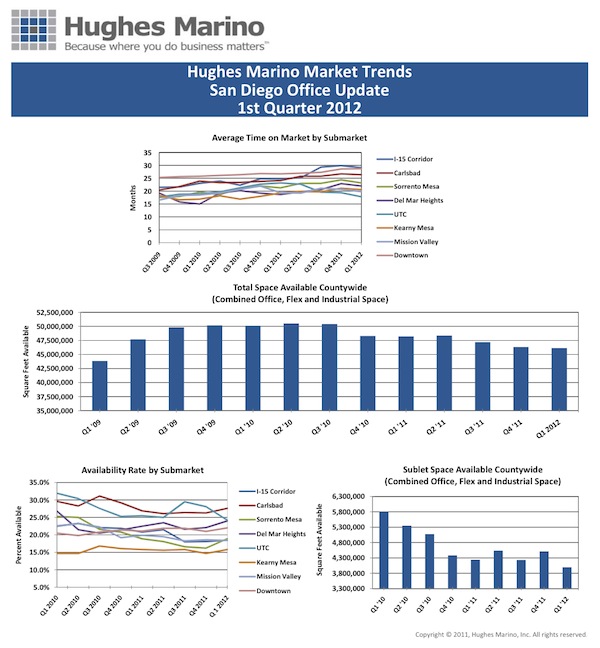

The first quarter 2012 commercial real estate statistics bear out our 2011 forecasts of an early market correction that we were advising would begin in 2012. The aggregate amount of sublease space on the market continues to trend down, as does total availability county-wide. 2012 has the potential to still show net absorption of 2M square feet for the year, even though only a net 161,000 square feet of space came off the market in Q1 2012. We have several clients that expect to hire over 100 people this year, and dozens of companies we are working with are expecting to hire 5-35 more people this year. Across the 250+ active clients Hughes Marino is representing, virtually none are in distress, and companies across size ranges and industries are stable or growing.

For the first time in 5 years, with the exception of downtown, there is a tipping point of decreased time on the market in virtually every submarket, as space that has been on the market for many years is starting to get leased up. While average time on the market still ranges from 18-29 months, good space that is well priced and attractively built out is finally moving. There is a dramatic decrease in availability in Class A office space regionally, while Class B still is relatively stagnant. As landlords are beginning to press rents for Class A space, tenants will begin to look back to Class B alternatives that can deliver great value. There is also a solid window remaining for corporate users to purchase real estate for their own occupancy, as owners with vacant buildings that have been on the market for a few years throw in the towel and want to unload those buildings. However, ownership of one’s facility has to be a strategic fit with the business’s future and potential exit strategies.

Downtown had negative absorption during Q1 2012, and continues to be a stubbornly tough market for landlords in raising rental rates and lowering concessions. While some of the more premium space has been leased over the last twelve months, what is left is more commodity space – and warrants deeper discounts and more concessions in order to incentivize tenants to move into it. Coincidentally, more and more companies in downtown are taking advantage of the Enterprise Zone (which encapsulates downtown) and are receiving large state tax refunds as a result, typically more than compensating for downtown’s parking expenses.

© 2012 Hughes Marino, Inc. All rights reserved.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.