Halfway through 2024, the Orange County office market continues to grapple with the aftermath of the pandemic and shifting workplace trends. While many tenants have had the opportunity to downsize in line with their evolved office space needs, almost half of all office tenants are still operating in their pre-Covid footprints as their leases have yet to expire. In the next four years, those tenants approaching their 2025-2029 lease expirations will generally downsize. Considering that many tenants have only recently felt confident enough to accept their new hybrid office reality, we’ll continue seeing increased supply in the Orange County office sector for at least the next 3-4 years as the remainder of the office tenants shed space.

Sublease Inventory Surge

Sublease inventory, which is the leading-edge barometer of the office market health, continues to surpass pre-Covid levels. While the chart below shows a 17% YTD decline from the 4.5M 2023 record breaking amount, much of that has come off the market as spaces that have been offered for sublease for 2-3 years are now reverting back to the building owners as new vacancies.

Rising Availability Rates

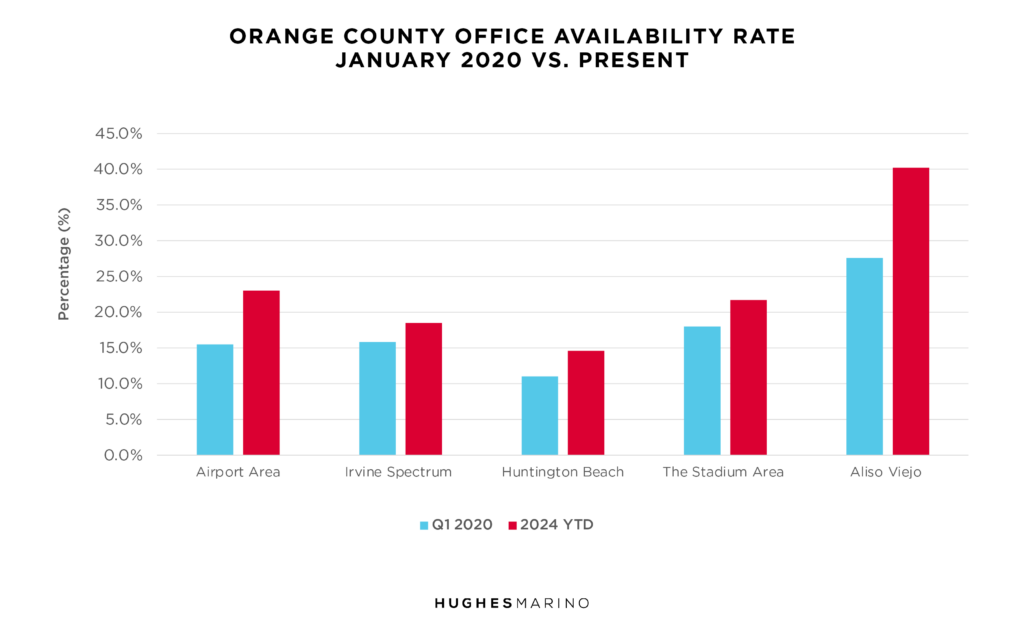

In the first quarter of 2020, the overall availability rate in Orange County was 13.6%. However, after reaching a peak in Q2 of 2023 at 19.5%, the latest data shows availability holding steady over the last three quarters at 19%, one of the lowest in the United States. While the data suggests that the Orange County office market could be stabilizing to a “new normal,” the submarket availability rate data provides a better picture of how distributed the damage is.

Airport Area – The Airport Area submarket, which includes Irvine (north of the Irvine Spectrum), Newport Beach, Costa Mesa and South Santa Ana, has the largest concentration of high-rise office space in Orange County. While hammered with a 23% availability rate, the Airport Area submarket represents 40% of the total available office inventory for the County, creating an environment where the Airport Area submarket may take decades to recover…if ever. One of the factors plaguing this submarket is its high concentration of generic high-rise office buildings, generally built more than 30 years ago. These buildings all possess similar amenities and features, leading most tenants to base their leasing decisions solely on commodity pricing, which has created a cutthroat landlord negotiating environment that is a race to the bottom.

Irvine Spectrum – The Irvine Spectrum submarket has the highest concentration of newly constructed office buildings, which has attracted many large companies willing to pay higher rents for better quality space over the years. However, a flood of large blocks of available space has created a challenging environment for landlords. Availability rates have risen from 15.8% in Q1 2020 to 18.5% today, as landlords, namely the Irvine Company, struggle to lease their recently developed space.

Aliso Viejo – Aliso Viejo’s office market has historically benefited from occupancy from a handful of large tech and medical device tenants consuming significant portions of the 2.2M SF office market. However, since 2020, many of these users have offloaded most, if not all, of their office space, creating a historic availability swing. Already underperforming pre-Covid, the pre-Covid Aliso Viejo availability rate has increased dramatically from 27.6% to a record breaking 40.2%. Combined with 73 Toll Road spikes in pricing making the monthly cost of commuting more expensive than renting a monthly parking spot in Downtown LA, we expect the Aliso Viejo market to become a bloodbath, with likely half of building owners there being foreclosed upon over the next 2-4 years.

Huntington Beach – This submarket has experienced a moderate increase in availability, from 11% pre-Covid to 14.6% today. Despite its attractive coastal location, Huntington Beach has not been immune to the broader trends affecting office space demand.

The Stadium Area (Platinum Triangle) – Surrounding Angels Stadium, this submarket has seen pre-Covid availability rates grow from 18% to almost 22% today. As the furthest north major office submarket in Orange County, the Stadium Area has benefited from a more supply-constrained Class A office inventory, which has lessened the overall impact in increased availability, but any submarket with over 20% availability today is in distress.

Opportunities for Tenants

More than four years post-pandemic, a meaningful return to the office has not yet materialized for most companies in Orange County. Many organizations continue to operate in a hybrid model, with some percentage of their employees fully remote, while others are eager to address their new space needs as their pre-Covid leases approach expiration. The continued trend of space shedding has kept inventory levels at historic highs and is providing well-represented tenants with the ability to secure extremely favorable outcomes in their lease negotiations. Whether you’re looking to renew, downsize, restructure, relocate or expand, the abundance of available space in every major submarket is creating a generational opportunity for tenants across Orange County.

Marketing statistics provided by CoStar.