While you cannot open a business periodical without reading an article about the meltdown of office space throughout the United States, which we forecasted would occur back in the Summer of 2020, no one is talking about the slide of industrial real estate nationally… until now… and as a business owner or executive running a manufacturing, research or distribution company, there’s a lot of good news on the horizon for you.

While in supply and demand equilibrium pre-Covid, the 2020-2021 industrial real estate demand surge was driven by companies shortening up supply chains, and ecommerce companies expanding to accommodate the spike in Covid-driven consumer online purchasing. This created a historic decline in industrial availability rates, and a corresponding spike in rental rates. In most U.S. markets, availability went from 8%-12% down to the low to medium single digits. This triggered industrial rental rates to increase from 25%-50% in most major U.S. markets—doubling in the Southern California Inland Empire market—as tenants competed for limited spaces. The shortages were particularly severe for larger companies seeking over 100,000 SF, and many tenants were forced to sign 10-year leases just to get to the front of the line and secure space. Strong credit also helped companies like Amazon, DHL, Target.com and Walmart.com take down tens of millions of square feet, and companies of lesser credit often had to settle for buildings in sub-optimal locations.

Record Amount of New Construction

To meet this demand, developers did what developers do, and started building large projects as fast as they could entitle and construct them, only to find city building departments bogged down by their own remote working inefficiency and an explosion of permit requests, and construction materials shortages that delayed deliveries of new industrial buildings. Seeing no end in sight to the demand surge from 2020-2022, developers in 2023 and so far into 2024, completed 1.172 billion SF of new industrial buildings, 44% of which is still vacant and for lease today. Right now, another 318M SF of industrial space is under construction, 52% of which is still available for lease, and all further flooding the market through 2025. Meanwhile in 2026-2027, the construction loans on most of these buildings are also coming due, whereby landlords with vacant buildings will find themselves handing the keys back to the lenders.

Record Amount of Sublease Space

Simultaneously, from 2023 and rising into 2024, a glut of industrial sublease space flooded the market as consumers resumed their pre-Covid purchasing behavior. In turn, ecommerce companies began reducing their footprint, and other companies started rationalizing their Covid expansions. Everyone is talking about how U.S. corporations have flooded the U.S. metro office markets with 235M SF of sublease space as employees have gone remote or hybrid. At the same time, for different reasons, U.S. industrial companies have dumped 231M SF of industrial space on the market for sublease, a high never seen before in commercial real estate history. In the U.S. today, there’s as much industrial space for sublease as there is office space—let that sink in!

Availability Rates Back to Pre-Covid Levels—Higher in Many Cases

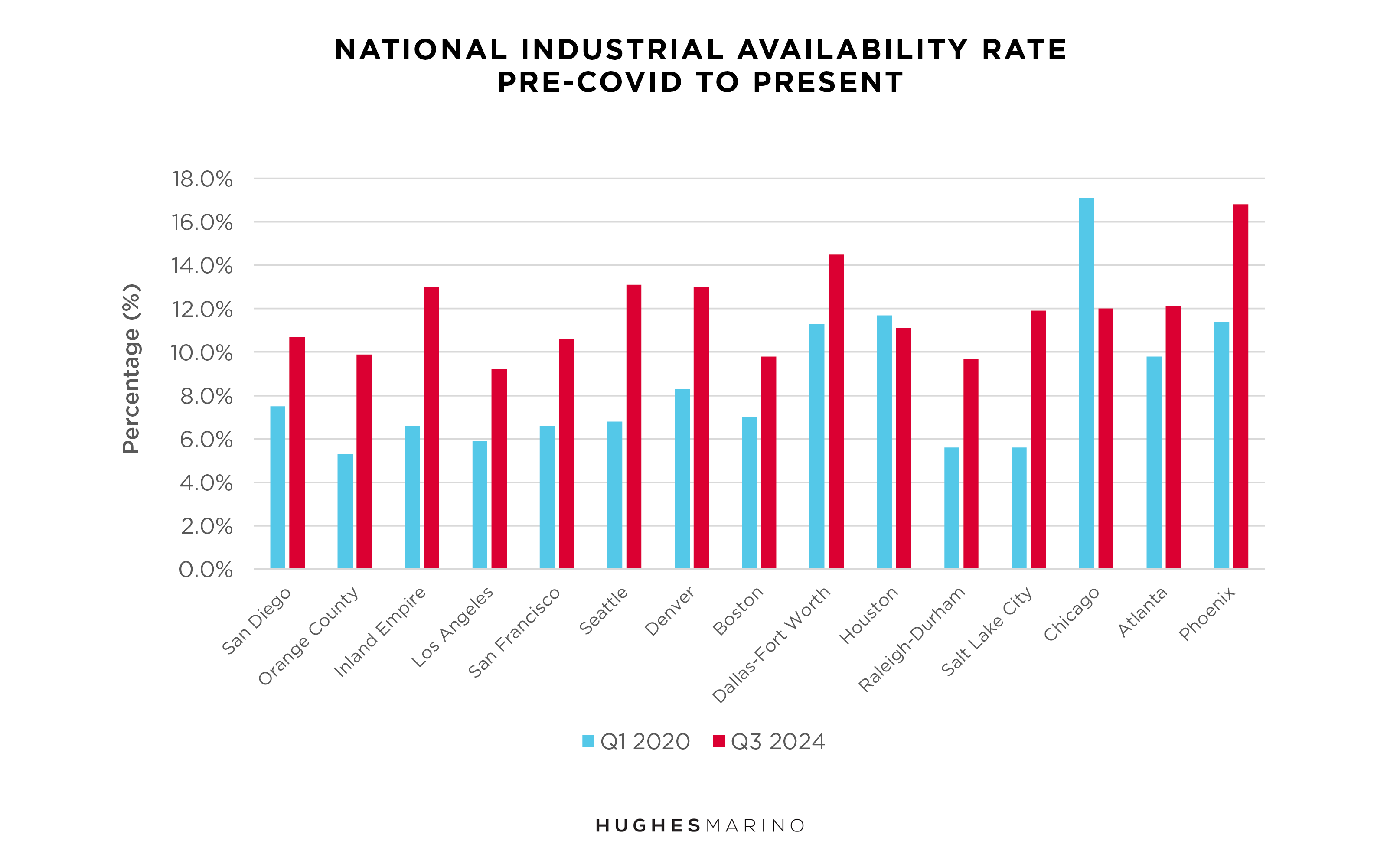

Since 2023, industrial companies have slowed down their growth, with many putting the brakes on their expansions. The bottom line is that the combined effect of new construction and sublease supply, plus a decline in demand, have resulted in availability rates in most major metro areas returning to, or way above in many cases, their pre-Covid levels. With the exceptions of Houston and Chicago, every other major metro area reported on is 30% to 100% higher than the pre-Covid availability. The availability rates pre-Covid as compared to today are as follows in this graph, and most markets in full reversal.

More Options Than Ever

The best news for business owners and management teams is that companies looking to lease industrial space in most U.S. markets, of any size, have more choices than they have had in years. The supply of large buildings existing and under construction over 200,000 SF for bigger tenants is at a glut condition in most markets, with 134 options the Southern California Inland Empire, 166 in Dallas-Fort Worth metro and 54 in Houston metro.

…But Rental Rates Still Stuck in the Past

One would think that with pre-Covid availability rates back, business owners signing leases would also see the return of pre-Covid pricing… but that hasn’t happened. The first reason is that commercial real estate markets are very sticky and have little short-term volatility, so price declines lag downturns. Secondly, landlords work collectively to hold the line on prices, anchoring off of each other, and backstopped by the brokerage community that represents these owners in supporting the pricing these landlords are used to achieving. Last, given there is no transparency in commercial leases, landlords and their brokers maintain the historic asking prices, where business owners and management teams are at an information, leverage and representation deficit. A tenant signing a renewal at 5% off asking might feel like they got a good deal, while we are negotiating leases with that same landlord that are 15% off, with loads of free rent and large tenant improvement allowances… and landlords aren’t giving deals to tenants unless someone pushes them to do so.

Market statistics provided by CoStar.