By Jason Hughes & David Marino

The story of the “canary in the coal mine” is an advanced warning of danger. The metaphor originates from when miners used to carry caged canaries while at work; if the air in the mine became toxic, the canary would die before levels of gas became hazardous to humans. Many of our clients consider Hughes Marino the canary—an alert system that would be the first to go on record that the commercial real estate market had become toxic…like we did back in 1999 and 2007, a year in advance to each of those prior major recessions. Well, that day is today.

The commercial real estate market will invariably suffer the spillover effects from the slowing global economy and uncertainty within the capital markets. Landlords and their brokers that are hired and chartered to lease, manage and sell landlords’ buildings will initially try and convince tenants that the commercial markets are unaffected. But we can look historically to the single leading indicator of what the future has to hold—the rise of sublease inventory.

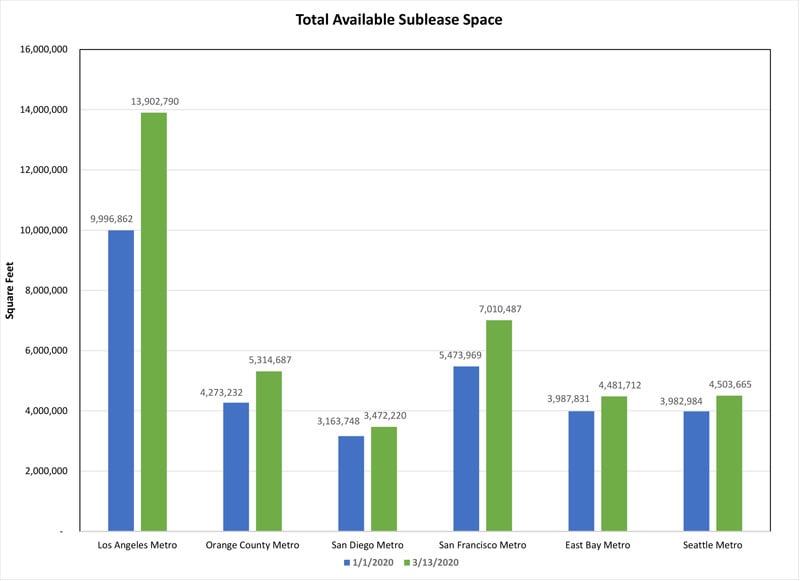

Having weathered three recessions over our more than three decades, the first thing that happens when the economy slows is tenants put excess space inventory on the market for sublease. Tenants begin to evaluate existing inefficiencies, lean down headcount (or anticipate reduction) and reduce economic activities around R&D, inventories and supply chain activities. For the past decade, we have been reporting quarterly on the total amount of sublease inventory available, which consistently declined from 2010-2017, and has maintained equilibrium to date. But now that leading indicator of tenant health is beginning to change—literally in the last few weeks. Year to date, the total inventory of available square footage for sublease from corporate America has gone up 39% in the Los Angeles metropolitan area, 28% in the San Francisco metropolitan area, and 24% in the Orange County region. The other West Coast marketplaces of Seattle, East Bay in Northern California and San Diego have lesser spikes at 13%, 12% and 10% respectively. If this trend continues…and we expect it will…there’s going to be a significant increase in the supply of commercial sublease space across the West Coast markets this year, and reasonably therefore across the entire country. In fact, sublease inventory nationally has increased 14% year to date from 232M square feet to 264M square feet.

When tenants become competitors to landlords with space to sublease, it always ends badly for building owners. Consider that tenants who are re-evaluating their occupancy needs are generally in below market leases that were signed years ago, and they will immediately undercut the landlord for the limited tenant activity with offerings that are 20 to 30% below market. Also consider that most of the space for sublease has likely been built out over the last five years, so the offerings for sublease are not only in good cosmetic condition and generally code compliant, but also will generally be presented as “plug and play,” offering furnished and technology enabled space for the new subtenant. Furnishing a commercial space costs a tenant $20-$30 per square foot, so the capital expense savings for the incoming subtenant are massive, and the landlords can’t compete.

More broadly, what this subleasing leading indicator also means is that there is a simultaneous demand shock taking place in the system real time. Certainly, any tenant with a lease expiring is going to need to transact to either renew or relocate, but companies otherwise planning for business expansions will carefully weigh their options. What’s unique this time is that schools are shutting down, with working parents and executives now staying home, and most companies shuttering office operations for four weeks…or longer. Tenant demand will slow; however, executives and business owners will eventually return to their businesses to assess what the new normal looks like.

Landlords are going to inevitably see vacancy rates increase and rental rates decline, as tenants with leases expiring look to reduce occupancy costs by increasing efficiency and finding other ways to reduce their occupancy costs. Default risk of tenants with less than a year’s worth of operating cash will simultaneously spike. What we can expect from our decades of experience is that free rent will begin to become re-introduced in the markets as landlords compete with subleases, and each other, to try and maintain their asking rental rates. As competition for tenants increases and rent abatement alone isn’t an adequate lever to secure the most attractive companies, landlords will become more aggressive with their rental rates and incentives in order stabilize their respective portfolios. Historically this process of rent deflation has taken up to two years to hit bottom and doesn’t happen overnight. For those old enough to remember, back in 1990, people would say “survive ‘till ’95.” While we don’t want to be alarmist, we really don’t know where this will end, or when.

Our historic perspective, along with our tenant representation only advocacy platform, positions us perfectly to advise tenants to respond to these market corrections as they develop, as you can be sure that the landlord’s broker isn’t going to be doing you any favors. Understanding the nuances and complexities in your specific market location and operational requirements, and how to maximize your leverage and cost savings as a result of this seismic shift of circumstances, should be your brokers highest priority. Slowing or accelerating the process may offer your company very favorable results. Most importantly, when your landlord’s listing broker calls you to renew your lease, they are going to try and convince you that that the commercial real estate market is not as bad as it is. Please feel free to contact us for a second opinion and no cost or obligation evaluation based on what your precise situation is.

Today our priority is the well-being of our families, friends, colleagues and fellow Americans, and we know we are faced with a dynamic environment. The commercial real estate world is not insulated from these changes, and tenants are going to see a softer market in the coming year driven by subleases and higher vacancy rates. Empirically, tenants and landlords can be assured that this spillover to the commercial real estate asset class is inevitable. While it’s going to be a bumpy ride for all of us, the hyperinflation in rents across the country is over, and the market is going to become tenant favorable in the very near future for all of the wrong reasons.

Jason Hughes, Chairman & CEO

David Marino, Executive Vice President

David Marino is senior executive managing partner of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.