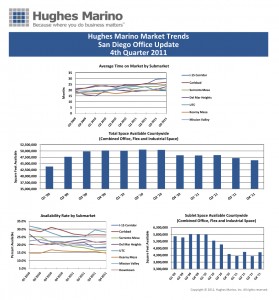

The commercial real estate market ended in 2011 with strong signs of a recovery in the making. The recovery of the job market is starting to fill up office space, and the supply chain that requires industrial space is on the mend too. In the 4th quarter, 865,000 square feet of office, lab and industrial space came off the market, making 2011’s net absorption 1.957M square feet of total space. On the heels of the 2.134M square feet that came off in Q4, 2010, a combined 8% of the total inventory of available space came off the market in the last five quarters combined.

The commercial real estate market ended in 2011 with strong signs of a recovery in the making. The recovery of the job market is starting to fill up office space, and the supply chain that requires industrial space is on the mend too. In the 4th quarter, 865,000 square feet of office, lab and industrial space came off the market, making 2011’s net absorption 1.957M square feet of total space. On the heels of the 2.134M square feet that came off in Q4, 2010, a combined 8% of the total inventory of available space came off the market in the last five quarters combined.

While every office submarket has seen a drop in availability over the last two years, the most improved office submarkets are Sorrento Mesa, the I-15 corridor, Del Mar Heights and Mission Valley. UTC and Carlsbad ended the year with the highest office space availabilities in the County, and continue to be where the best value can be found. There has been a mild recovery in Torrey Pines wet lab space, as the biotech sector shows signs of recovery, and biofuel companies have added to demand for wet lab space. As UTC Class A office shows signs of firming up, 2014 will be a tough year as LPL moves out of 6 buildings on the Towne Centre Drive corridor, and into a new 417,000 sf high rise build to suit with Hines at La Jolla Commons in UTC. Del Mar Heights should see some recovery slowing in the next year as Bank of Internet moves out of 40,000 sf in that market, and other tenants like Covario and Legend 3D consider more value-oriented submarkets, and make moves accordingly. Latham will be also moving out of second-generation space, and likely into a new build to suit that the firm is pursuing.

2012 will be another year of net absorption across all product types, with likely another 2,000,000 square feet coming off the market. As such, we expect to see landlords “testing the ceiling” of how far they can push rents. We are already seeing landlords coming out with proposals offering less free rent, higher annual rent increases, and higher face rates. The transactions we did in 2010 where we negotiated at least a month free per year of lease term (many leases we closed with 2 months free per year of term), moving allowances, low annual rent increases, and termination rights will go down in history as the bottom of the commercial market in this last commercial real estate correction. 2011 was a year of modest firming, where face rates remained unchanged, but landlords began to eat away at free rent concessions and moving allowances. 2012 will go down as a transitional year, where the pendulum starts to move towards the landlords’ favor, and tenants that lock in long-term leases now are going to look wise for many years to come.

© 2012 Hughes Marino, Inc. All rights reserved.

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.