By Owen Rice

Commercial real estate trends are not absolute–and they’re not necessarily exactly the same in all markets or submarkets. However, general trends matter when predicting what the future holds, even when these trends seem to be changing weekly in response to vaccination levels and the easing of government restrictions.

That being said, for several decades we have reported on the commercial real estate market trends in calendar years. But this year in review is about the “Covid Year.” After all, it was just mid-March of last year when the shelter-in-place orders took effect and we all thought this would be over in two or three weeks.

A year later, the effects of this past Covid Year on the commercial real estate sector have been unanticipated and inconsistent. On one extreme is biotech and medical device research and manufacturing space, never being in stronger demand as those industry sectors have raised unprecedented amounts of capital chasing Covid related diagnostics and therapies, and also pursuing cures for multiple other diseases. The supply of lab space has seen incredible competition and upward pressure on rents, where wet lab rents have gone up 20% in the last year, from San Diego to San Francisco to Seattle. In some Biotech markets like Boston, you can barely find existing lab space in almost any size category.

This Covid Year has also destroyed the retail sector and created unprecedented industrial demand as consumers shifted from retail shopping to online shopping in a hyper accelerated way. What might have taken a decade occurred in just this past Covid Year. A few hundred thousand retail and restaurant business closures have decimated the retail commercial real estate sector with “for lease” tombstones in door fronts on every block in every city. Meanwhile, industrial and distribution space demand has hockey sticked-up to unprecedented levels. Amazon alone has leased over 150 million square feet of distribution space this Covid Year. Other online retailers have leased tens of millions more. This uptick in demand has created competition for space, with big credit tenants signing 10-year leases while pushing the little guy into paying more expensive rents with fewer choices.

This Covid Year has had a major effect on the office space sector. For decades employers have dabbled and experimented with remote working for employees with varied results. Overnight at the start of this past Covid Year, virtually every office worker in United States was forced to work remotely, in most cases without the proper tools and technology to effectively do so. Corporate America, the world’s leader in global technology, pivoted and adapted whereby in just a few months, business owners and CEOs found that most of their remaining team members were working as productively, if not more so, remote. As a result, many companies that had leases expiring have simply relinquished their space and not renewed or maintained any kind of office footprint. Thousands of others have put their excess or unused office space on the market for sublease.

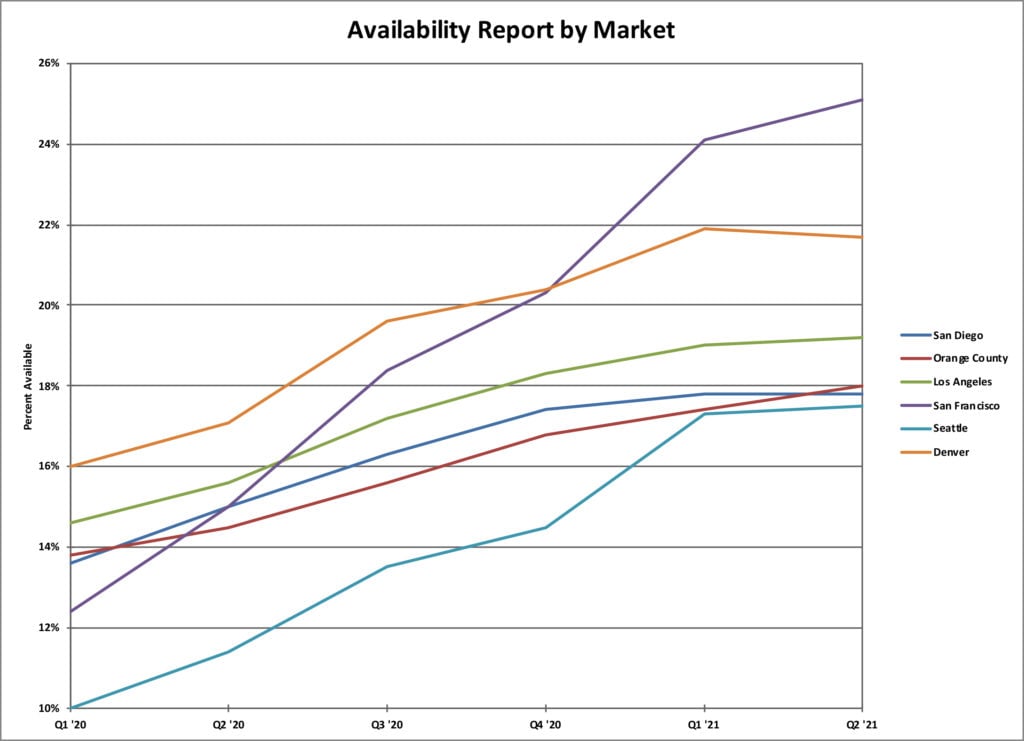

While there are exceptions and outliers in numerous suburban markets, the above two acts alone have caused an accelerated and unprecedented uptick of office availability throughout all of the major urban office markets except Washington DC, where the government and defense industry backbones appear to have back-stopped the flood of office space supply. However, nearly every other office market in the United States has been flooded with excess office space as Corporate America went remote and continues to generally operate remote going into our second Covid Year. The metro office availability rate during this last Covid Year has increased in Seattle by 74%, Denver by 38%, Los Angeles by 30%, San Diego by 32%, and in Orange County by 27%. However, nothing is more severe than San Francisco, where the metro office availability rate has literally almost doubled this last Covid Year, up 93% since this last Covid Year began.

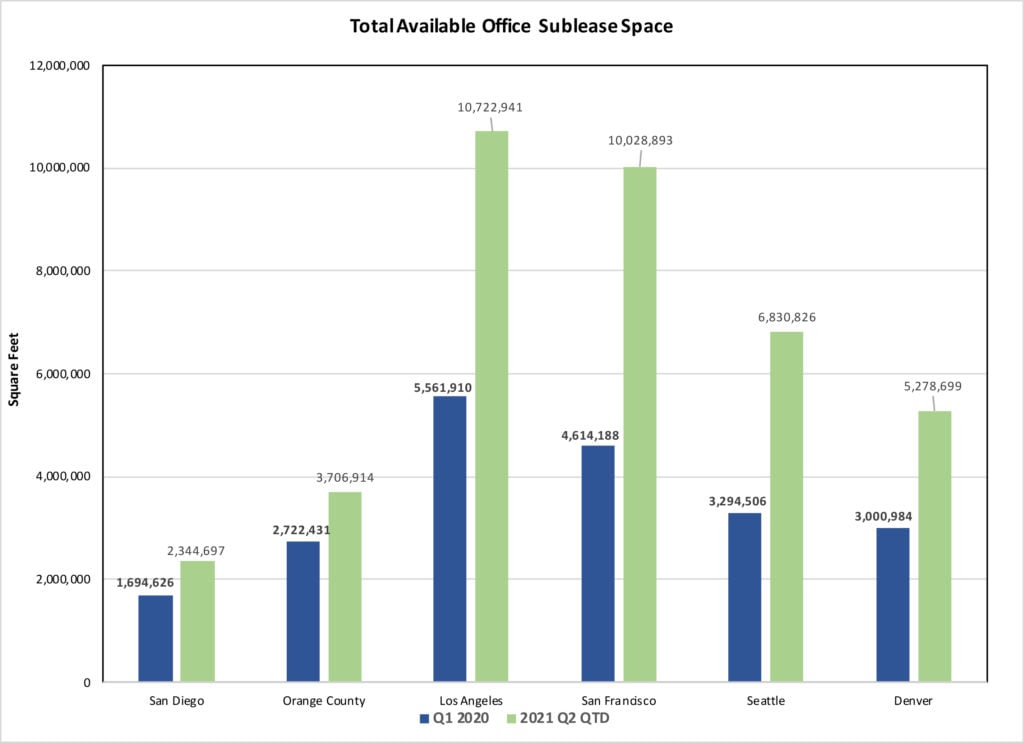

Part of the problem in San Francisco is that the flood of sublease inventory now makes up half of the available office space market, creating fierce competition against landlords. These subleases can be had as “plug and play” opportunities, saving a subtenant all of the furniture and technology fit up costs, at rents anywhere from 25%-40% below what the same landlord is trying to charge depending on the market and situation, and typically for lengths of term from 1-4 years. Over 10 million square feet of sublease inventory is now available in San Francisco, the record high and literally double that of the Tech Wreck of 2000. Office sublease availability is also flooding major markets like New York City at 24 million square feet, and approximately 10 million square feet of sublease space is also available now each in Los Angeles, Boston, Chicago, Dallas, and Washington, D.C., 8 million in Houston, 7 million in Seattle, 6 million in Atlanta, and the list goes on. These are unprecedented numbers, each having doubled this last Covid Year. This sublease inventory is reflective of Corporate America relinquishing their office space and not coming back to occupy the pre-Covid capacity. The worst is likely not behind us with sublease inventory coming to market, as initial indications are that it is going to be another year of dumping out of space as many companies begin to assess how to reoccupy their office space and will inevitably find that the supply of space is significantly more than what the returning employees will need.

In response to this flood of space that has come back to market, landlords have yet to lower asking rents by more than 5%-10% from before this pre-Covid Year. Instead, we are negotiating higher tenant improvement allowances, large free rent packages, moving allowances, parking concessions, expansion rights and other benefits for the tenant. Landlords and their brokers are doing everything they can to prop up their asking rents to create the illusion that the market isn’t that depressed—but the market is down 20%-25% this last Covid Year when concessions are factored in. We have seen this before as we went into prior real estate recessions, and by next year some landlords will start to break ranks and lower prices.

What is of great concern for the office space sector is what the next several years will bring to office space demand. Remote working is currently an acceptable option and is being embraced, at least at some level, by many employers as an employee recruiting and retention benefit…or requirement. Multiple surveys have been done where a small percentage of employees have said they would contemplate resigning from their position if forced to come back to the office full time. Complicating the issue, many employees have simply moved out of the area of where they were formally employed, with expectations to permanently remote work in completely different cities than their employers base of operations. There is incredible tension in the marketplace right now as employers discuss how to get their employees back to the office, and many employees simply don’t want to come, or are afraid to come, or have adapted to their new work-life balance without any commuting cost and time spent. More and more employers are realizing that complex problem-solving, corporate culture building and mentoring and training requires people to be together in person. Meanwhile, some employees will have nothing of it for all kinds of reasons they submit. We have multiple clients who are concerned they cannot convince their people to come back, no matter how nice and safe of an office space they provide.

What does this all mean for the real estate markets? Well, we believe that there has been a structural change in how real estate office space is evaluated–at least for the next few years–and that less, more efficient and flexible use of space will be the focus. Yes, many companies will get their people back and many will grow because of their unique business position. However, a large segment of the business community will quickly come to the realization that they need less space…and in some cases, a lot less. Imagine if everyone comes back, but they come back a lot smaller, only needing 60% to 75% of their pre-Covid size. The availability spikes that we’ve seen in the last Covid Year are going to project into the second Covid Year, and beyond. As Corporate America generally downsizes, moving to smaller spaces in mass, the consequence of that to the commercial real estate market is called “negative net absorption.” That is the phenomenon when 50,000 square-foot tenants become 30,000 square feet, 30,000 square-foot tenants become 20,000 square feet, 20,000 square-foot tenants become 12,000 square feet, and so on, and so on. Assuming this trend persists, it’s a grim forecast for office landlords, described as death by 1,000 slices, resulting from the mass resizing of Corporate America taking place over a multi-year period.

The above trends are affecting central business districts and most suburban markets, but there are a handful of niche areas that are weathering the storm successfully, mostly propped up by deep pocketed (and price insensitive) tech and blue-chip companies. The likely result of all of this? The softest market in the last 20 years, where availability rates in some areas reach 30% to 40% by 2023 and 2024. While a terrible prediction for office building owners, the tenants in those markets most affected are going to find cheaper prices, greater concessions, flexible leases and more choices than most of us have seen in our careers.

Marketing statistics provided by CoStar Group.

Owen Rice is an executive managing director at Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact Owen at 1-844-662-6635 or owen@hughesmarino.com to learn more.