power, as now they are competing against themselves, versus subleases that can often be had for 30% off market. Downtown’s availability rate (different from vacancy rate) has remained at 22% for the last twenty-two months, showing very little net growth across all industry sectors.

The result of the improving suburban markets is that tenants have fewer options to choose from, and those options are beginning to get more expensive than they were in the last few years. The lack of supply can be particularly felt in space over 15,000 square feet, or in Class A office space. Class A is tight as so many tenants traded up from lower end space to Class A space during this recession, where Class A could be had for less money than tenants were previously paying for lower quality space. Free rent is beginning to slide away, but landlords are still aggressive with the tenant improvement allowances that they will fund. Landlords are beginning to push annual rent increases from 3% to 3.5% in some cases, expecting rents to inflate over the next 3-5 years. Downtown has mostly been musical chairs; landlords are still very generous with rental rates and concessions in order to induce tenants to relocate to alternate buildings – or to simply renew.

There is an old expression that “when the tide comes in, all boats float.” But that could not be further from the case when it comes to the commercial real estate market. Some office submarkets are outperforming others in this commercial real estate recovery. Trends are favorable for the I-15 corridor, Carlsbad, UTC and Mission Valley. The I-15 corridor ended the quarter at 16.9% availability–the lowest in 22 quarters. For Carlsbad at 24.9%, it’s the lowest in 19 quarters. For UTC at 21.2% availability, it’s the lowest in 16 quarters. But Mission Valley beats them all, currently at 16.5%, the lowest availability rate in San Diego County, and the lowest in 24 quarters! Downtown continues in a stall, and Del Mar Heights is the highest it’s been in a few years, due to some major tenants moving out of that market.

© 2012 Hughes Marino, Inc. All rights reserved.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.